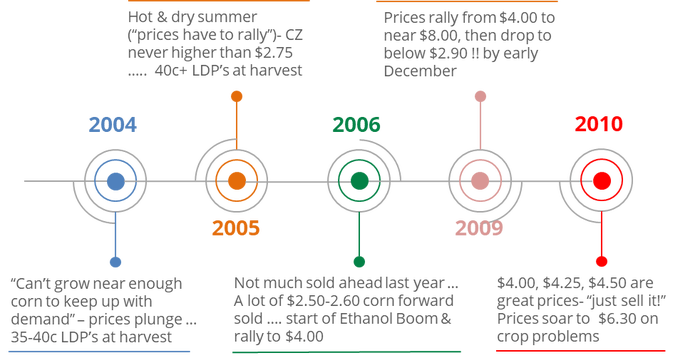

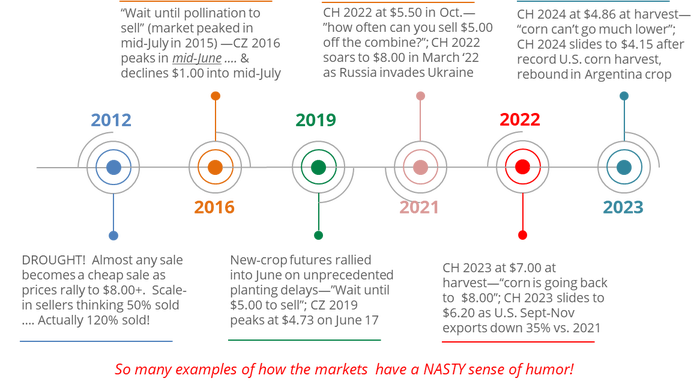

The 2024 U.S. growing season is likely to bring surprises and opportunities. A review of the corn market since 2004 reveals how quickly price perception and trends can change, emphasizing the unpredictability of prices. To manage market volatility, a disciplined approach that establishes a floor price while allowing flexibility to participate in market rallies is a sound risk management strategy.

Over the past few months, I have presented at outlook meetings in various areas around the country. It was good to be "back on the road," as I always enjoy visiting with producers and learning about their operations. Each year, we share a brief outlook on markets along with Advance Trading’s risk management philosophy. While going through my files, I came across the slides below that were previously presented by one of our advisors. After updating the overview with what occurred in 2023, it re-emphasized the difficulty—in fact, impossibility—of predicting prices.

Market volatility can be viewed with fear or as an opportunity. It's easy to see how frustration can set in if a win-lose approach to marketing is implemented. For example, aggressively storing corn at harvest last fall without downside price protection, and with March 2024 corn futures near $5, did not turn out well.

While supply and demand fundamentals are constantly changing, the good news is tools are available to manage volatility. A disciplined approach that establishes a floor price but also allows flexibility to participate in market rallies is a sound risk management strategy. Find an advisor prepared to assist in executing a marketing plan for any remaining 2023 crop, as well as projected 2024 production.

What just happened?

The recent developments in the soybean market over the past four weeks are a textbook example of the risk in attempting to predict prices.

The much-anticipated USDA monthly supply/demand report released on Jan. 12 initially fueled a bearish reaction, sending March soybean futures down to $12.01. After the market digested the perceived bearish numbers, however, it consolidated and staged a respectable recovery.

From Jan. 18 to the early evening of Jan. 24, the contract rallied $0.46½ to trade just shy of $12.50.

Prices then whipsawed lower, plummeting back to $12.15 by the following morning. Since then, the market has traded sideways to lower, eventually sliding below $11.80 on Wednesday, marking an 8-month low. As the dust settled, a natural question to ask is, “what happened?”

The short answer is it’s impossible to say. It’s worth noting there were some warning signs for weaker U.S. export demand. For example, the total volume of export sales of soybeans reported for Jan. 19-25 was a paltry 6.0 million bushels—a marketing year low. As noted above, the price of March futures rallied significantly from Jan. 18 to Jan. 24.

Looked at another way, a case could be made that soybean importers did not purchase U.S. beans as the market rebounded. In fact, they remained on the sidelines as the rally proceeded. At the same time, there were longer-range forecasts that hinted at a more favorable weather pattern in Argentina following a three-week period of dryness.

As we move closer to mid-February, the latest forecast is, in fact, calling for above-normal precipitation and normal temperatures in Argentina at a time when the soybean crop is setting and filling pods. So not only did end-users not chase the market higher, but weather conditions in a key export competitor improved.

Turn uncertainty into opportunity

This serves as an important reminder of a key risk management principle: The wide array of factors that simultaneously affect the markets makes predicting day-to-day price movement impossible, much less projecting long-term trends.

Accepting and embracing this principle is a critical step in developing and implementing a risk management strategy designed to defend your balance sheet. A strategy built upon discipline in managing a position—as opposed to price prediction—can turn market uncertainty into opportunity.

The wide array of factors that simultaneously affect the markets makes predicting day-to-day price movement impossible. Turning market uncertainty into opportunity is a primary objective of a disciplined risk management strategy designed to defend your balance sheet.

Find an advisor who is ready to assist in the execution of a customized marketing plan for your operation.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like