March 20, 2024

I’ve always said that farmers are the original conservationists, taking care of the land, leaving things better for the next generation. The same can be said for harvesting solar energy. Farmers have done it for millennia. Except instead of storing energy in batteries, they store energy in seeds and grains.

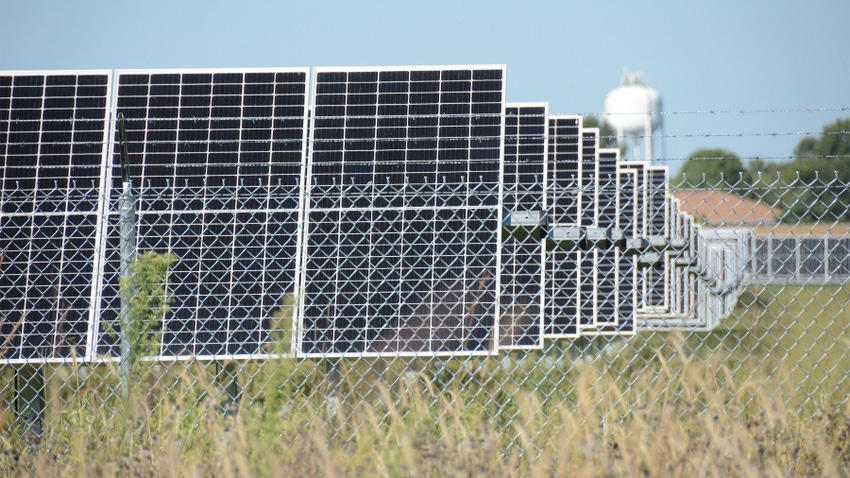

We have seen a recent explosion of interest in developing solar energy, and many companies have approached farmers and landowners to lease their ground. With all this activity, professional farm managers have fielded questions about how a solar lease might affect farmland values — or even the option to lease.

A gentleman asked me that very question recently. He owns a farm in Michigan and saw my article last fall about how to navigate wind and solar leases. Not being licensed in Michigan, I was not able to help him, but referred him to a colleague based in Michigan. One of the advantages of being a member of the Illinois Society of Professional Farm Managers and Rural Appraisers is our access to land professionals across the nation.

Still, the question had me curious. While considering it, I spoke with Herb Meyer of Peoria Appraisal Service, who informed me of an auction conducted by Ag Exchange and its ramifications in Peoria County, Ill., last December. This sale was a multi-parcel auction with seven tracts: One included a developed community-scale solar farm; two other tracts held options for solar development, while the remaining tracts were typical farm ground. This sale was a good opportunity to see how the market treated similar ground with and without solar leases.

I also learned of another farmland sale in DeKalb County, Ill., last fall where a portion of the farm was encumbered with a solar lease and developed solar farm. This farm sold privately and was about one-third solar development and two-thirds farmland.

Two sales do not make a trend. But we can make interesting observations from them:

1. Value starts with the land. In both sales, the value of the developed ground was similar to the value of undeveloped ground of similar quality. This stands to reason: If the ground is to be put back into production once the solar lease expires, Class A ground will still outyield Class C ground and holds more value.

2. Higher returns can be expected. In both cases, the indicated return for the money invested for the developed ground was about 7%. Farmland returns for similar soil qualities range from 1.5% to 2.5%. With solar leases, there is additional risk when leasing a farm. You are tied into that lessee making good on their lease payment. If they don’t pay, it could take years and significant money to evict them, remove the equipment and return the farm to tillable conditions. A higher return is justified.

3. Lease value is in the lessee. As referenced above, a lease is only as good as the person who pays it. In my line of work, much effort is put into qualifying a farm lessee before the document is signed. The 5 C’s of Credit are something we rely on regularly.

The challenge with solar is that the industry is so new, it’s hard to know who the bad players are just yet. But just like with wind development, the companies that are hard to work with and slow making payments will surface. Leases with those companies are worth less than leases with companies that are good to work with, and that difference in value will show up in land prices.

4. Locked return equals locked value? The solar leases on both these sales were negotiated early in the product life cycle. Although rents are substantially higher than current ag rents, they have been surpassed by other deals in the works across the prairie. Additionally, they were negotiated when inflation was leisurely, and their 2% annual increases seemed reasonable.

Now what happens if inflation heats up even more or farmland returns skyrocket? Will the value of the land locked into a 20- or 30-year nearly flat lease keep up with neighboring properties? I’d venture to guess it will not. It depends on how much time is left on the lease. The other side of that coin is whether the farmland will value hold if the farm economy tanks. If the underlying value starts with the land, I would say probably not.

In the two sales I’ve examined, one doesn’t appear to have a premium or discount due to the solar development, while the other may have had a 10% premium attached. There was also no premium or discount for the properties with options.

Land is an imperfect market. Anyone who has been to an auction with two angry neighbors knows that value given to farmland comes in all kinds of packages. I expect value attributable to solar development will be loosely tied to the value of the underlying productivity of the land on which it sits, coupled with the remaining number of years left on the lease, positively or negatively correlated with the quality of the lessee.

About the Author(s)

You May Also Like