Has the soybean pendulum swung from bullish to bearish? The market action within the past several sessions has signaled how the narrative is changing.

The market has been in an uptrend over the past several months, propelled by a drought that ravaged the Argentina crop. We are seeing an atmospheric change as Argentina finally received some meaningful rain this past weekend. It was not enough to end the drought, but enough to stabilize the crop.

As we roll through the week, the chance of significant South American showers continues to show up in the forecast with two crucial events anticipated to fall over the next ten days. The trade will take several months to determine how much the rain improved the crop, but late rains may positively impact production aspects on later planted crops.

Currently, USDA estimates the Argentina crop at 45.5 MMT and Brazil crop at 153 MMT. OilWorld currently has the lowest Argentina crop estimate at 34 MMT. In the big picture, we anticipate the harvest in Brazil and other South American countries will offset a good portion of the Argentina losses.

If OilWorld’s South American production forecast estimates come to fruition, total South American production would be down 13.5 MMT from USDA's current number. Yet, global production would still be a record at 374.5 MMT.

Slow start in Brazil

Harvest progress in Brazil is off to a slow start. AgRural reported Brazil's harvest had reached 2% complete as of last Thursday, down from a 5% pace a year ago. The slow start has allowed the U.S. to stay in the export game longer than many anticipated. We anticipate soybean exports dropping off expediently as China shifts its buying from the U.S. to Brazil. The worst-case scenario for the U.S. would be for China to cancel unshipped purchases and redirect them to Brazil.

Speculator interest

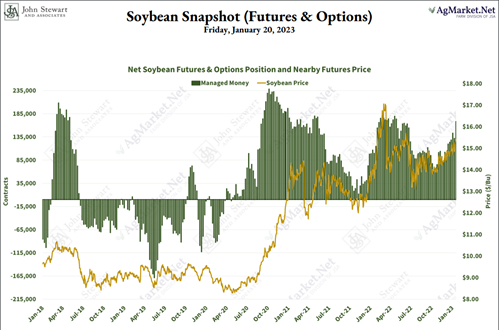

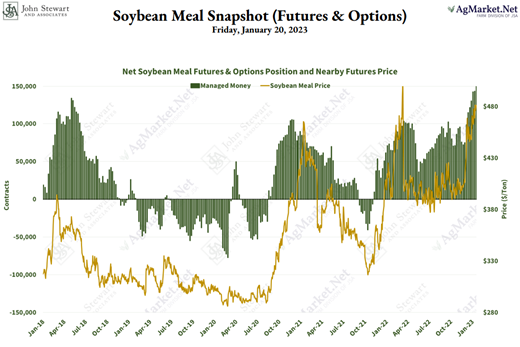

The drought hype and slower expected early harvest pace have garnered interest from the speculator community. It’s resulting in a record-long fund position in soymeal (150,939 contracts) and the largest fund position in soybeans in the past eight months (253,899 contracts).

The risk is high that the funds that piled into these products could choose to exit them; prices could fall hard and fast when they do. As you can see from the graphs above, price movement tends to track the funds buying and selling.

New-crop soybeans have seen more downward pressure than old-crop soybeans recently, which may be attributed to early thoughts on the new-crop balance sheet. Early thoughts are how U.S. soybean acres could come in at 88.0 million this spring, up from 87.5 million during 2022 and the 87.0 million acre estimate by USDA within the updated Agricultural Baseline Projections report released during November.

If U.S. farmers plant 88 million acres of soybeans and have an average national yield of 52 bpa, production will top out at 4.42 billion bushels ( 87.1 harvest acres), an increase of 166 million bushels over this year's crop. If realized, this could lead to ending stocks near 350 million bushels, up 140 million bushels from the current old crop estimate. The increase in ending stocks is projected to happen despite an increase in use by 59 million bushels year-on-year.

With the odds increasing that the weather-driven bull market is ending and new crop-ending stocks will rise, we encourage producers to aggressively implement risk-management procedures for old and new crop soybeans. When you consider the cost of inputs and the cost of money, the upcoming crop may be the most expensive you have ever planted.

Remember, the market does not guarantee you profit; it is up to you to do that for your operation. Don't hesitate to contact me at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like