Growers who profited from the huge rally in 2020 crop corn and soybeans after harvest likely are laughing all the way to the bank as they get ready to fire up their combines this fall. But even those who rolled the dice and won should take time to perform a postmortem on their storage strategies to make sure they understand the lessons from this historic year.

Results of our annual study of marketing methods show two key learnings that can help guide decisions even in years when the sky isn’t the limit. Both factors could be very much in play for harvest 2021.

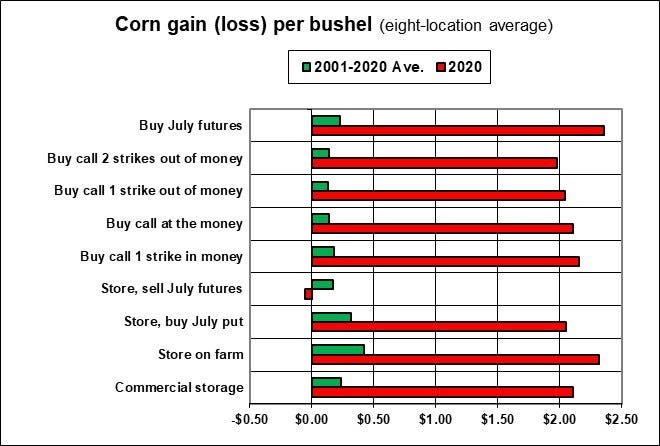

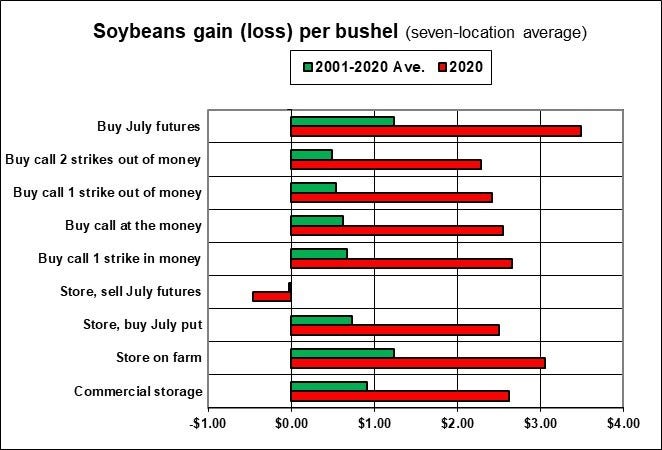

To evaluate results, we looked at how returns compared to the harvest cash price at various locations around the Midwest, including eight for corn and seven for soybeans. This long-term project uses cash, futures and options data dating back to the 1985 crop year, when agricultural puts and calls began trading after a decades-long ban. Net gain or loss compared to harvest are figured on positions held through expiration of July options. Those contracts went off the board June 25 this year, nearly nine months after the Oct. 1 start date for the strategies.

Futures were way off their May highs by late June – corn by $2, with soybeans down more than $3.50. Still, storage offered historically attractive returns compared to the other 35 years in our study.

And the winner is…

But the best-performing strategy wasn’t storing grain unhedged on farm, the method that on average earned the most since 1985. Instead, honors went to selling cash corn or soybeans at harvest and buying July futures, which is similar to delivering the grain out of the field under a July basis contract.

Using futures beat cash corn storage by seven cents a bushel, netting $2.36. Buying July soybeans futures after selling cash in October added $3.49 to the harvest price, 51 cents more than holding the beans in the bin. Futures��’ advantage likely was even greater, because our calculations only take into account costs for handling, brokerage commissions and interest on debt incurred by not raising cash at harvest to pay off loans. No charge is assumed for depreciation on bins or shrink, which vary widely by location and year.

The reason for futures’ relative success can be traced back to market conditions at harvest. Corn basis averaged 32 cents a bushel under July futures. That’s 10 cents a bushel stronger than average. Soybean basis of 27 cents under was 14 cents stronger than the 1985-2020 average. While futures were subdued, smaller supplies of leftover 2019 crops and strengthening demand already had buyers pushing bids.

Carry, the difference between July and harvest delivery futures, reflected that dynamic. July corn futures typically trade for around 25 cents more than December to encourage grain to move into storage. Last October that spread traded less than 10 cents as end users bought the nearby trying to hedge their needs.

Soybean carry normally is less than corn on a per month basis, but swelled to 50 cents or more total from November to July during the trade war with China. The world’s largest importer was buying again last fall, however, causing July 2021 to sell at a discount to November 2020.

Storage hedges failed

The relative lack of carry and strong harvest cash markets limited basis appreciation. Selling futures to hedge stored corn returned gains 72% of the time in our study, the most of any strategy. But trying this so-called storage hedge on 2020 crop corn lost seven cents a bushel.

Hedging soybeans at harvest is the least profitable strategy in our long-term study, struggling to break even on average from 1985 to 2020. And it lost 50 cents a bushel compared to the harvest cash price on 2020 crop soybeans.

Losses on basis meant futures did the heavy lifting for grain held on farm, leading to the success of the sell cash/buy futures strategy.

Big moves by futures are behind the second key take-away from our study. Replacing harvest sales with call options returns a higher net price only a third of the time for corn. Soybean options perform a little better, but still beat the harvest price less than half the time.

Calls convey the right to buy futures for a fixed strike price, many years losing money by expiring worth nothing or much less than the premium paid up front at harvest. For 2020 crops the right to buy corn and soybean futures for the harvest price became far more valuable. An at-the-money call option typically reflects only half the change in its underlying futures in the short term, its so-called delta. But 2020 calls netted $2.11, 89% of the gains in futures. Soybean calls earned 73% of the futures gains. Near-the-money options bought at harvest moved deep into the money as futures rallied, raising their deltas until they performed more like futures than options.

Of course, the 2020 marketing year was an outlier. So what does that say about 2021 storage possibilities?

First, watch harvest basis and carry for direction. Weak basis and normal spreads increase potential returns for cash storage. But if basis stays tight, lack of big carries could be a red flag for cash storage and basis appreciation. July 2022 vs. harvest spreads for both corn and soybeans were tighter than normal this summer, but should widen out if production estimates improve or demand shows cracks.

Second, be realistic about options. Soybean calls have a better chance of making money than corn, but using either for long-term replacements to cash inventories requires big moves by futures to pay off. Compare the cost of commercial storage to options’ premiums, factoring in potential for basis gains to see if taking grain to town might be an alternative despite its high price tag at most locations.

About the Author(s)

You May Also Like