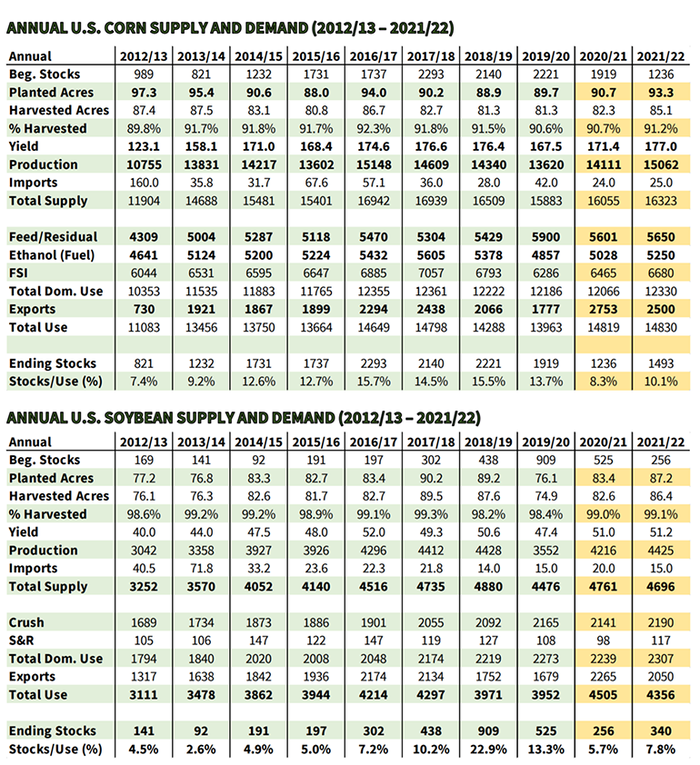

The December WASDE report tends to be a somewhat muted affair, and the 2021 version followed the script providing no significant surprises. USDA chose to leave the domestic corn and soybean balance sheets unchanged. December U.S. Corn 21/22 carryout remains at 1.493 billion bushels while the soybean 21/22 carryout remains at 340 million bushels.

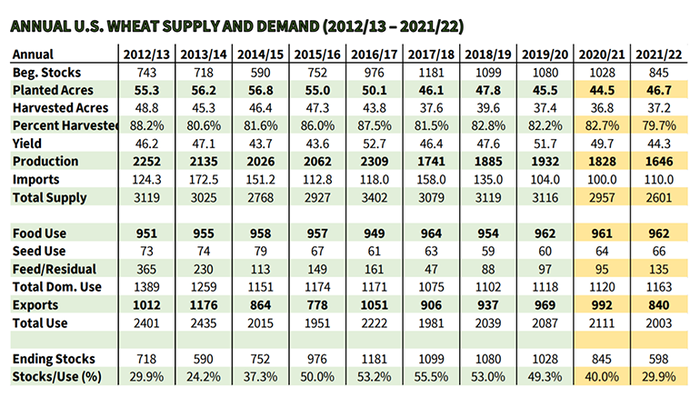

The only domestic adjustments were made to the wheat balance sheet where exports were reduced by 20 mb to 840 mil bu. vs. 992 last year. Food use was unchanged at 962 million bushels, and feed use remained unchanged at 135 mil bu. Imports were lowered by 5 mb. USDA raised hard red winter wheat stocks ten million bu. to 309 vs. 428 last year. Soft red winter wheat stocks were left at 93 mil bu. vs. 85 last year. U.S. hard red spring wheat stocks were increased five million bu. to 132 million bu. vs. 235 last year. It put the 2021/22 wheat carryout at 598.

Global wheat gains

As for the world numbers, World 21/22 Wheat carryout came in at 278.18MMT vs. the November estimate of 275.80 MMT. Most of the gains come from Australia, where they are looking at a second consecutive record crop. Australian wheat was pegged at 34.0 MMT for 21/22 compared with 31.5MMT in November and 33.3MMT in 20/21. Russia's production increased by 1.0 MMT to 75.5 MMT. Canada's output was raised 0.7 MMT to 21.65MMT. Even with these upward revisions, world wheat stocks are still the lowest in 5 years.

Global corn production was revised higher as larger crops in the European Union and Ukraine more than offset a smaller crop in China. USDA bumped Ukraine's corn crop by 2 MMT to 40 MMT and raised their anticipated exports by 1MMT to 32.5MMT. China's 21/22 corn output was lowered to 272.55 MMT vs. 273MMT last month. USDA estimated Brazil’s corn crop at 118.0 MMT, unchanged from November while Argentina was unchanged as well at 54.5 MMT

Bullish soybean news

We got some bullish news on the world soybean front as world 2021/22 oilseed production was revised slightly lower. World 21/22 Soybean carryout is now projected at 102.0 MMT. In November, the USDA estimated ending stocks at 103.78 MMT. The USDA left Brazil beans unchanged at 144.0 MMT and Argentina unchanged at 49.5MMT.

With the report out of the way and the holidays fast approaching, the temptation is to say all will be quiet on the trading front -- but do not be lulled to sleep. The volatility could easily build as we wrap up the calendar year as traders adjust positions in front of what usually is one of the biggest report days of the year when the USDA will dump four separate numbers at the same time on Jan. 12. The reports included in this data dump include an update to NASS supply and demand balance sheets which is partially driven by the three other reports: NASS Crop Production Annual Summary, the quarterly grain stocks report, and the winter wheat and canola seedings report.

Between now and the January report, the trade's attention will be focused on weather, demand and geopolitical influence. On the weather front, South American weather has seen favorable conditions in Northern and Central Brazil, while Southern areas of Brazil, Uruguay, Paraguay and Argentina are drying out as La Niña takes hold. Dryness in the western plains, Canada and parts of Europe also need to be monitored.

Soybean market bulls were fearful that USDA would cut soybean exports on this week's report, which didn't happen. Cumulative sales have reached 69.6% of the USDA forecast, which is a shade above the five-year average of 68.4%. But total commitments are near 1,425 vs. 1,940 last year. If export sales start to fade and the window for the US to dominate the soybean export market tends to close as Brazil's crop size tends to get determined, we could see the export demand revised lower in upcoming reports. Until then, the last several weeks of soybean export sales have actually reduced the weekly sales needed to achieve USDA’s marketing year sales goal.

The corn export number suggests that USDA’s export number could move higher if demand is strong early in the calendar year, as it typically is. Cumulative sales have reached 57.6% of the USDA's forecast for this marketing year versus the five-year average of 47.3%. Total export commitment is near 1.439 million bushels versus 1.561 million bushels last year. The USDA chose to leave the ethanol corn demand unchanged on this week's report at 5.250 billion bushels. With the current ethanol sector profitability, this number could be understated by 150 million bushels. The strong basis we see in the country from the ethanol sector suggests corn demand for ethanol grind will remain strong.

Geopolitical tensions with China will keep trade attention on the daily export wire, looking for any indications that they are shifting demand away from the U.S.

As always, feel free to contact me directly at 815-665-0461 or anyone on the AgMarket.Net team at 844-4AGMRKT. We are here to help.

Reach Jim at 815-665-0461, [email protected] or on Twitter.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like