If your Black Friday menu includes leftovers of fieldwork or chores, following the markets is only one more task to add to the to-do list. But even if you plan an extended holiday instead with family, football and, of course, more food, what happens to corn and soybean futures Nov. 24 may be just another burp.

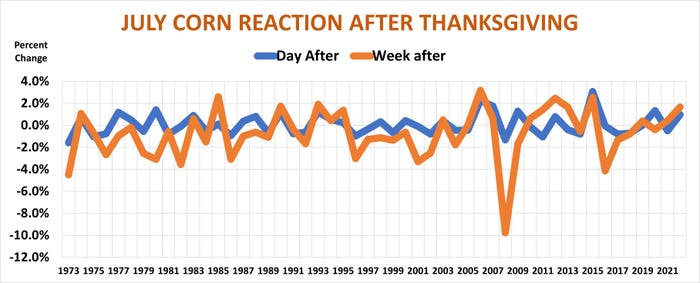

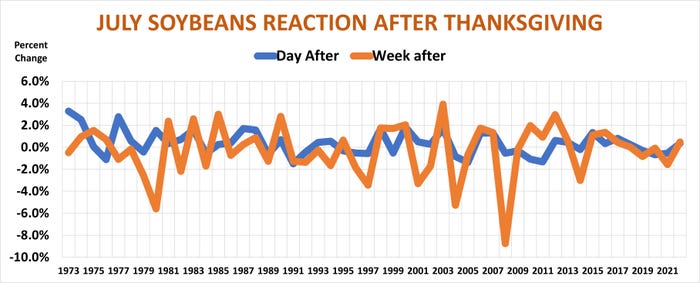

Market moves on what’s normally a half-day of trading are normally within 2% of the close from Wednesday.

A week later, the tale of the tape is a different story. Much bigger downdrafts are possible, some approaching 10%.

While that would trigger indigestion if it happens in 2023, it may not be a sign of the season. Though post-turkey day trading in soybeans was especially volatile over the past 50 years, the trend into the New Year for both crops is pretty much a coin flip.

And in the long run, some years what happens to corn and soybeans as November ends is relevant by the time summer rolls around.

So here’s what history says about Thanksgiving trading patterns – and beyond, using July futures contracts as a marker.

Different drummers

The connection between prices historically one and seven days after the holiday is modest, but still strong enough to be statistically significant – so it’s not just a matter of chance. But corn and soybean reactions march to different drummers. The pattern for corn is more reliable – reliably a toss-up, that is. Prices a week after Thanksgiving are just as likely not to move in the same direction they did the day after.

The correlation for soybeans is lower, but prices tend to move in the opposite direction. So, if prices are higher the day after, they tend to be lower a week later.

Here’s how those statistics played out over the last half century.

Corn closed higher on Black Friday 22 years and fell 27 years, closing unchanged in 2019. A week after, futures were higher only 18 times and lower 31 times, with prices unchanged in 2005.

July soybean futures closed with gains the day after the holiday 30 years, falling the other 20. One week after futures were split 50-50 between gains and losses.

Soybean gains compared to corn on average were bigger the day after, 2.5% to .4%. Both contracts lost around 1.67% one week after.

Exceptions to average

Averages, of course, can be misleading on several fronts.

Though futures normally trade in fairly narrow ranges in the week after Thanksgiving, that rule has exceptions. Big ones.

The holiday produced nothing but heartburn in 2008. July soybeans tumbled 80 cents that year, giving back 8.8% of their pre-holiday value. July corn fared even worse on a percentage basis, slipping 38.5 cents, or 9.8%. Shoppers might appreciate big discounts like those, but farmers who held off on sales likely were nervous.

Those worries were justified for corn, which dropped another 23% into the summer of 2009. But soybeans paid no attention. By June futures were up more than $2, reaching at that time a record for “beans in the teens.”

Bearish corn path

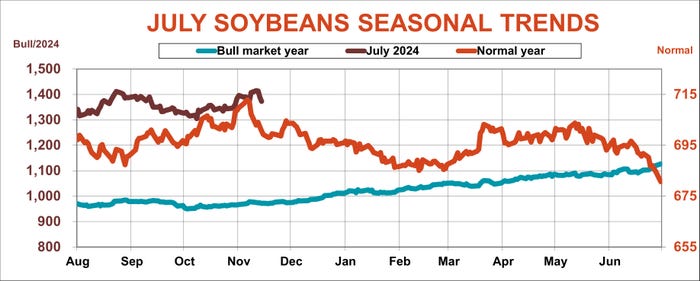

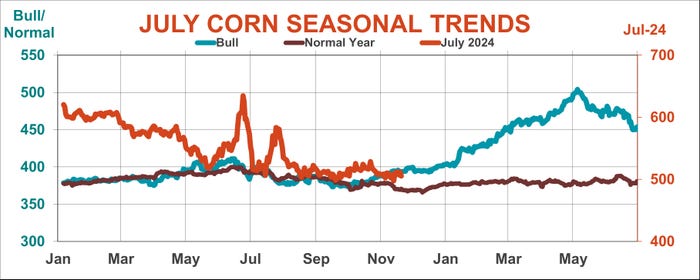

While Thanksgiving markets this year may or not generate sales opportunities for growers, the perspectives for corn and soybeans look different headed into the first half of 2024. Seasonal trend charts aren’t foolproof, but offer a roadmap on what could happen depending on whether futures take a bullish turn into spring and summer.

The trend for July corn isn’t encouraging. The contract posted its lowest close in more than three years on Nov. 10. Taking out lows from the summer and fall puts prices squarely on the path followed in years of normal production, when the market on average never got back to highs from previous quarters before going into delivery at the end of June. If that trend holds, rallies typically have limited upside from current levels.

Big profits aren’t out of the question, but take unusual demand news. Futures jumped 80% from Thanksgiving 2007 into delivery in June 2008, despite then-record production due to a huge increase in acreage. What caused farmers to plant more ground? The spurt in demand from the nascent ethanol boom, a factor that 15 years later is pretty much over and done with. So, without some other event to spur usage, there’s no fundamental reason for corn to take off until growing season weather takes center stage.

To be sure, not all years with “normal” production were bearish from here on in. But losses, some of them big, are the rule not the exception.

Soybean optimism

The soybean season appears more encouraging, because July 2024 so far is following the pattern seen in past bullish years. The contract made a new high for the year just before the Nov. 9 World Agricultural Supply and Demand Estimates, in line with the long-term average. But in years with normal production, that’s usually a top – prices never get close again into summer.

This year July futures kept on going after the WASDE, getting a boost from record October crush and hopes for renewed exports to China before prices set back at the end of last week.

If trading the rest of November can stay well clear above October’s July 2024 closing low of $13.0475, the market would be following the trend seen on average in past years of bullish price moves. While that’s no guarantee, it’s at least cause for a measure of optimism for those with old crop yet to price.

Whatever your plans – for the holidays or marketing crops – keeping an eye on these long-term patterns can take some worry out of missing a day’s trading to spend time with family and friends.

Knorr writes from Chicago, Ill. Email him at [email protected].

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like