December is here – the final month of the year. At the end of this week, we will be receiving USDA’s monthly World Agricultural Supply and Demand Estimates. WASDE will forecast the U.S. and world supply and usage across the agricultural complex. The December report has historically been one that contains very little excitement. Therefore, it carries very little fanfare.

What is very important for you farmers out there: Start paying attention to the little banner across the top of the online shopping services you use. You know, the one that says how many days you have to order your wife that Christmas gift and ensure delivery before December 25! You may thank me later.

I don’t like to discount the importance of a government report which gives us insight into the fundamentals of our business. The report itself provides information that the market has spent most of the year analyzing. Now with the harvest complete, most have a pretty good handle on what the supply situation looks like.

The January report is known to give us excitement as it provides the final yield and production numbers (along with the Quarterly Grain Stocks report). I don’t want to shrug this report off as if it doesn’t have anything to talk about. If you have been paying attention to the daily grain commentary, you understand there are questions brewing.

Watch these factors

Here are a few things to look for in Friday’s report:

The demand for corn, soybeans and wheat is likely to remain unchanged.

Domestic use of grains and oilseeds continues to be strong.

Soybean crush remains on pace for a record year of over 2.3 billion bushels and ethanol grind is getting back to its “heyday” of over 5.325 billion bushels.

The main point remains what the U.S. sells to other countries. USDA has dropped the corn export estimate twice since May (when they began releasing 2023 crop estimates and surprisingly increased exports in the November report back up to 2.075 billion bushels).

Soybean exports have been cut over 220 million bushels since May, (including four months in a row July through October). Even though this week we had marketing year highs in export shipments for corn, we don’t expect much adjustment from USDA in this report. That goes for soybeans and wheat (even though there are rumors that China is sniffing around for all three commodities).

Eye on South America

The timing of normal export patterns out of the U.S. has been unseasonal this marketing year. That is something that we may need to get used to with the expanded capacity from South America.

For corn, both Brazil and Argentina have doubled their production since 2010 and Brazil has doubled their soybean production in the same time period. This has added to the volatility in our corn and especially soybean markets over the last couple of years (especially this season, particularly with the excess rain in Southern Brazil and dryness concerns in the northern growing regions).

This leads to the next focal point of Friday’s report. Several private analysts have already cut Brazil’s soybean production from 8-15 MMT. USDA is currently at 163 MMT.

Will USDA be aggressive and cut production this early in the South American growing season?

Will they assume the slower pace of Brazil’s planting will assure the second corn crop not be as bountiful?

Assumptions are being made, but will the USDA confirm and by how much?

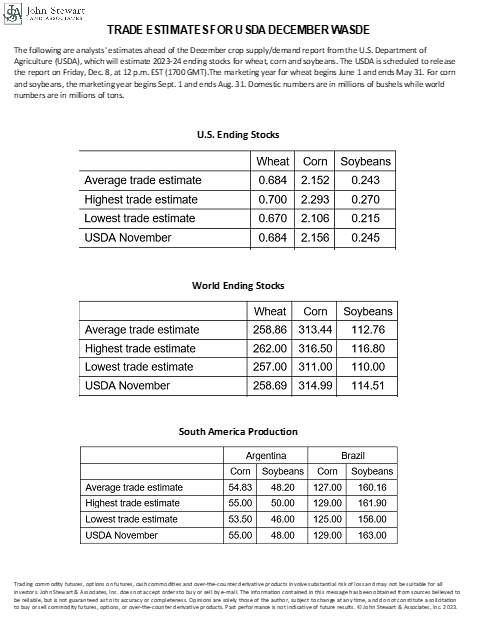

Below you will find the pre-report estimates for the December WASDE. As you can see, the range of estimates for the domestic carryout is rather small (especially, when compared to the Brazil production estimates as their growing season is off to a dusty start).

Be sure and get busy on that shopping list and have an awesome Christmas!

If you have questions or would like specific recommendations for your operations, don't hesitate to contact me directly at 608-384-5438 or anyone on the AgMarket.Net team at 844-4AGMRKT.

Burks is a partner at Agmarket.Net.

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading information and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

About the Author(s)

You May Also Like