We are experiencing the October price doldrums. Corn futures have traded in a very meager trading range for nearly a month with the end of October looking to continue the trend.

Corn futures prices at $6.75 for corn for the nearby December contract is significant. Historically speaking, that is a lofty price level (especially at harvest time), but corn is king and current underlying supply fundamentals remain supportive, even though demand aspects remain a questionable quandary.

As you know, corn harvest is nearly halfway complete in the United States with yield results continuing to come in mixed. It is definitely not a record crop. We have known that was the reality since August, when corn prices started to rally when the various crop tours discovered extreme drought-stricken corn in fields.

Yet, more time needs to pass until the industry finds out if the yields in the better-producing regions of the country can more than offset the devastating yields in drought-stricken regions.

My hunch is that in the upcoming monthly USDA WASDE reports, the U.S. corn yield will continue to inch lower than the 171.9 bu/acre nationwide yield listed now.

Waiting for yield news

The United States is the world’s largest corn exporter, and many of our global customers who rely on importing corn from the United States recently seem to only be purchasing their corn import needs hand-to-mouth, or in smaller amounts.

Some of this might be due of course to higher global corn prices and a higher U.S. dollar. But could it be that these countries are waiting to hear if potentially the American farmers could ultimately pull off a larger crop than expected? Are they also waiting and hoping that prices might work a touch lower before their next round of corn needs to be purchased?

And so here prices sit, in the doldrums of a 30-cent trading range for nearby corn futures which has held this market captive since late August. Keep in mind, the longer prices trade in a sideways consolidation pattern, ultimately, the bigger the price break tends to be down the road.

Overall, global demand for corn has diminished slightly from last year, but demand is still firm overall. For example, for the past two years, the commodity industry has been told Chinese demand for commodities would slow because the country is locked down due to strict COVID restrictions. But actually, Chinese demand for corn has grown over the past three years.

Chinese corn demand increases

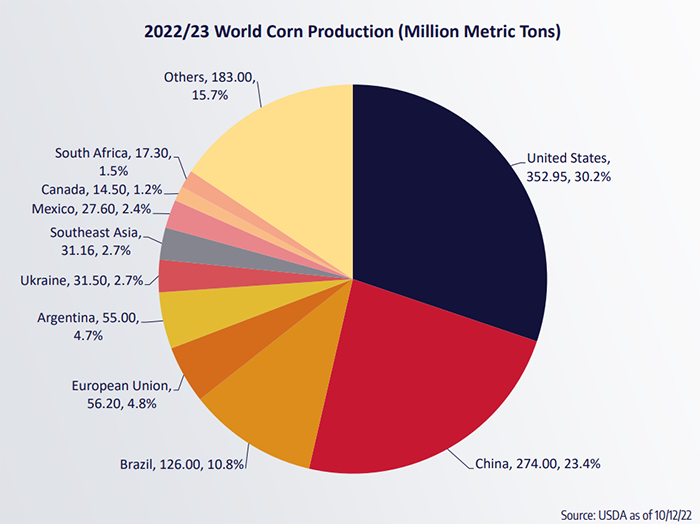

China essentially grows one-quarter of all the world’s corn. They use all of it and export none of it. In the past three years, their actual overall domestic demand has outpaced what they produce domestically, and that is why they have started to import corn.

According to the most recent USDA WASDE report, 2022/23 Chinese corn production is pegged at 274 million metric tons while total domestic use is marked at 295 mmt. Total Chinese corn production in 2021/22 was 272.55 mmt with total domestic use totaling 291 mmt. In 2020/21, total Chinese corn production was 260.67 mmt with total domestic use at 285 mmt.

As you can see, China uses more corn than it grows, and total demand for domestic use of corn is on the rise in China.

In 2020/21, China imported a whopping 29.51 mmt of cheap $3.00 corn. In 2021/22, China imported 22 mmt of corn. And now for 2022/23, China is expected to import 18mmt.

Wait for it -- the hecklers are out there again suggesting that Chinese demand for commodities will slow, but clearly the numbers do not show that, at least for corn. It makes me wonder if China was NOT on various rotating lockdowns, how much stronger would their demand actually be?

And think of it from this perspective, if Chinese corn demand was going to be permanently slower, then why is China still busy securing various grain commodities from different countries, and negotiating new grain importing contracts?

China is not slowing grain commodity demand, they are simply re-strategizing for their future needs. China has two primary issues: actual farmable land inadequacy (which is why they are snagging their claws into other countries around the world) and working to improve their domestic production via improved seed and farming practices. Bottom line: China needs corn. They will continue to be importers.

Major global corn exporters

There are primarily four countries that are the main suppliers of corn for export to the world: the United States, Argentina, Brazil and Ukraine. According to USDA data, here is how the export numbers compare over the past three years:

In 2020/21 the four largest global exporters of corn were the United States (69.78 mmt), Argentina (40.94 mmt), Ukraine (23.86 mmt) and then Brazil (at 21.02 mmt) for a total sum of 155.60 mmt.

In 2021/22 the four largest global exporters of corn were the United States (62.78 mmt), Brazil (44.50) and Argentina (37.50 mmt) and Ukraine (27 mmt) for a total sum of 171.78 mmt.

The four largest global exporters of corn for 2022/23 are as follows: The United States (54.61 mmt), Brazil (47 mmt) Argentina (41 mmt) and Ukraine (15.5 mmt) for a total sum of 158.11.

If you look closely at the numbers, the increase in export business that Brazil has gained over the past two years helps to offset the loss in export capabilities from Ukraine. So it is not as though there is MORE corn to export on the global front for 2022/23. It is just now that Brazil has become a larger competitor due to Ukraine becoming less of a competitor.

The point here is to not be afraid of the media rhetoric that Brazil is going to gain all of the world’s corn export business. Yes, China will be buying more from Brazil, but some of that is due to the fact that Ukraine will have less to export, and China needs to continue to grow its web of global food suppliers from BOTH hemispheres.

Export reduction already priced into the market

Please note that the USDA has been reducing export demand for corn since the May USDA WASDE report. Back in May of 2022, the USDA pegged 2022/23 corn exports at 2.4 billion bushels versus the most recent export number of 2.150 billion bushels. Compared to previous years, export demand is down, due to higher prices.

In 2021/22, the U.S. exported 2.471 billion bushels of corn, and when China had its buying spree back in 2020/21, the U.S. exported a whopping 2.747 billion bushels of corn.

Due to higher prices and a higher U.S. dollar, the USDA has been doing a good job of showing that demand for corn has been reduced. This is priced into the market already.

Also priced into the market is the fact that Brazil has the potential to export larger amounts of corn due to not only a larger crop but also a recent agreement to sell corn to China.

The world still needs corn

Back to China, Chinese corn imports for 2022/23 are pegged at 18 mmt. Chinese domestic demand continues to climb, currently pegged at 295 mmt, up from 291 mmt 2021/22, and also up from 285 mmt in 2020/21 due primarily to an increase in feed demand. Their hog herd is rebuilding.

Also keep in mind that even though China will now allow Brazilian corn imports, China will still require Brazil to prove that the imported corn is not contaminated and meets some of the various production and inspection standards China is asking the Brazilian producers to adhere to.

Don’t forget our other very important countries that buy U.S. corn. Did you know that Mexico has purchased the most U.S. corn so far this year? Mexico is followed by China, Japan and Canada with Columbia, South Korea, European Union, Taiwan, Honduras, and Guatemala rounding out the top ten importing nations.

We have steady customers, but due to higher prices and a higher U.S. dollar, the customers are buying hand-to-mouth. Granted, it is not the rapid pace we are used to, but we are not selling $3.00 corn either. The U.S. is tight on supplies, and remember, the entire northern hemisphere did not have a record crop this summer.

My final point: corn is fairly priced. Demand reduction has been included on nearly every single monthly USDA WASDE report since May, (while also the size of this U.S. crop has been getting smaller as well). Quite frankly, I�’m not sure how much additional demand destruction could actually occur for corn, it would take a black swan event.

The window of sit and wait and hope will be coming to a close soon; for those who are hoping U.S. has a slightly larger than anticipated crop, for those who are hoping that South America has a perfect growing season in January and February, for those who are hoping that the Ukraine war is resolved soon and the grain export corridor remains open throughout winter.

And if I was an end user, I’d be doing everything in my power go through various risk management strategies and start working to secure physical corn now because if the South American crop is not perfect, if the war in Ukraine escalates and if the competition for spring planted acres in this country begins early (because once again, we are faced with nine grain and oilseed commodities in the United States that have tight ending stocks), corn prices have the potential to blast through $7.00 technical resistance levels on charts with sights set on $8.00. Corn is still king.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like