I drove for a couple of hours through the western region of Minas Gerais this past weekend, mostly through intermittent rainfall. Crops from the road seemed to be developing well and were off to a good start. We will finish planting on our farm tomorrow.

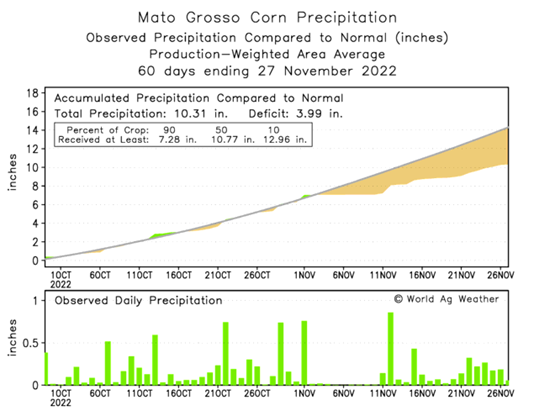

Dry weather has been creeping into parts of Mato Grosso beginning in early November. So far they are about 4 inches below their average accumulated rainfall. Many areas are experiencing their first “veranico” (Indian Summer) of the year. A “veranico” is a two-to-four-week dry spell. Depending on your soil fertility, they don’t always cause major yield damage, but they can take the top off of yield.

While we don’t see any long-term crop damage, recently planted soybeans will need a good soaking rain sooner rather than later for proper germination. We do see rainfall filling in the drier areas later this weekend and on into next week, although there are spots in central Mato Grosso, for example, that are expected to receive less than an inch. This won’t be enough to break the “veranico.” As rainfall has favored the eastern growing belt in Brazil, soil moisture has already been depleted in much of Mato Grosso, Mato Grosso do Sul and Goiás.

Finished planting

Mato Grosso and Mato Grosso do Sul are finished with planting and the MAPITOBA region should be finished in the next week or so. Brazil’s soybean planting will wrap up in Rio Grande do Sul, where EMATER (Brazil’s Extension service) reports 60% planted as of last week, roughly 5% behind their five-year average. Planting is now accelerated, having planted 30% of their soybean area in the last seven days and so they should conclude soybeans in the next week. Some of that speed is coming at the expense of their first crop of corn, which is going in slowly. Their summer crop of corn was 82% planted last week, expanded only by 2%. Fields are showing signs of drought stress. You can find corn in several different growth stages as only 70% of the fields have germinated and yet 10% are already in the grain filling stage.

Large crop ahead

Despite some of these dry weather issues in southern Brazil and Mato Grosso, all signs point to a large crop in line with USDA projections of 150 MMT for soybeans and 126 MMT for first crop corn. Brazil won’t begin planting the larger, second crop of corn until January and so it seems premature to conclude they will have a successful corn crop, however, the first crop of corn is off to a good start and their second crop of corn should be seeded on schedule which is a big factor when calculating its probability of success.

Brazil has already met its soybean export targets of 77 MMT with one month left to go in the year. Similar to soybeans, Brazil’s corn exports should reach close to their goal of 38 MMT this month, leaving the month of December where exports could reach closer to 42 MMT.

Iran and Spain have made up the majority of Brazil’s corn exports until now. They are going to have to make room for China as it has been well publicized of their agreement with Brazil to begin buying corn from them as early as this week.

ANEC, Brazil’s National Association of Grain Exporters, believes corn exports to China could amount to 230 million bushels in 2023, while some see it as high as 400 million bushels. The logical concern for the US market is that if China is buying that much from Brazil, then they are buying that much less from the U.S. In reality the U.S. will make up some of that loss by selling to other buyers, and so I don’t see this news as overly bearish as they make it sound. Although at the same time I question whether the U.S. will be able to find alternate buyers for all of it. I would also point out that the amount of corn that China is supposedly going to buy from Brazil, is close to the amount that the Ukraine corn export market lost, even with the grain corridor still open. And I don’t see that changing anytime soon.

Argentina continues to remain predominately dry as we head into December. Many areas will receive 1” to 2” inches this week, but other areas should be prepared to receive next to nothing. Rainfall will mostly benefit the Buenos Aires region as they are expected to receive 2” to 4”. Planting will continue to move along at a slow pace, likely reaching into January.

Inflation woes

Inflation has been so rampant in Argentina, that farmers are hoarding soybeans as a hedge against inflation. This isn’t anything new, but as inflation has worsened, soybean sales have dried up even further. This past summer the Argentinian government offered a premium on crop sales through the use of a higher exchange rate as a way to get farmers to sell their crops and get more U.S. dollars in the country. As we stated at the time, it worked so well, they were going to have to keep doing it. Enter round 2 of offering exchange rate premiums.

For a limited time, farmers with soybeans can sell them at nearly a 40% premium above the current market. This will shake loose a lot of unsold grain. As long as inflation remains rampant, Argentina is going to have to maintain these programs if they want farmers to part with their grain in a timely manner. It will be that farmers will begin to expect it and so won’t sell anything until it happens again. Argentina desperately needs those crops sold to foreigners in dollars to pay off their dollarized debt.

Most Brazilians have moved on from the election results and are now focused on something much more important: soccer. The World Cup is taking place in Qatar right now and Brazil has won their first two matches. Brazil’s World Cup celebrations make our Superbowl look like a high school graduation party. The country shuts down for a few hours as Brazil takes the field. Of course, the more they win, the more time the country shuts down.

Those games used to take place in the summer during our busy cotton ginning season. I tried to offer the employees large screen TV’s in exchange for not shutting down the cotton gin in the middle of the day to watch soccer. I was told that there would be mutiny, so I backed down. Mato Grosso farmers are lucky they have finished planting, otherwise the tractor operators would literally stop in the middle of the day to watch the game. Come to think of it, that is probably why we are finishing planting tomorrow and not today. You just don’t mess with Brazilians when it comes to their soccer.

Matthew Kruse is President of Commstock Investments. He can be reached at 712-227-1110.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like