The Brazilian second crop corn harvest continues to make progress, surpassing the halfway point over the weekend and likely reaching 55% complete as this is published online.

IMEA (Brazil’s institute of ag economics) placed Mato Grosso harvest progress at 84% this past weekend. At current speed they will be wrapping up harvest next week as expected. Surrounding states such as Tocantins, Goiás, and Mato Grosso do Sul will harvest well into August as they are respectively 60%, 35% and 20% complete. Parana, the second largest “safrinha” production state, is only 12% complete which is nearly half of its historical average. Harvest will be slow in these other states due to high moisture content and later planting dates.

How big is the crop?

Crop estimates continue to have a broad range. Last week, a widely followed Brazilian crop tour pegged Brazil’s second corn crop at 107.2 MMT, which combined with the first and third crop would place it at 137 MMT overall. This represents the high end of the range, with CONAB at 127 MMT on the low end of the range, for a 10 MMT difference amounting to nearly 400 million bushels! USDA is in the middle at 133 MMT overall.

Either way, we expect there will be lots of corn sitting in piles outside fairly soon, due to lack of storage.

Much of this crop tour’s increase in yield is coming from Mato Grosso, where they estimate the state yield to be 107 bpa while IMEA’s latest yield projection was an even 100 bpa. This alone would add 3.4 MMT to the overall yield. They also see a 44% yield increase in Goiás compared to last year.

While we see the crop getting larger due to expansive rains in Mato Grosso and late season moisture in Parana, we are a bit more timid with our estimates coming in towards the lower end. We have seen this happen many times before, where earlier planted crops produce above average yields, getting farmers excited. They have yet to harvest their later planted crops which did not benefit from nearly as much rainfall, as confirmed by one of our farmer contacts in Central Mato Grosso.

There is a huge yield difference between corn planted in January and corn planted in March. Yields for these later planted fields tend to fall exponentially and so we won’t know until the harvest is completely finished in early September. Much like the soybeans, projections rise going into harvest and then fall several months later following post-harvest updates.

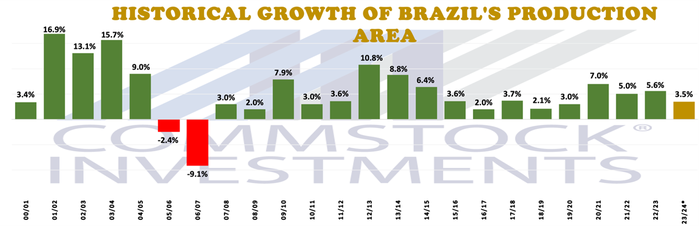

In my blog last week we discussed how soybean area growth is projected higher in Brazil next season; the question is by how much. The average percent of soybean area growth in Brazil for the last twenty years is 5.4%.

While we highlighted one private estimate showing 23/24 growth at 3.5%, another private estimate sees growth at a modest 0.5% due to lower grain prices and higher costs.

While we don’t expect to maintain the historical pace, we do see the euphoria of strong soybean prices lingering a bit longer. Many long-term investment decisions for next season have been made a year or more ago. While soybean prices have dropped, so has corn prices and the cost of fertilizer. If anything, we see a shift from corn acres to soybean acres in the South, especially in first crop production, as soybeans are still cheaper to plant and slightly more drought resistant. The shift in lower beans acres in the U.S. will also help to prop up global prices, increasing export demand from Brazil.

Matthew Kruse is President of Commstock Investments. You can subscribe to The Commstock Report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Read more about:

BrazilAbout the Author(s)

You May Also Like