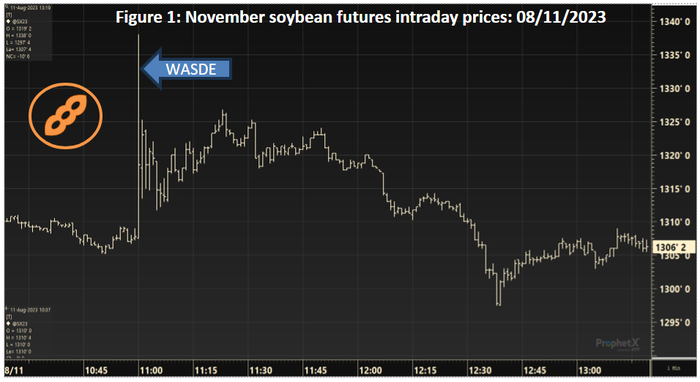

Lower U.S. corn and soybean production and new crop ending stocks highlighted the USDA’s August 11 supply and demand report. Immediately following the report, futures prices for corn and soybeans soared but subsequently collapsed to finish lower at the close of trading.

This is yet another reminder that prices are unpredictable and disciplined management of price volatility is an excellent way to defend your balance sheet.

As always, the USDA supply and demand report contained some surprises. For soybeans, USDA forecast the 2023 U.S. soybean crop at 4.205 billion bushels—below the average trade guess of 4.252 and near the low end of the range of 4.173-4.300. The national average yield is forecast at 50.9 bushels per acre, down 1.1 bushel from July and near the low end of the trade range of 50.5-52.0.

In the wake of recent increased rain in key areas, debate has already begun about the yield forecast and is likely to continue into the next USDA report on Sept. 12.

Turning to the old crop balance sheet, U.S. imports for 2022/23 were increased 5 million bushels to 30 mbu, boosting ending stocks to 0.260 bbu (vs. average trade guess of 0.252). For new-crop, exports were reduced 25 mbu to 1.825 bbu with the USDA noting “lower supplies.”

Despite lower usage, ending stocks for 2023/24 were reduced by 55 mbu to 0.245 bbu—below the average trade guess of 0.263 but within the range of 0.191-0.313. The average farm price for 2022/23 is forecast at $14.20, unchanged from last month, while the average price for 2023/24 increased $0.30 to $12.70. Within seconds after the report was released, November 2023 soybean futures rallied $0.30 from $13.08 to $13.38.

Looking at corn, the 2023 crop is pegged at 15.111 bbu—slightly below the average trade guess of 15.153 (range: 14.885-15.361). The national average yield of 175.1 bpa was down 2.4 bu. from July but within the trade range of 172.4-178.0.

Total supply for 2023/24 is projected at 16.6 bbu—up almost 10% from a year ago.

Turning to old-crop, non-ethanol food, seed and industrial use of corn was lowered 20 mbu, and exports were reduced 25 mbu. As a result, ending stocks for 2022/23 were increased 55 mbu to 1.457 bbu—slightly above the average trade guess of 1.410.

For new-crop, reductions in usage were noted for exports (50 mbu), feed/residual (25) and non-ethanol FSI (20). Total usage for 2023/24 is forecast at 14.390 bbu—up 5% vs. last year. Ending stocks are pegged at 2.202 bbu—slightly above the average trade guess of 2.167 (range: 1.961-2.358). The average farm price for 2022/23 was unchanged at $6.60, while the estimate for 2023/24 increased $0.10 to $4.90. Within seconds minutes after the report was released, December 2023 corn futures rallied nearly $0.10 from $4.98 ¼ to $5.07 ½.

Despite the initial bullish reaction to the report, futures prices for corn and soybeans at the close of trading on Friday were lower; November soybeans fell almost $0.32 from the post-report high to close at $13.06 ¼, while December corn plunged $0.20 ¼ to finish at $4.87 ¼.

This is yet another reminder that prices are unpredictable and disciplined management of price volatility is an excellent way to defend your balance sheet. Find an advisor you can trust to provide guidance on your marketing strategy as harvest nears.

Contact Advance Trading at (800) 747-9021 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like