December 4, 2023

Although it is nearly two months before USDA’s annual count of U.S. and state cattle inventories, early information points to a decline in the January 2024 cow herd between 1.5% and 3.5%, setting cattle producers up for a strong run of prices.

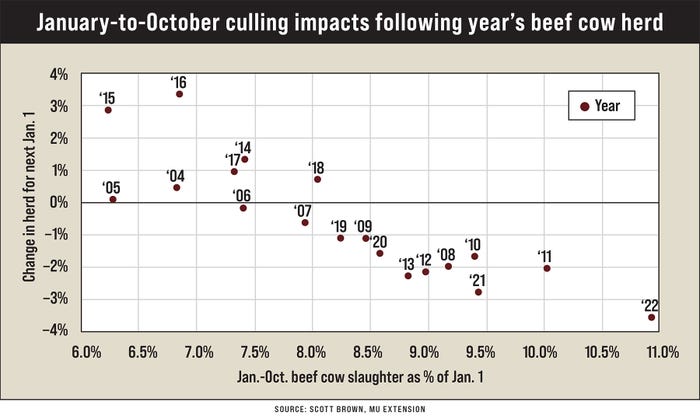

The early speculation is based on 10 months of beef cow slaughter data already in the books and a strong relationship in past years between slaughter rates and next year’s herd size.

While there are more influences than the culling rate that affect future beef cow inventory (including the number of heifers added to the herd as replacements and previous-year data revisions), this piece of data has mapped well to reported January beef cow numbers in recent years.

PRICES: Check the latest commodity data for live cattle and feeder cattle

A look at slaughter numbers

Through the end of October, 10% of the beginning beef cow herd has been slaughtered, down from the 11% recorded last year that contributed to a 3.6% decline in beef cow numbers to begin 2023. The chart shows a very similar culling rate occurred in the first 10 months of 2011, and it led to a 2% drop in beef cow numbers to begin 2012.

Since 2004, a January-to-October culling rate of 8.2% or more has always led to a decline in the beef cow herd the following year, and when the culling rate exceeded 8.5%, the herd declined by 1.5% or more.

Analyzing regional beef cow slaughter information, culling rates have trended differently throughout the country:

Southeast region. The drought has intensified in recent months, and this year’s culling rate remained near last year’s elevated level.

Mid-South and Southwest region. Arkansas, Louisiana, New Mexico, Oklahoma and Texas saw a larger decline in the culling rate relative to a year ago than the national average, as have many other Western areas.

Impact of reduced cow herd

What is expected if the beef cow herd drops by 1.5% or more to begin 2024?

While it is not a guarantee that feeder cattle prices will see another year of increases, the odds are stacked in that direction.

In the 10 years since 1990 when the beef cow herd declined by 1.5% or more, the Oklahoma City 600- to 650-pound feeder-steer price increased in eight of those years, with an average growth of 15.6%.

A sharp decline in the 2024 beef cow herd number would also increase the likelihood for another decline in 2025.

Even with cow-calf returns nearing record levels, dry conditions that continue to plague important cow-calf production areas are weighing heavily on any efforts to rebuild the herd. The current drought monitor map displays a much larger percentage of stressed areas than was the case from 2014-18, when the last rebuilding phase took place.

Although we will not receive the details regarding the cow inventory count until late January, you can make use of the information that it is likely to show on your operation now. The odds are high that higher prices will continue for at least one or two more years. Make sure that you are well positioned to take advantage.

Brown is a livestock economist with the University of Missouri. He grew up on a diversified farm in northwest Missouri.

Read more about:

BeefAbout the Author(s)

You May Also Like