The USDA released their annual grain outlook Thursday morning and it was not good. Much of the results were telegraphed ahead of time as we had shared in previous reports that even with cuts to corn acres, ending stocks still increased due to improving yields and an already hefty supply.

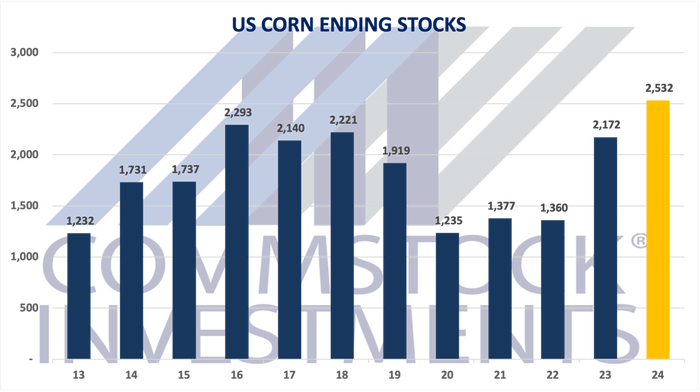

The USDA foresees 91 million planted acres this season, down 3.6 million from last year. They are using an average yield of 181 bpa compared to 177.3 last season. This brings ending stocks up 2.532 billion bushels compared to 2.172 billion for this year.

Where is the bottom?

There was a lot of pushback last year on the USDA using a national yield of 181 bpa for corn. I don’t think they will get the same pushback this year considering 2023 results. Despite adverse weather, we still set a record for national corn yield at 177.3 bpa. What happens in a normal weather year? What is scary to me is that the 181 bpa corn yield is seen as a ceiling when it is not. If we can get 177 bpa in a bad year, who’s to say we cannot get 182 or 183 in a good year for a national average?

With these baseline figures, the USDA has now set the tone for 2024. The focus will now shift towards an acreage debate for the next six weeks about whether it is too high or too low. Just to get us back to par with this season, we would have to reduce acres by an additional 2 million. Not easily done. On the demand side, we all know low prices cure low prices. But how low do we have to go to find the cure?

As a general statement, we like to believe that these annual outlook numbers usually present the most bearish scenario for the year. There can likely be improvements made to the export numbers which were left at 2.15 billion bushels. Brazil exports will be down for 2024 due to a shorter crop and higher domestic consumption. We need to take advantage of the time between now and June when their harvest begins to hit the market. Brazil’s weather will also still be an important factor. If rainfall shuts off early in March, it could provide additional support. It would be easy to point to weather scares as a potential catalyst for rallies, but these are highly unpredictable and hoping for a drought someplace is not a good marketing plan.

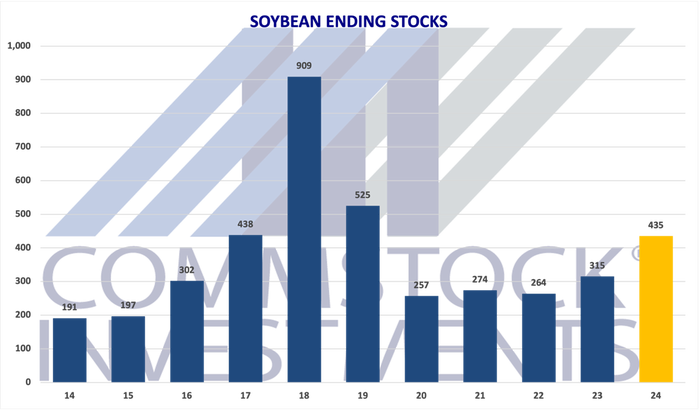

The situation in soybeans is perhaps not as dire in corn, but neither is it a positive one. The USDA plugged in planted acreage at 87.5 million, up 3.9 million from last year. They used an average yield of 52 bpa compared to 50.6 bpa last season. Ending stocks increase to 435 million bushels, compared to 315 million this year and 264 million in 2022. While 435 million would likely not be considered “burdensome” by any means, it is also no longer considered tight. It is somewhere in the middle.

Soy needs a new customer

There are high expectations for renewable diesel to begin consuming more soybeans. We need that like yesterday. I don’t see us getting a lot of help on exports as China’s imports are slowing down as they struggle with their economy and continue to buy as much from Brazil as possible. And this is all without any trade wars. We need to set a 20-year goal as an agriculture community to find or build a replacement for China as a customer. Whether that comes in the form of renewable diesel, I don’t really care. But long term we believe it is unsustainable to rely on China as much as we have in the past.

Markets are all oversold and sentiment is extremely bearish. That is usually around the time we find a bottom. Seasonals would suggest that we could still rally into spring planting, especially if the spring weather does not cooperate. But we may have to define what is a rally. Depending upon the severity of the weather, we may be limited to only 25-cent rallies.

There are no easy answers in bear markets. We need to remind ourselves that anything is possible. While a move below $4 seemed improbable not that long ago, today’s report from the USDA took us one step closer to that possibility.

Matthew Kruse is president of Commstock Investments. Subscribe to their report at www.commstock.com.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

About the Author(s)

You May Also Like