After trading at all time high price levels just one year ago, Class III Milk futures have tanked. An increase in milk production in response to the higher prices was met with modest demand. This sent prices lower over the course of a year.

Is a price low near?

From a technical perspective, Class III milk futures are extremely oversold on daily, weekly, and monthly charts. While there is no technical sign of a bottom at the moment, various technical indicators seem to be attempting to create “buy signals,” but a fundamental catalyst is needed to spark the ultimate price change in direction.

There are a few additional indicators starting to pop up that might be pointing to a potential bottom sooner than later in the dairy market.

Looking at the funds (the big money in the marketplace) the funds have held a record net short position for several weeks. When the funds hold so many contracts in one direction, it doesn’t take much of a catalyst to get them to start exiting their short position.

Updated milk production report

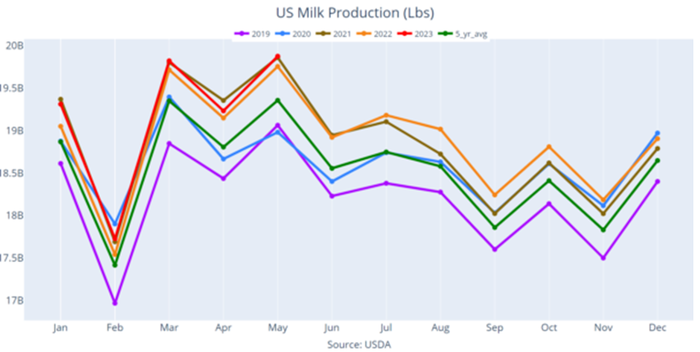

It was just reported that May milk production was up just 0.60% from the same month last year. This is met with mixed reactions. From one standpoint, overall production is still increasing, so that might weigh on prices. However, milk production growth has now been below 1.00% growth for three months in a row.

Year-over-year growth so far in 2023 for milk production has been trending lower when you look specifically at each month. January production was up 1.40%, February production up1.10%, March production up 0.50%, April production up 0.40%, and now May production up 0.60%

So it would seem that producers may have been intentionally producing less, in effort to help raise that milk price higher.

Additionally, the report stated that U.S. milk cows are down 16,000 head from April. As you know, I live in dairy country in eastern Wisconsin, and the talk around here is that a lot of dairy cattle are getting culled recently, both in response to higher cattle prices and the fact that a good portion of Wisconsin is getting hot and dry, and producers are concerned about hay crops and higher feed costs in general.

The dairy market is already dealing with extremely tight margins. Over the past few weeks, the corn price has rallied roughly $1.40 from the May price low while soybean meal has added $52.50 per ton recently.

Can the feed rally be the catalyst the dairy market needs to bounce off of extremely oversold conditions?

The feed rally and lower milk production growth are a start, but what’s missing is demand.

Dairy demand

Cheese prices have not been fabulous. Demand for cheese has been spotty. The spot block/barrel average finished at $1.44375/lb, earlier this week, which is its lowest price since May of 2020! That was after the Covid free fall! And as cheap as prices are, cheese buyers have shown little interest at these levels. Should the cheese price find support and start to correct higher, that would likely also help the Class III milk futures start to rally.

Also not fabulous in terms of demand are U.S. dairy exports. Dairy exports in April totaled 218,820 metric tons, which was down 12% from the same month last year as well as 13% lower than March. This was the first time in 15 months that the total dairy export tonnage was under the 5-year average for the respective month. Butter exports were hardest hit on a percentage basis, down 64% from April 2022 and half the total from the month prior. The next major dairy export report does not come out until July 6.

Again, no sign of a bottom for Class III milk prices at the moment, but that might be starting to change.

Reach Naomi Blohm at 800-334-9779, on Twitter: @naomiblohm, and at [email protected].

Disclaimer: The data contained herein is believed to be drawn from reliable sources but cannot be guaranteed. Individuals acting on this information are responsible for their own actions. Commodity trading may not be suitable for all recipients of this report. Futures and options trading involve significant risk of loss and may not be suitable for everyone. Therefore, carefully consider whether such trading is suitable for you in light of your financial condition. Examples of seasonal price moves or extreme market conditions are not meant to imply that such moves or conditions are common occurrences or likely to occur. Futures prices have already factored in the seasonal aspects of supply and demand. No representation is being made that scenario planning, strategy or discipline will guarantee success or profits. Any decisions you may make to buy, sell or hold a futures or options position on such research are entirely your own and not in any way deemed to be endorsed by or attributed to Total Farm Marketing. Total Farm Marketing and TFM refer to Stewart-Peterson Group Inc., Stewart-Peterson Inc., and SP Risk Services LLC. Stewart-Peterson Group Inc. is registered with the Commodity Futures Trading Commission (CFTC) as an introducing broker and is a member of National Futures Association. SP Risk Services, LLC is an insurance agency and an equal opportunity provider. Stewart-Peterson Inc. is a publishing company. A customer may have relationships with all three companies. SP Risk Services LLC and Stewart-Peterson Inc. are wholly owned by Stewart-Peterson Group Inc. unless otherwise noted, services referenced are services of Stewart-Peterson Group Inc. Presented for solicitation.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like