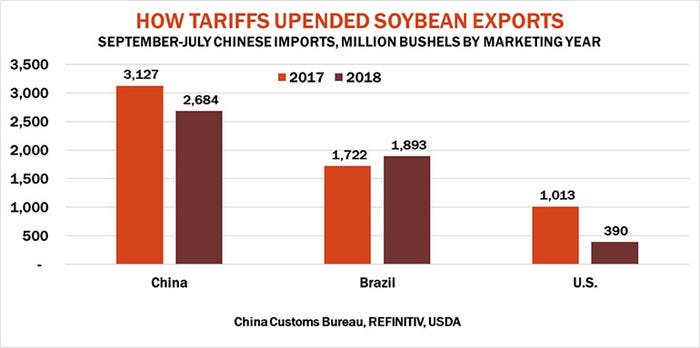

Another week, another mixed round of export sales data from USDA. All eyes were on China, which told its soybean industry last week to stop buying from the U.S. in retaliation of President Donald Trump’s threat to trigger more tariffs on Chinese goods.

“But before the latest salvos in the trade war, China’s footprints were all over data on international sales,” notes Farm Futures senior grain market analyst Bryce Knorr.

Today’s export sales report showed new Chinese purchases of 4.6 million bushels of old crop and 7.1 million bushels for delivery in the 2019 marketing year that begins Sept. 1, Knorr says.

“Chinese buyers also continue to take delivery of previous purchases made during the brief truce in the trade dispute as a goodwill gesture,” he says. “Shipments to China totaled 19 million bushels last week, leaving 142 million bushels still on the books.”

Still, total 2018 crop exports to China from the U.S. total 390 million bushels, compared to 1.01 billion during the first 11 months of the 2017 crop selling season, Knorr adds.

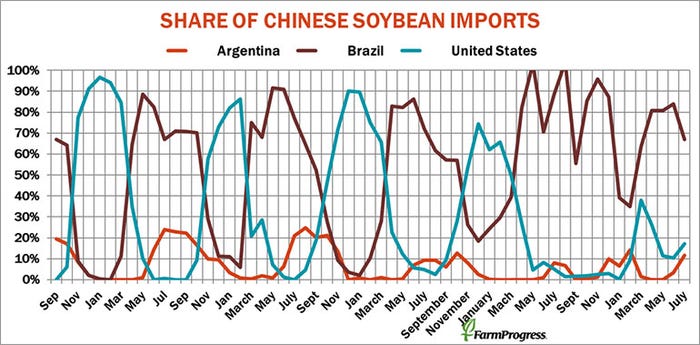

“Chinese purchases from Brazil are up, but not by all that much because total Chinese imports are down 14% year-on-year, largely due to the impact of African Swine Fever,” he says.

The latest data from the Chinese customs agency out overnight showed an uptick in imports last month because arrivals from both the U.S. and Brazil all landed. Normally China would be buying mostly from South America during the U.S. summer, when soybean supplies are typically tighter. But the trade war upended those usual patterns. July Chinese imports of 318 million bushels were the highest in a year, but that’s likely to be merely a footnote when all is said and done.

“Soybean shipments must continue run at very strong levels through August to reach USDA’s forecast for the marketing year,” Knorr says. “Otherwise, some of those deals will be rolled to new crop or perhaps even cancelled.”

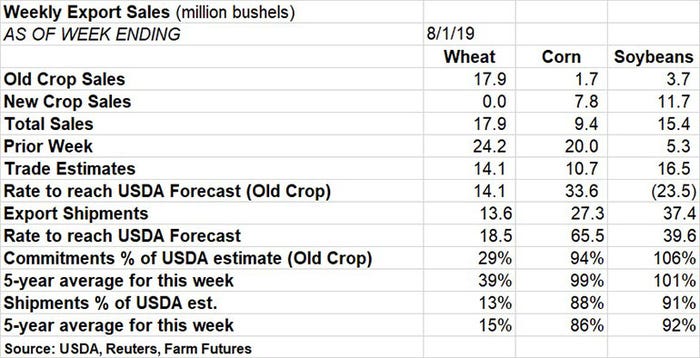

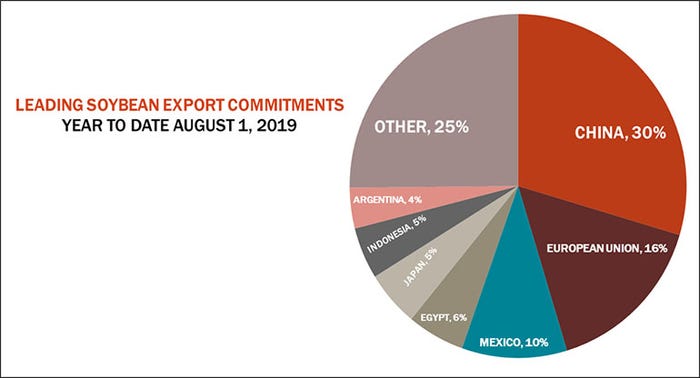

Soybeans found 3.7 million bushels in old crop sales for the week ending August 1, plus another 11.7 million bushels in new crop sales for a total of 15.4 million bushels. That nearly tripled the prior week’s tally of 5.3 million bushels but still lagged behind trade estimates of 16.5 million bushels.

Soybean export shipments were for 37.4 million bushels. As the 2018/19 marketing year winds down, China remains the No. 1 destination for U.S. soybean export commitments, with 30% of the total. Other top destinations include the European Union (16%), Mexico (10%) and Egypt (6%).

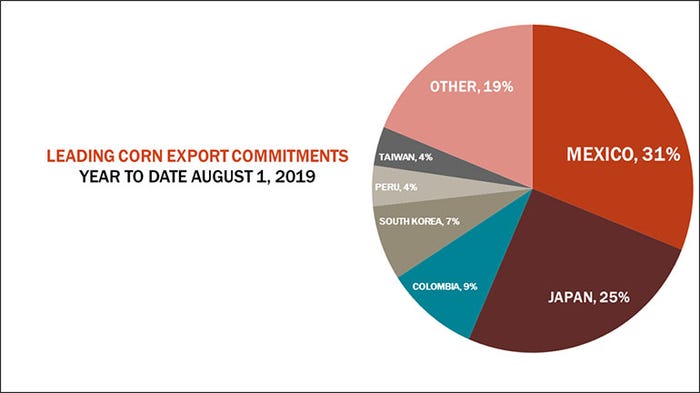

Corn export sales struggled last week, gathering just 1.7 million bushels of old crop sales plus another 7.8 million bushels in new crop sales for a total of 9.4 million bushels. That was less than half of the prior week’s tally of 20.0 million bushels but mostly in line with trade estimates of 10.7 million bushels.

“Hopes for corn to hit USDA’s target are fading, with both sales and shipments lagging,” Knorr says. “The agency is likely to lower its forecast for exports in Monday’s supply and demand report, increasing leftover supplies to cushion the smaller production we expect for 2019.”

Corn export shipments were for 27.3 million bushels. With less than a month remaining in the 2018/19 marketing year, Mexico tops all destinations for U.S. corn export commitments, accounting for 31% of the total. Other leading destinations include Japan (25%), Colombia (9%) and South Korea (7%).

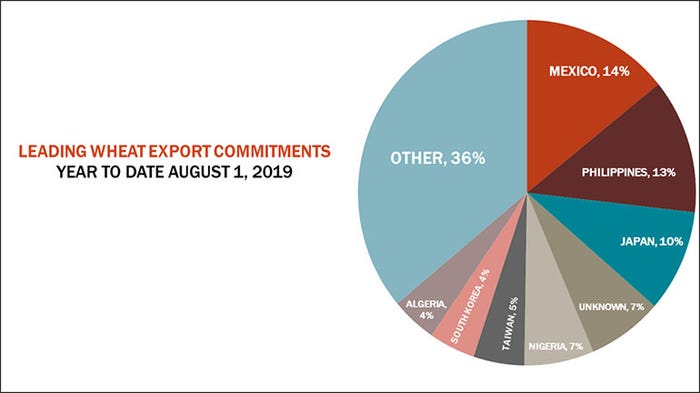

Wheat export sales retreated last week after landing 17.9 million bushels in total sales. That was moderately behind the prior week’s tally of 24.2 million bushels but ahead of trade estimates of 14.1 million bushels.

“Wheat export sales weren’t great but hit the target needed every week to reach USDA’s forecast,” Knorr says. “Wheat continues to be sold a variety of countries, though most aren’t taking large amounts. No buyers booked more than a single cargo last week. Buyers included China, which also picked up some sorghum.”

Now two months into the 2019/20 marketing year, Mexico leads all destinations for U.S. wheat export commitments, with 14% of the total. Other top destinations include the Philippines (13%), Japan (10%), unknown destinations (7%) and Nigeria (7%).

About the Author(s)

You May Also Like