September 6, 2018

The value (price) of wheat is determined by quantity and quality. Quantity is reflected by the KC wheat contract price, while quality is mostly reflected in the basis.

Wheat prices are determined by adding the basis to (or subtracting from, if a negative basis) the nearby KC contract price. At this writing, the KC December contract price is $5.30, and the basis in Burlington, Okla., is minus 10 cents. The Burlington Cooperative Association elevator is offering $5.20 per bushel for U.S. Number 1 hard red winter (HRW) wheat. (Cash Price = Futures Contract Price – Basis 1).

The KC wheat contract price sets the base price for all hard red winter wheat. The basis (difference between the local price and the KC contract price) adjusts the KC contract price for location, handling costs, and quality.

Location is mostly the transportation cost to terminal markets (flour mill or export elevator). Quality includes all grade and non-grade factors that impact price. Wheat quality factors typically have a significantly larger impact on the basis than changes in transportation costs.

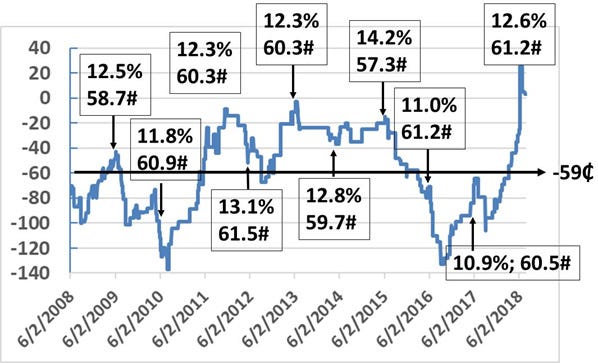

The daily basis (June 2, 2008 through August 28, 2018) for an elevator in Burlington, Okla., is shown in Figure 1. The basis range for the 10-year period is between a minus $1.38 and a positive 23 cents. The 10-year average basis was a minus 59 cents.

Also shown in Figure 1 are the average annual protein levels and test weights of Oklahoma wheat by marketing year (Plains Grain Incorporated).

Flour mills and export buyers tend to contract for U.S. Number HRW wheat (60 pound minimum test weight) with a minimum 12 percent protein. Flour mills buy 12.2 percent to 12.5 percent protein wheat.

The 2009 Oklahoma wheat crop averaged 12.5 percent protein and 58.7 pounds test weight (Figure 1). Protein was well above 12.2 percent, but test weight was below 60 pounds. The basis declined from minus 42 cents to minus $1.00, and was at minus 98 cents at the beginning of the 2010 harvest. Relatively low test weight and large stocks led to a 60 cent decline in the basis.

The 2010 wheat had adequate test weight (60.9 pounds), but relatively low protein (11.8 percent). With relatively high beginning stocks and production, the basis declined from minus $1.00 to minus $1.38.

By August 1, 2010, it was apparent that foreign wheat production and quality would be below average. It was also possible to blend the 2009 U.S. HRW wheat (high protein/low test weight) with 2010 wheat (low protein/high test weight) to better meet market demand. The basis increased from minus $1.38 to minus 22 cents by June 1, 2011.

The 2011, 2012, 2013, and 2014 wheat crops all had protein above 12.2 percent, and the test weight was mostly above 60 pounds. The basis remained above average in the minus-60 to minus-3 cent range.

The 2015 wheat crop had well above average protein but well below average test weight, and the basis fell from minus 18 cents to minus 75 cents (below average). Even though test weights were above 60 pounds, extremely low protein in 2016 and 2017 resulted in the basis remaining below average and returning to the minus $1.35 level.

12.6 percent protein in 2018, combined with 61.2 pound test weight, resulted in the basis increasing from minus $1.10 to positive 24 cents.

The basis information in Figure 1 shows that the market premium for protein and test weight is reflected in the basis. To a certain extent, protein may be more important than test weight. However, as shown in 2015, with protein well above average, test weight can result in below average basis.

Figure 1. Burlington Oklahoma Daily Basis and Average Marketing Year Protein and Test Weight.

About the Author(s)

You May Also Like