Is the recent rally in the soybean market driven by supply or demand? The short answer is first supply, next demand, and then supply again. There are several pronounced factors currently influencing soybean prices. Here is a deep dive look at them.

Supplies shrink to historic levels

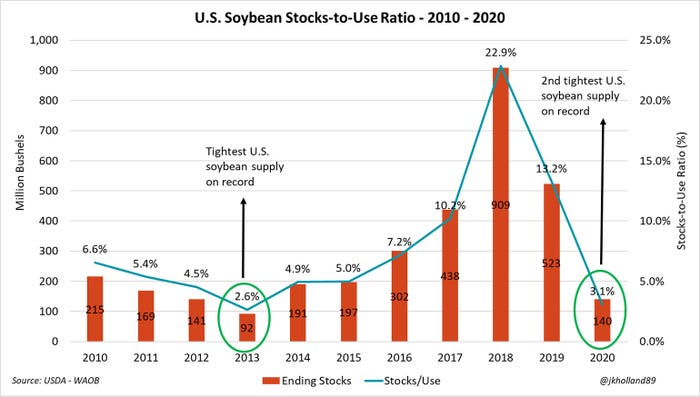

U.S. soybean production for 2020 dropped slightly from previous USDA estimates based on the January 2020 WASDE and Crop Production reports. Yields fell half a bushel to 50.2 bushels per acre – still the third highest yield in U.S. history. Production dropped marginally from earlier estimates to 4.135 billion bushels. It marked a 16% increase from 2019 yields and notched the fourth highest volume for U.S. soybean production on record.

Though residual usage was cut for the 2020/21 year and 20 million bushels of imports were added to the U.S. soy balance sheet, ending soybean stocks shrunk even more as export and domestic crushing demand increased. U.S. soybean supplies remain at their 2nd tightest level on record as strong global and domestic demand sends global buyers scrambling for U.S. soy.

Quarterly stocks data found December 1, 2020 U.S. soybean stocks at 2.9 billion bushels – the lowest for that time of year in four years. It’s no secret that demand is high. Revised usage data finds that June – September consumption rates recovered to the second highest on record in the wake of the pandemic.

Blistering export paces

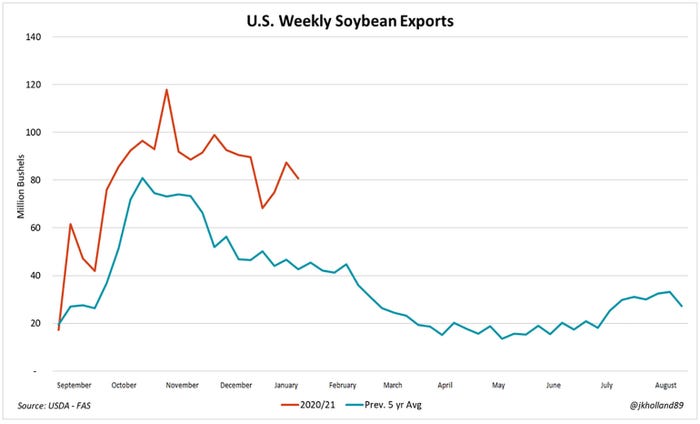

As of January 21, 1.67 billion bushels of 2020/21 soybeans have been shipped into international channels. The total represents nearly 79% of all current soybean export commitments for the 2020/21 marketing year.

Chinese purchases have made up the lion’s share of this year’s increased soybean demand as its hog herd inches closer to a full recovery from African Swine Fever. At 1.14 billion bushels of soybeans exported to China so far in the 2020/21 marketing year, 68% of all U.S. soybean exports have ended up in China.

And it’s not just China that has a healthy appetite for soybeans. The two next largest soybean buyers from the U.S. in 2019/20 – Japan and Mexico – have already purchased and shipped 2.8 times as many bushels of soybeans since the 2020/21 marketing year began last September compared to the same period a year ago.

Countries in the Middle East, Southeast Asia, and Europe also increased soy demand this year. Current marketing year to date soybean export loading paces to all countries less China, are 41% higher than the same time in 2019.

In the January 2020 WASDE, USDA raised old crop soybean export forecasts to 2.23 billion bushels, which would set a new record high for U.S. soy exports, if realized. With over 75% of that total already shipped to international buyers less than five months into the marketing year and weekly loading paces at record levels, market participants are justifiably concerned that soybean supplies will run out before next fall’s harvest.

Demand rationing could take one of several forms. Prices could rise high enough that buyers can no longer afford U.S. soybeans. Slow farmer sales could also keep domestic usage rates low. At the moment, it remains unclear if the chicken or the egg will come first. But by the end of this summer, market incentives for soybeans will likely look vastly different than the current trading environment.

Logistics of demand rationing

Demand rationing will be necessary going forward to maintain adequate stocks through the end of the current 2020/21 marketing year. But that is easier said than done. Through early 2021, soy crush margins were largely positive. A weak dollar did little to deter export interest for both commodities, especially after price corrections in the futures market in late January.

Export demand for soymeal shipped out of the U.S. Gulf weakened in late January. Livestock and poultry producers are increasingly being pushed out of the market amid high soymeal futures prices, limiting demand potential. Futures gains have some support from concerns about supply availability from South America, namely in Argentina where economic turmoil continues to disrupt grain flows.

As U.S. soy stocks dwindle, processors are rapidly snapping up any extra soybeans on the market. Reports of processors across the Midwest buying record forward purchases as far out as May are not uncommon in today’s trading environment. Poultry production is forecast to decline in the second half of 2021 due to increasing soy prices.

It suggests that processors could start to reduce crush rates, compete for bushels with exporters, and possibly import South American soybeans – at a premium.

Increased soymeal exports in 2020 following an atypically slow shipping season from top global soymeal exporter, Argentina, as well as an increase in soy diesel, powered 2020 crush volumes to the highest on record. But the near future is less certain.

"They've got a program in place that will keep crush rates strong until maybe about May. Thereafter there is some openness to it," Dan Basse, president of Chicago-based consultancy AgResource Co told a reporter with Reuters.

Phase 1 goals…met?

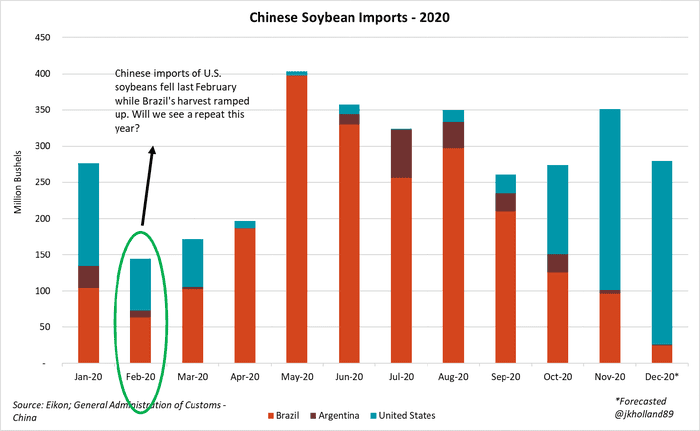

Soybeans have been one of the crown jewels of the Phase 1 trade agreement between the U.S. and China. Chinese and unknown buyers represent 278.9 million bushels of remaining exports – or 62% of total outstanding sales of U.S. soybeans. U.S. export loading paces to China in the next month will be critical to price stability, before the cheaper and larger Brazilian crop takes over export channels in March.

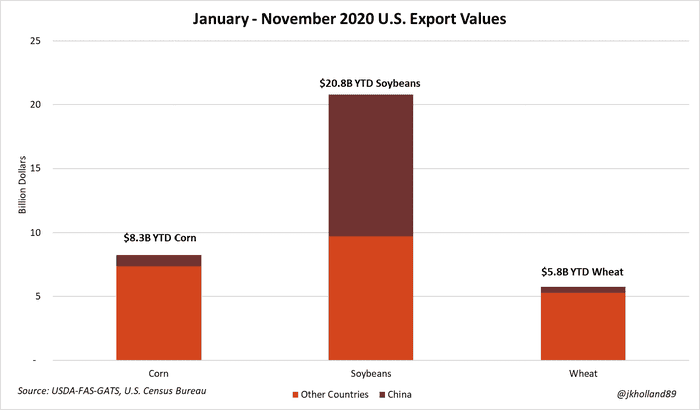

The Phase 1 trade deal was negotiated on the basis of currency, not volume. The agreement stipulates that Chinese purchases of U.S. ag goods would be $12.5 billion over the 2017 baseline in 2020 and $19.5 billion over the same benchmark in 2021. China purchased $24 billion of U.S. ag products in 2017, placing the 2020 target at $36.5 billion and 2021 goal at $43.5 billion.

The latest Census data for January through November 2020, shows that China purchased nearly $24 billion of U.S. agricultural goods. That is 12% higher than the same period during the 2017 baseline. Strong harvest loading paces – and grain prices – in December 2020 suggest that China will come within striking distance of meeting Phase 1 goals for 2020.

South American crops

Help for tight stocks may be on the way as Brazil’s newly harvested soybean crop hits export channels. Steady rains in Brazil during December and January helped yields to somewhat recover from dry La Niña weather conditions. Brazilian farmers are about a month behind filling soybean export orders due to the planting and rain delays.

Brazilian soybean harvest experienced early-season rain delays as well. The Brazilian soybean growing season was already playing catch-up after dry soils delayed plantings last fall. AgRural, an ag research firm in Brazil, estimates only 0.7% of Brazil’s planted soybean acreage has been harvested as of January 21, down from 4.2% during the same period last year due to the rain delays.

Estimates peg January 2021 soybean export out of Brazil at a mere 8.3 million bushels, down from last week’s forecast for the month, which was estimated at 37.7 million bushels. The rain delays compounded with last fall’s planting delays continue to keep the lucrative Brazilian soy crop from reaching export terminals as quickly as international buyers – mainly China – would like.

While the showers will benefit late-planted soybeans in Brazil’s more parched Southern regions, the additional delays will limit acreage and yield potential for the second corn crop, known in Brazil as the safrinha crop. The safrinha makes up 75% of Brazil’s corn production, most of which is sent into export channels upon harvest.

The Brazilian currency, the reais, tumbled to new lows last year as the pandemic sent foreign investors flocking to the U.S. dollar. But the drop benefited farmers, AgroBravo’s CEO Julio Bravo points out, as the exchange rate against the dollar led Brazilian farmers to their most profitable year on record. In the latest South American Crop Watch column, Bravo reflects that consumers have borne the burden of a weak currency as the cost of basic goods increase. As long as Chinese demand for soybeans remains steady, Brazilian farmers could see another lucrative year.

In the January 2021 WASDE report, 2020/21 Argentine soybean production was slashed another 73.5 million bushels to 1.76 billion bushels as drought concerns persist. USDA left Brazilian soybean production unchanged for now at 4.886 billion bushels, as dry conditions do not currently seem to be as detrimental to the crop as its Argentine counterpart. Even with a slight shortfall, the 2020/21 Brazilian soy crop will be the largest on record ever – for any country in the world.

New crop acreage intentions

USDA’s deputy chief economist, Cynthia Nickerson, says USDA expects to see higher corn and soybean acreage planted in 2021 based off current market pricing. "Since the price of both soy and corn are higher, the price signals are really to plant more of both, and that's what we expect to see - expansion of both into 2021," Nickerson stated.

Farm Futures’ January 2021 survey questioned farmers about planting intentions for the 2021 season. Will farmers truly expand acreage as USDA suggests? Stay tuned. Those results will be released Friday, February 5, 2021 at 7 am CST.

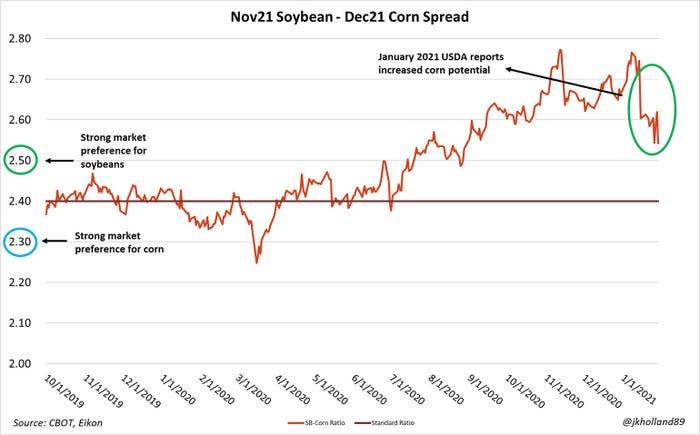

Of course, 2020’s crop shortfalls, record demand from China, and a recovering economy are playing no small part in corn’s comeback this year. But the new crop price ratio continues to favor soybean acreage this spring, albeit not as strongly as before USDA’s surprising January 2020 reports.

Deferred contracts provide some insight to this phenomenon. March and May 2022 corn contracts have more storage incentives priced into their value than March and May 2022 soybean futures. The lower priced new crop soybeans suggest markets are concerned about higher soybean acreage this spring.

The new crop soybean – corn price spread also indicates farmers who plant beans will likely make top dollar this coming fall and winter. However, corn growers with storage options could be poised to take advantage of springtime rallies based on the current price spreads. Expect this year’s acreage battle to be the most contentious since 2018.

U.S. weather woes

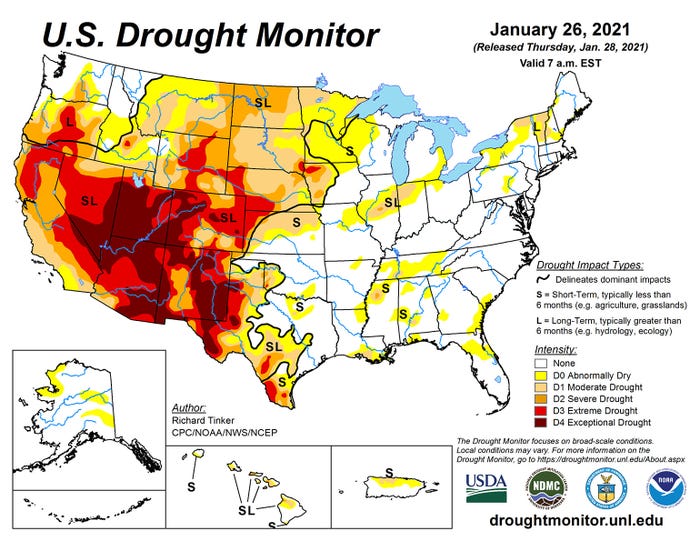

As of late January, nearly 94% of acreage in the U.S. High Plains was categorized in some sort of abnormally dry or exceptional drought condition. Winter snow storms in the Midwest helped replenish soil moisture conditions, but scattered areas of dryness remain from last summer’s late season drought, as abnormally dry acreage in the Midwest hovers just over 40%.

With planting season on the horizon, soil conditions in many areas of the Heartland are hardly conducive to healthy crops this spring. Without substantial moisture over the next few weeks, 2021 could turn in to a third straight year of crop shortfalls.

The weather forecasts will continue to have substantial impacts on grain prices this year, both in terms of livestock and poultry feed consumption and production potential. As early 2021 rallies were supported by drought conditions exacerbated by La Niña weather patterns in South America, similar weather shifts in the U.S. will also impact global grains prices this spring.

Potential acreage shifts?

While most planting decisions have been made, it is always the acres on the margins that have the potential to swing markets. Growers in the South have more market options for different crop rotations, so rising prospects for cotton and sorghum could compete against corn and soybean acreage this spring.

If Chinese soybean demand completely reverts to Brazilian supplies in the next couple months and fuel demand finally rebounds, corn acreage will be a more lucrative bet for farmers going into 2021 planting season. On the other hand, soybeans could win the battle if crop shortfalls in South America are substantial.

As always, profit opportunity will come down to timing. Fundamental supply and demand factors support current price levels though rallies remain vulnerable to corrections. The seemingly ever-present global COVID-19 pandemic will continue to influence prices and input availability as spring approaches, leaving farmers to come up with creative solutions to stay on track.

Click the download button below to download this report.

Read more about:

Bull MarketAbout the Author(s)

You May Also Like