June 3, 2011

There's an old saying that history likes to repeats itself. If that's true, what month in 2011 might the highest price for new crop December corn futures occur?

Steve Johnson, an Iowa State University Extension farm management specialist, takes a look at that question and provides the following report.

Source: U of MN CFFM, October 2010

A recent study completed by Brugler Marketing & Management, LLC reviewed 35 years of price movements using December corn futures. This study looked at monthly highs going back to 1975 in order to identify a seasonal trend for monthly highs in the December corn futures contract. The study began annually in January of the year of expiration, resulting in a full 12 months of history for each December contract.

Months with high corn prices, look at the last 35 years

Over the past 35 years, monthly highs in June and July occur most often with 5 years each. Since 2007, June represented 3 out of the last 4 year's highs, with November being the high in 2010.

This period of transition from spring to summer is usually the time frame when crop stress has reduced the yield potential and just prior to pollination. Planted acres are confirmed in the June 30 USDA report along with weekly crop progress ratings. Price volatility for December corn futures options contracts tend to peak during the months of June and July.

Over the past 35 years, 19 of those found December corn futures prices higher in June than in January. There were 17 years of higher prices in July than the following December. Only 9 of those 35 years did the high occur from August through December or about 25.7%. The highest price occurred from January through July in 27 of those years or 74.3% of the time. The months of January and March were tied for the number of actual highs even though those highs weren't as high on average. In a multi-year down trend those months will tend to be the high, but such years are in the minority.

Should you base your grain marketing on history of highs?

What if a producer based a trading system on the history of typical highs? They would sell a portion of their new crop corn based on the month's probability to have the high price for the year. The top 6 months would be January, March, April, May, June, July and November. The highest percent sold would be the months of June and July at 18.5% each.

Weighting Sales For Months With High Prices

Jan | Mar | Apr | May | Jun | Jul | Nov |

4 | 4 | 3 | 3 | 5 | 5 | 3 |

14.8 | 14.8 | 11.1 | 11.1 | 18.5 | 18.5 | 11.1 |

Source: Brugler Marketing & Management, May 2011

The results annually should be selling above the average price for the year. This also assumes that the producer can pick the days of the month with the highest price.

Impact of 2010 early corn sales on prices was evident

Last year the corn futures prices exhibited a contra-seasonal up trend starting in late June. The highest price of the year occurred in early November. For corn allocated to be sold using the weighted sales by months with high prices would have allowed the producer to capture part of the December 2010 corn futures contract move from the $3.87 per bushel June high to $6.05 per bushel November high.

The portion of remaining bushels to sell would be 11.1% so this portion would have been priced near that high. This would have gotten an average overall price of $4.31 per bushel using December 2010 corn futures contract for any portion sold at the highs of the month. The basis for these contracts would still have to be calculated for the actual average cash price.

What is the potential for 2011 corn sales and prices?

As of mid-May 2011, using this same pricing system for December 2011 corn futures and the monthly high prices would have yielded an average futures price of $6.40 per bushel. The Brugler study notes that a producer cannot consistently guess the highs for each month consistently. However, the study gives a producer an idea of where the months with the likely highs occur and to consider weighting sales accordingly to create an above average final sales price.

The 2011 year thus far is similar to a few other years that saw higher highs each month from January through April. Those years were 2008 (high set in June), 2006 and 1995 (high set in November) as well as 2004 (high set in April). Also the years of 1988, 1990 and 1996 saw increasing prices each month with the highest price of the year in July.

It is highly unlikely that the $6.83 ¾ per bushel high for December 2011 corn futures price set on April 20 will be the high for the year. In reviewing the 35 years of price history, only 1 of the 7 years that had higher highs each month through May set its high in April.

Look at the seasonal futures price trends for corn

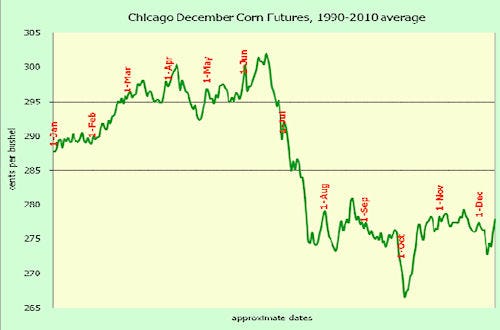

Another way of looking at price history for December corn futures contracts is a line graph. The University of Minnesota Center for Farm Financial Management (CFFM) compiles annually the average corn futures price each week over the most recent 20 years. Refer to the graph, 'Chicago DecemberCorn Futures' at the beginning of this article. The graph runs from 1990 through 2010.

What becomes obvious in this line graph is the tendency for the average December corn futures contract highs of the year to occur during the months of March, April, May and June. This is the same time period where uncertainties of crop stress might reduce the corn yield potential occurs and typically just prior to pollination. Also, USDA releases crop reports on June 30 each year including planted acreage that helps confirm the potential for the overall corn production nationwide.

Conclusion: Expect extreme corn price volatility, and consider spreading out your sales over several months.

With the tight corn ending stocks forecast for both the 2010 and 2011 crop years, expect extreme price volatility in June and July. However, trying to guess the month with the highest price would be difficult.

Consider spreading out your new crop sales over several months. Incremental sales during the first 7 months of the year (January through July) would tend to have a higher probability of high futures prices. Producers should have a new crop marketing plan established and use discipline in order to implement this plan.

Use a variety of marketing tools including cash forward contracts, minimum price contracts as well as the use futures and options. Committing bushels to delivery could be complimented by the use of crop insurance products, especially Revenue Protection. This farm-level coverage uses the higher of the harvest price (October) or the projected price (February) to determine the final revenue guarantee should a yield loss occur.

For farm management information and analysis, go to ISU's Ag Decision Maker site www.extension.iastate.edu/agdm and ISU Extension farm management specialist Steve Johnson's site www.extension.iastate.edu/polk/farmmanagement.htm.

You May Also Like