All signposts are pointing to lower average prices, and therefore a lower average price range, for cattle this year.

For anyone who attempts to market cattle in the higher half of the range, this makes a big difference in where and when they should target their sales. For you folks that sell calves every year in October or November, just expect lower prices than you've fetched the last two year.

CattleFax only a couple weeks ago lowered its average price expectation for calf prices this fall, and this week the Livestock Marketing Information Center lowered its price forecasts.

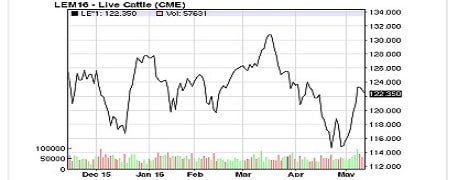

A mystery: The live-cattle price charts appear to be in the middle of their new range.

LMIC said its forecast for calves to be sold this fall have been reduced and are currently about 15% below 2015 prices. Specifically, LMIC is projecting fourth-quarter prices for 500-600-pound steers in the Southern Plains to average between $181-189, and 700-800-pound steers to average between $147-152.

For comparison, in 2015 those heavier steers in the Southern Plains averaged $177, and in 2014 they averaged $240.

Year-over-year, the percentage decline in cull animal prices is even larger, LMIC said. It is running 25% to 30% below 2015 pricing. Together with lower calf prices, this is lowering returns to cow-calf producers significantly. The marketing groups said costs of production are likely to decline slightly compared to 2015, due to lower feedstuff and fuel costs. On a per-cow basis, however, the year-on-year drop in those items will be only about 3%, or roughly $25 per cow.

LMIC said its estimated return to cow-calf producers peaked in calendar year 2014, surging to just over $530 per cow. In 2015, the return was just over $300. That was the second-highest ever calculated by the LMIC, unadjusted for inflation. With the recent downward adjustment in LMIC’s forecast cattle prices, the 2016 return was lowered to $133 per cow. If realized, that will be the lowest since 2013.

While that is still a positive return over cash costs of production, including pasture rent, for some relatively high-cost operations that return may not cover all economic costs. A further decline is forecast for 2017.

LMIC economists suggested these rapid declines cow-calf returns in 2016 and 2017 may cause producers to ratchet back beef cowherd expansion.

Since the mid 1970’s, the Livestock Marketing Information Center (LMIC) has estimated annual cow-calf returns based on a typical commercial full-time operation. Those estimates are for market analysis purposes and are not intended to represent an individual operation or resource base. The index only includes cash costs of production and pasture rent, and no return to owner management or labor are included.

Current pricing

Depending on whose prognostications you care to hear, the current cattle market appears it could be about in the middle of a possible new range, and perhaps in a recovery.

It's truly a no-man's land with no clear direction, however, as the basis from cash prices in the low $130s and futures below $124 gives little clue on direction.

Chris Swift, a Nashville commodities broker and market commentator who writes a daily column called "Shootin the Bull," said it is impossible to tell.

"Does cash start plummeting to meet the futures? Do futures rally to close the now widest basis I’ve seen? More questions than answers at this time," Swift said Wednesday afternoon.

Swift says it's a tough spot because the market could go either way, but there appears to be no good way to set up a reasonable hedge in these conditions.

"There is no put option, put spread, or much of anything one can do to produce a formidable hedge at this wide a positive basis," he added.

In his morning comments to subscribers he added this: "I understand waiting can be a double-edged sword, but I would sure like to see how traders react to a higher cash trade this week. If they fade it, it will lead me to anticipate that most of the good in this rally is gone. If they jump on June again, and pull the back months up with it, it will be perceived as an opportunity to mitigate some risk."

Moving more beef?

Meanwhile, Certified Angus Beef supply director Paul Dyskstra noted this week how feedlots are getting current under the onslaught from four weeks of big slaughter numbers, and how slaughter weights have declined somewhat.

Further, retail beef prices are falling and that could give consumers incentive to buy.

Average retail beef prices in the Wall Street Journal weekly survey dropped to $4.84/pound. That's down 15 cents from last week and 80 cents from one year ago.

About the Author(s)

You May Also Like