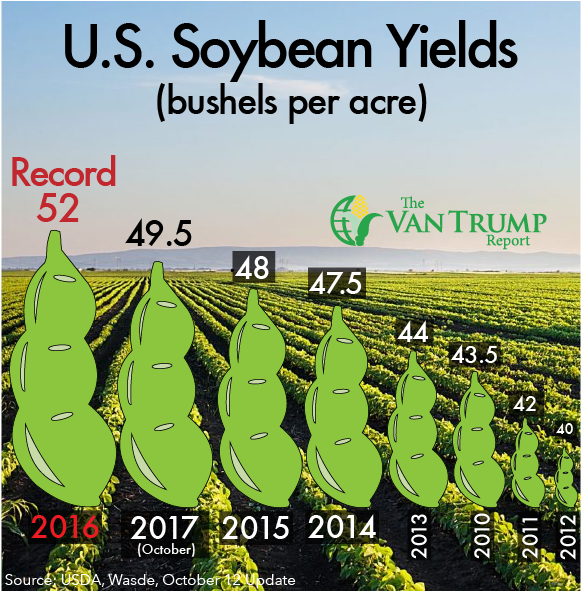

Soybean bulls are elated to see the USDA reduce their yield estimate from 49.9 down to 49.5 bushels per acre. This has many bulls thinking this trend of "reducing yield" could continue into year end as producers get into more problematic fields to the north.

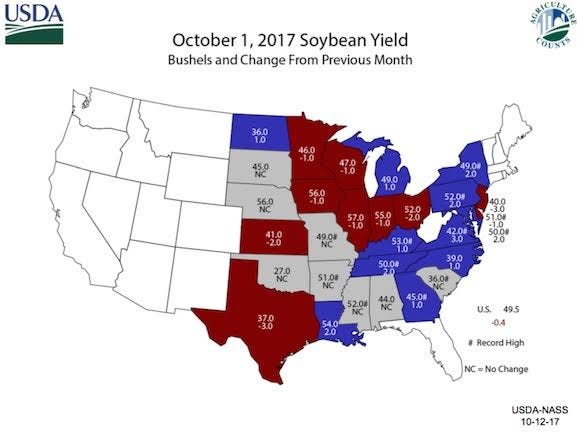

If you look at the USDA graphic included below you can see that some of the larger production states like Illinois, Indiana, Iowa and Minnesota were lowered by a full -1.0 bushel per acre. Ohio and Kansas were lowered by -2 bushels per acre.

Unfortunately, harvested acres were raised higher by +700,000, keeping total U.S. production at record levels, up +3% from last years record crop. Keep in mind harvested acres are up +8% compared to last year. The balance sheet was adjusted lower, with -44 million bushels taken out from last years crop; Exports and crush were left "unchanged".

Total U.S. ending stocks were lowered from 475 down to 430 million bushels. This now brings into deeper question the second half of the U.S. harvest. If by some crazy chance the U.S. yield were to deteriorate by another -1.5 bushels per acre, ending stocks would be at a much more bullish sub-300 million.

Personally don't see the U.S. yield falling to sub-48 bushels per acre, and I'm not 100% sold it falling to sub-49 bushels per acre, but for argument sake it certainly makes the balance sheet a bit more interesting, especially with so much weather uncertainty still remaining in South America and such strong global demand.

Bottom-line, until the trade is more certain about "production", it doesn't feel like it wants to pressure price. I was right on with my thoughts regarding a slight reduction in yield and higher harvested acres netting out to no real change, but I didn't see the trade reacting to that data with such enthusiasm. In other words, I wasn't at all surprised by yesterdays USDA adjustment, but I was surprised by the trades aggressiveness to the upside.

As a producer, I went ahead and reduced bit more of my estimated 2018 production and converted some 2017 hedges into cash sales. From my perspective the balance sheet has changed very little from the $9.07 low made back in mid-June or the early-August low at $9.21, so I felt it necessary to reward the rally.

GET ALL MY DAILY AG NEWS THOUGHTS HERE

About the Author(s)

You May Also Like