Soybean export sales continued to outpace corn and wheat for the week ending November 7, as they have done for much of the young 2019/20 marketing year. China remains in the spotlight as the No. 1 destination – but not in the same role as it played prior to its ongoing trade war with the U.S.

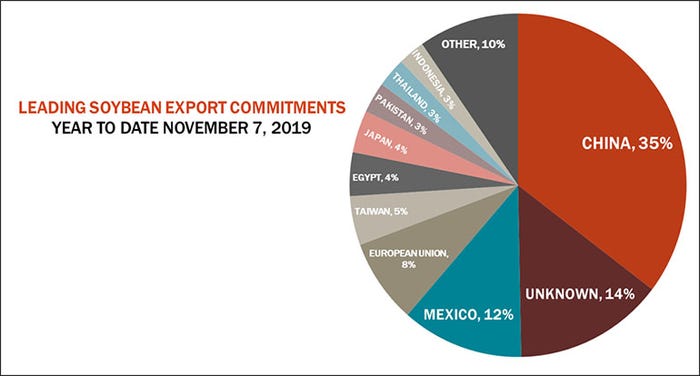

“China regularly accounted for about 60% of U.S. soybean exports,” according to Farm Futures senior grain market analyst Bryce Knorr. “So far, it’s taken 35% of total commitments. U.S. originations out of the Gulf are cheaper than Brazil right now. But that advantage will end when new crop Brazilian beans hit the export pipeline in February, according to forward prices.”

But China continues to ramp up its purchases of U.S. soybeans, taking 27.9 million bushels of this week’s total sales, Knorr notes. This brings total Chinese commitments to 290.6 million, plus another 4.7 million reported yesterday by USDA on its daily reporting system for large purchases, he says.

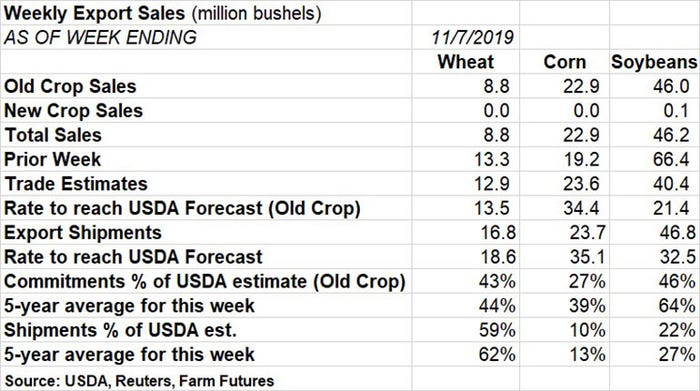

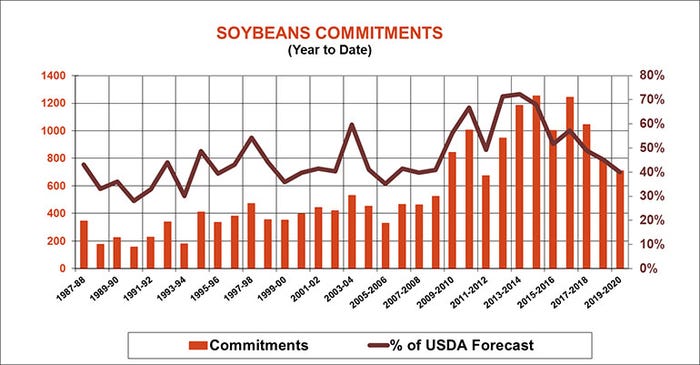

Total soybean exports reached 46.2 million bushels last week, exceeding the average trade guess of 40.4 million bushels but falling below the prior week’s tally of 66.4 million bushels. The weekly rate needed to match USDA forecasts continues to fall, landing at 21.4 million bushels. Soybean export shipments were similar, with 46.8 million bushels.

As Knorr points out, China leads all destinations for U.S. soybean export commitments in 2019/20, with 35% of the total. Other top destinations include unknown destinations (14%), Mexico (12%), the European Union (8%) and Taiwan (5%).

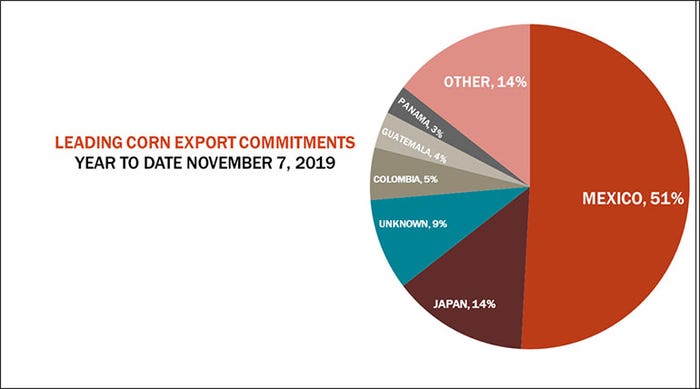

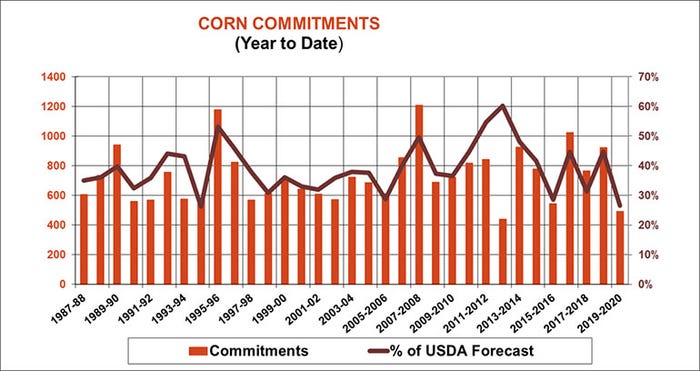

Corn export sales moved slightly higher than the prior week’s tally of 19.2 million bushels, reaching 22.9 million bushels for the week ending November 7. That was a touch behind trade estimates of 23.6 million bushels and lower than the weekly rate needed to reach USDA forecasts, now at 34.4 million bushels. Corn export shipments were similar, at 23.7 million bushels.

“Corn export sales improved modestly from the prior week but remain well behind the rate forecast by USDA,” Knorr says. “Competition remains fierce especially for Asian business. South Korean feed-makers continue to buy only minimal amounts of U.S. corn, sourcing it instead from South America and the Black Sea.”

Mexico far and away leads all destinations for U.S. corn export commitments in 2019/20, with 51% of the total. Other top destinations include Japan (14%), unknown destinations (9%), Colombia (5%), Guatemala (4%) and Panama (3%).

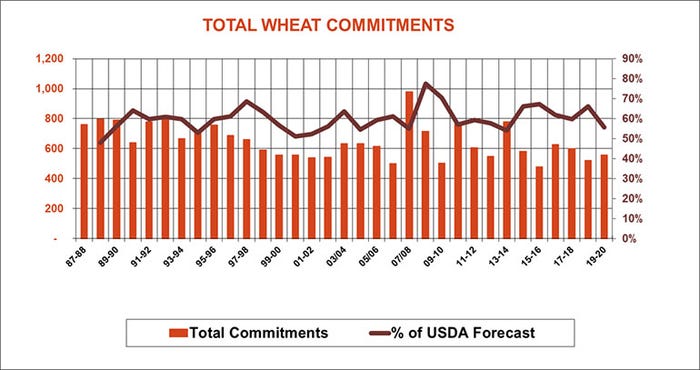

Wheat sales took an unwelcome dip from the prior week’s already lackluster 13.3 million bushels down to 8.8 million bushels. That was also below trade estimates of 12.9 million bushels and the weekly rate needed to match USDA forecasts, now at 13.5 million bushels. Wheat export shipments fared a little better, at 16.8 million bushels.

“Wheat sales nosedived this week to the lowest level since the start of the marketing year,” Knorr says. “Again, the problem is too much competition. The U.S. remains priced out of big markets like Egypt and other countries are buying only small amounts.”

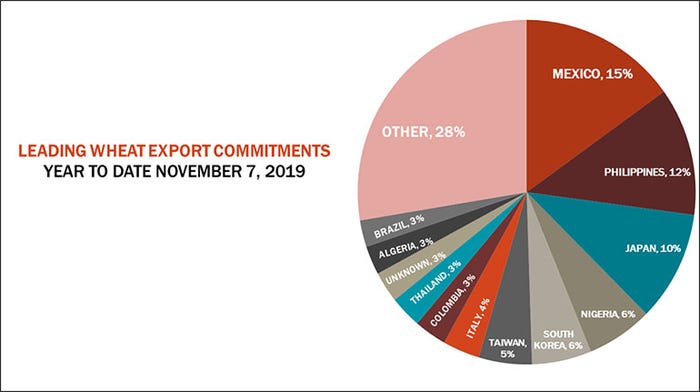

Mexico is the No. 1 destination for U.S. wheat export commitments this marketing year, with 15% of the total. Other leading destinations include the Philippines (12%), Japan (10%), Nigeria (6%) and South Korea (6%).

About the Author(s)

You May Also Like