Weather is usually the driving force behind summer markets, and that certainly appeared to be the case Monday. Some rain over the weekend in dry parts of the Midwest and forecast for more helped trigger near-limit losses in corn and a big drop in soybeans too.

But futures got a push from another source before they fell off a cliff: news the Biden Administration was discussing possible relaxation of Renewable Fuels Standard mandates to help petroleum refiners hurt by higher biofuel prices.

Like many shoot first, ask questions later events in the commodities market, it was highly unclear whether any changes would actually take place. Still, after a record-setting run by soybean oil prices, all it took was a little smoke for traders to scream “fire!”

Of course, soybean oil, the primary feedstock for biodiesel, really isn’t the issue in the seemingly never-ending showdown between the corn and petroleum industries over ethanol. But it was caught in the crossfire between the two camps over controversial waivers granted some small refiners, who say the high cost of ethanol is forcing them out of business. The curious timing of the latest stories – just a day after USDA increased its estimate of 2020 corn crop ethanol demand – only added to the intrigue.

USDA’s latest forecast was itself unexpected, because the agency’s projected increase over 2019 crop usage was higher than estimates out earlier last week from the U.S. Energy Information Administration that showed a smaller gain. And both estimates came in the face of ethanol industry profit margins that sank back deep in the red recently after a brief run into the black when more of the biofuel was needed to blend with gasoline as drivers took to the road again this summer on receding fears of the COVID pandemic.

However the RFS drama plays out over ethanol, the corn-based fuel doesn’t seem likely for a return to its glory days unless the industry can convince skeptics that it’s a bonafide “green” alternative.

Biodiesel faces some of the same concerns as ethanol. But because it can be used with or without petroleum blending, the surge in environmental interest fueled a gold rush mentality in the vegetable oil market globally.

USDA forecasts a 10% increase in U.S. biodiesel production in the 2020 marketing year, predicting a 26% surge for 2021. Crush accounts for around half of U.S. soybean demand, as much or more than exports, and an increase in soybean oil demand domestically is important because very little is exported, less than 10%.

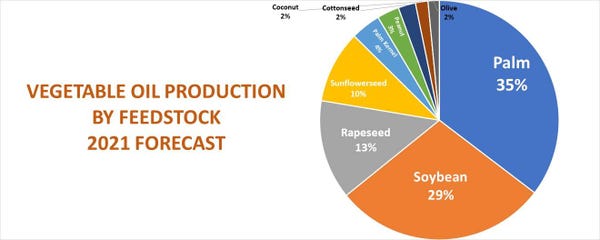

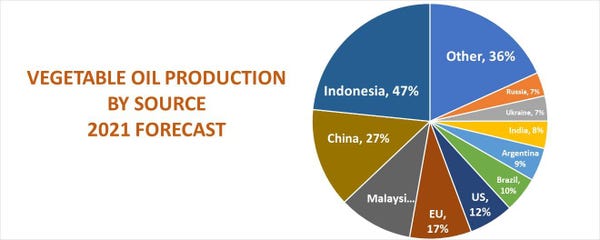

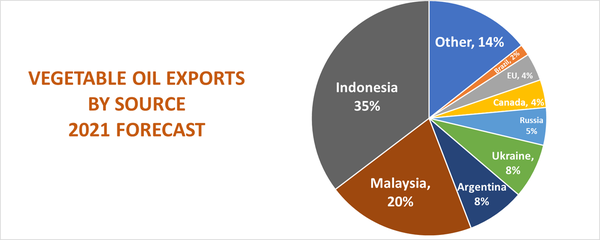

Indeed, while U.S. growers are big guns in the soybean market, in the overall vegetable oil market, no so much. Soybeans account for 29% of total vegetable oil production, behind palm oil, which is forecast to have a 35% market share in the 2021 marketing year. And the U.S. has just a 12% share of the world’s vegetable oil production, while accounting for only 1% of global trade in the commodity group. Indonesia and Malaysia, the big dogs in the tropical oil space, control a forecast 55% of vegetable oil exports.

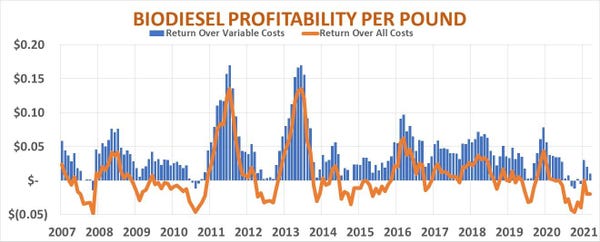

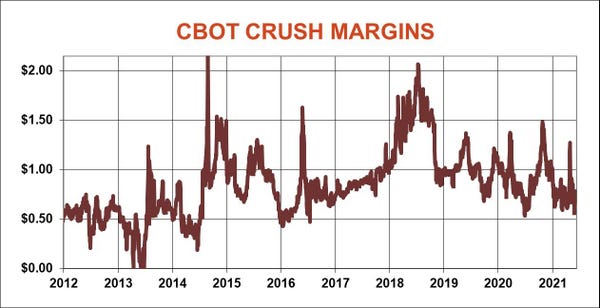

Increased U.S. usage of soybean-based biodiesel seems crucial to the long-term health of the industry, which appears to have run in the red again for most of the past year. Except in the best of times, plants lose money without the $1 a gallon tax credit that has been extended through 2022. The overall soybean processing industry faces CBOT crush margins near the low end of their range since 2016, with the exception of a brief rally this spring. While soybean meal normally drives crush, oil accounted for 48% of crush margins last week, nearly a record.

Demand could be crucial to this market too. The Greens drove some of the rally, but weather played a part as well, including a drought-hit soybean crop in Argentina, the world’s largest soyoil exporter. Global oil production is forecast to rise 4% in the coming year after staying flat during the 2020 marketing year.

Of course, the marketing year won’t even begin until crops in the northern hemisphere are made. Look for weather to continue to dominate price swings, unless significant changes are made to the RFS.

About the Author(s)

You May Also Like