Many factors influence commodity prices. Recently, movements in commodity prices have been driven by U.S. acreage estimates and weather concerns across a large portion of the Corn Belt, and this is likely to remain the principal focus of markets into August.

As of July 11, 2023, the percentage of soybeans in Moderate Drought (D1), Severe Drought (D2), Extreme Drought (D3), and Exceptional Drought (D4) was 1%, 6%, 20%, and 30%, respectively (USDA-Ag in Drought). However, there are always numerous factors impacting price direction simultaneously.

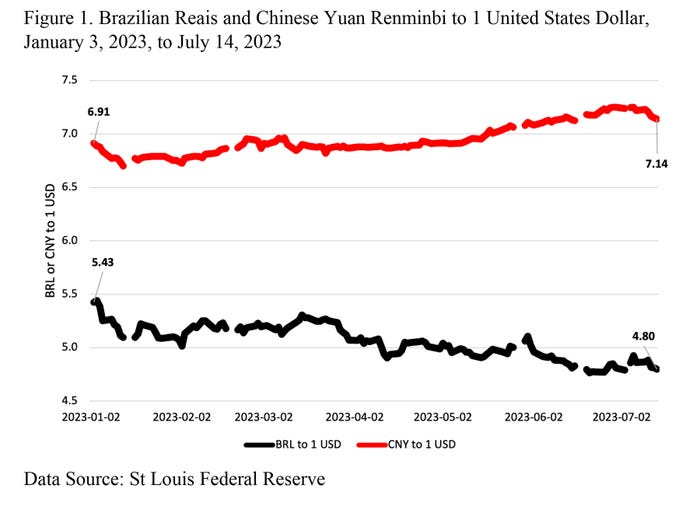

An interesting trend that has potential repercussions for soybean exports has been the movement in currency exchange rates in 2023.

Soybean exports are largely a three-country game. For the 2023/2024 marketing year, the majority of global soybean exports are expected to come from Brazil (56%) and the U.S. (31%), while China is projected to account for 59% of global soybean imports (USDA-PSD).

Prevailing exchange rates

As such, the prevailing currency exchange rates between the three countries are important. Figure 1 shows the number of Chinese Yuan Renminbi (CNY) and Brazilian Reais (BRL) required to purchase one United States Dollar (USD). Since the start of 2023, the BRL has increased by 11.6% compared to the USD, and the USD has appreciated by 3.3% compared to the CNY (Figure 1).

For example, on January 3, a bushel of soybeans worth 14.50 USD would be 78.67 BRL. On July 14, that same bushel of soybeans at 14.50 USD would be 69.58 BRL.

From a Chinese buyer’s perspective, due to changes in the value of currencies, a bushel of U.S. soybeans increased 3.3% from January 3 to July 14 and a bushel of soybeans from Brazil increased 15.4% over the same time.

Over this time, the change in currency values would support Chinese purchases of U.S. soybeans over Brazilian soybeans, all else being equal. However, supplies of soybeans in Brazil and the U.S. largely minimize this potential effect.

Brazil has record supplies, and based on current prices, could have record plantings this fall. The U.S. has lower acreage (83.5 million acres planted) than initially anticipated, lower potential yields due to drought, and limited endings stocks (230 million bushels) for the 2022/2023 marketing year.

Moving forward, trends in exchange rates could influence the quantity of soybeans purchased, by China, from the U.S. and Brazil.

If the USD appreciates in value, relative to BRL, it makes U.S. exports relatively more expensive for foreign buyers. If the USD depreciates in value, it makes U.S. exports less expensive for foreign buyers.

Source: Southern Ag Today

About the Author(s)

You May Also Like