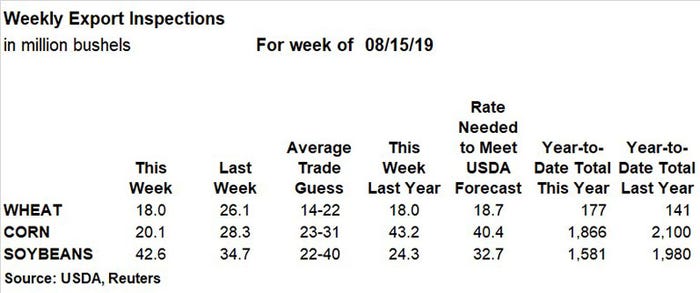

USDA handed out another mixed round of export inspection data in its weekly report. Soybeans saw the most bullish results after climbing moderately ahead of the prior week’s tally and besting trade estimates.

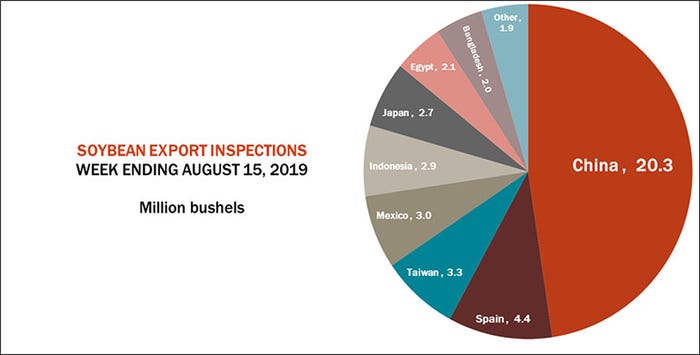

“Despite cancelling some old crop soybean purchases the prior week, China kept shipping out some of the sales it still has on the books,” according to Farm Futures senior grain market analyst Bryce Knorr. “After moving out 20.3 million bushels through Thursday, China still has more than 85 million in outstanding sales. With actual census exports running around 5% above inspections, the final figures for the 2018 marketing year could reach USDA’s forecast of 1.7 billion if shipments stay strong through the end of the month.”

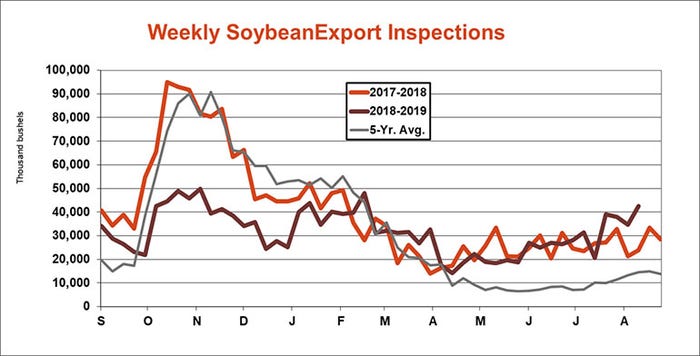

Total soybean export inspections were for 42.6 million bushels for the week ending August 15. That was better than the prior week’s total of 34.7 million bushels and above trade estimates that ranged between 22 million and 40 million bushels. The weekly rate needed to match USDA forecasts moved slightly lower, to 32.7 million bushels, while cumulative totals for the 2018/19 marketing year remain 20% below last year’s pace, at 1.581 billion bushels.

China’s 20.3 million bushels led all destinations for U.S. soybean export inspections last week. Other top destinations included Spain (4.4 million), Taiwan (3.3 million), Mexico (3.0 million), Indonesia (2.9 million) and Japan (2.7 million).

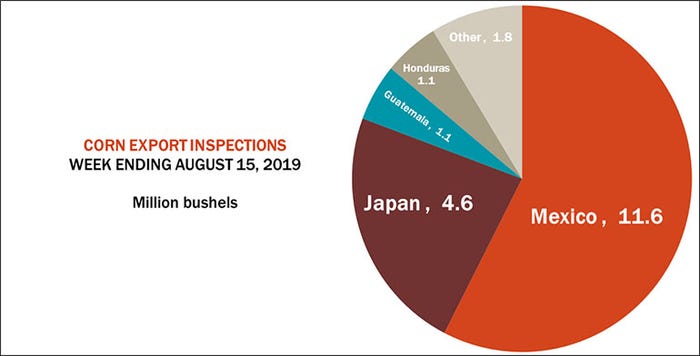

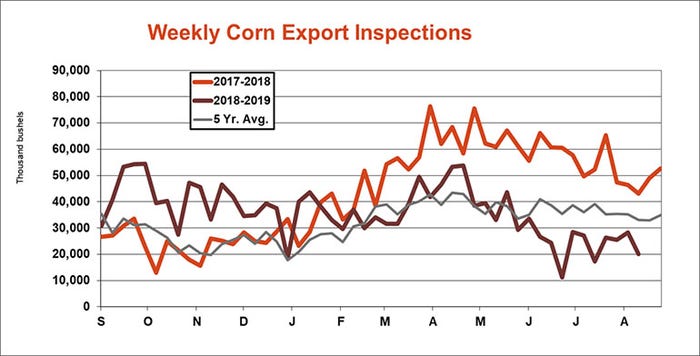

Corn export inspections moved moderately lower week-over-week, meantime, landing at 20.1 million bushels. That was also below analyst estimates that ranged between 22 million and 40 million bushels. The weekly rate needed to meet USDA forecasts moved higher, to 32.7 million bushels, and cumulative totals for the 2018/19 marketing year remain 11% lower year-over-year, at 1.866 billion bushels.

“Corn shipments continue to lose ground,” Knorr notes. “The total for the marketing year has a shot at hitting USDA’s target because census totals are running much higher than inspections this year. But sometimes totals recorded by the Foreign Agricultural Service wing of USDA don’t line up with numbers used by the agency’s outlook board in its monthly reports.”

Mexico led the way for U.S. corn export inspections last week, accounting for more than half of the total with 11.6 million bushels. Other top destinations included Japan (4.6 million), Guatemala (1.1 million) and Honduras (1.1 million).

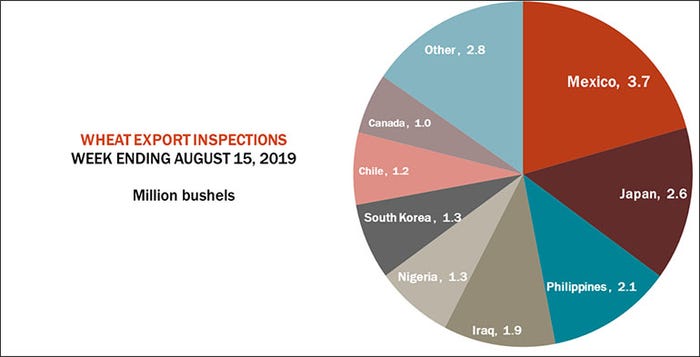

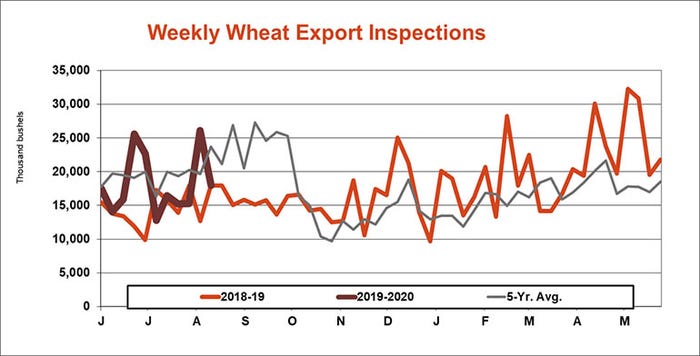

Wheat export inspections also retreated week-over-week after reaching 18.0 million bushels. That was moderately below the prior week’s tally of 26.1 million bushels but in the middle of trade estimates that ranged between 14 million and 22 million bushels. The weekly rate needed to match USDA forecasts moved slightly higher, to 18.7 million bushels, while cumulative totals for the 2019/20 marketing year remain 25% higher than a year ago, with 177 million bushels.

“Wheat inspections slipped a little last week but are still above the rate forecasted for the 2019 marketing year,” Knorr says.

Mexico was the No. 1 destination for U.S. wheat export inspections last week, with 3.7 million bushels. Other top destinations included Japan (2.6 million), the Philippines (2.1 million), Iraq (1.9 million), Nigeria (1.3 million) and South Korea (1.3 million).

About the Author(s)

You May Also Like