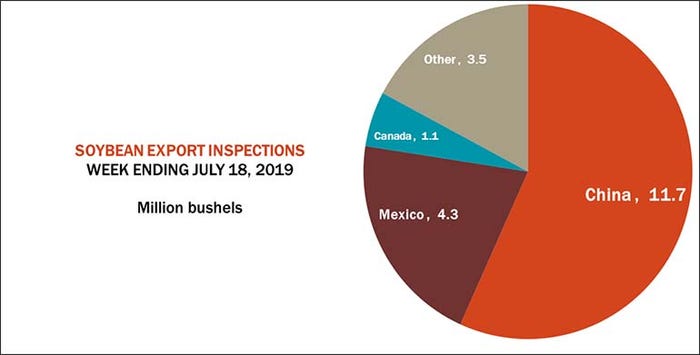

Reports over the weekend by Bloomberg suggested Chinese buyers were interested in making deals for U.S. farm goods, and today’s export inspections reinforced the notion that the talks are inching forward, according to Farm Futures senior grain market analyst Bryce Knorr.

“Chinese buyers loaded out 11.7 million of the 193 million bushels of outstanding sales they have on the books,” he says. “Still, that means China must take delivery on 30 million bushels a week, something that may be difficult to do, so some of those purchases may be rolled to new crop.��”

Cancelling those deals would be an outright “slap in the face” that wouldn’t go unnoticed, Knorr adds. But that scenario is unlikely because buyers are expected to be state-connected merchandisers who are part of the international grain-trading industry, he says.

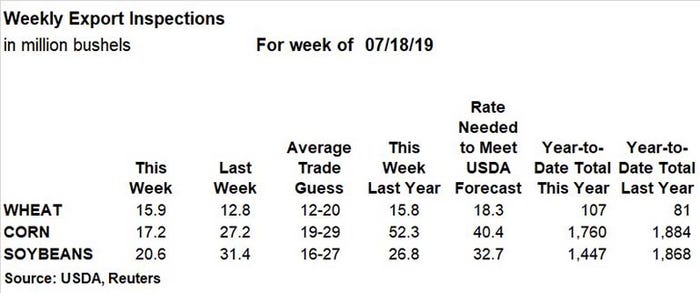

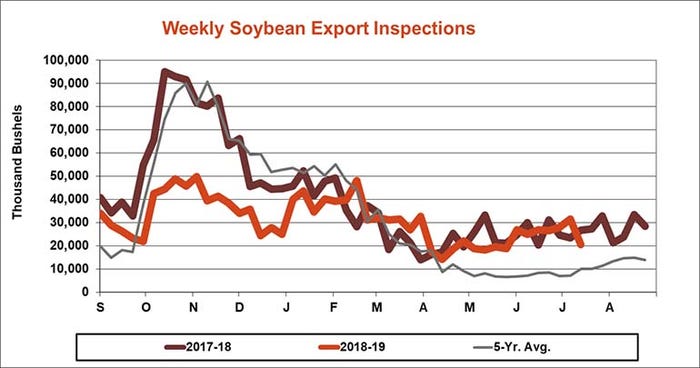

Total soybean export inspections for the week ending July 18 were still lackluster, with a tally of 20.6 million bushels. That was still in the middle of trade expectations that ranged between 16 million and 27 million bushels, however. The weekly rate needed to match USDA forecasts moved higher, to 32.7 million bushels, and cumulative totals for the 2018/19 marketing year are down 22.5% from a year ago, at 1.447 billion bushels.

Aside from China’s 11.7 million bushels, other leading destinations for U.S. export inspections last week included Mexico (4.3 million) and Colombia (1.1 million).

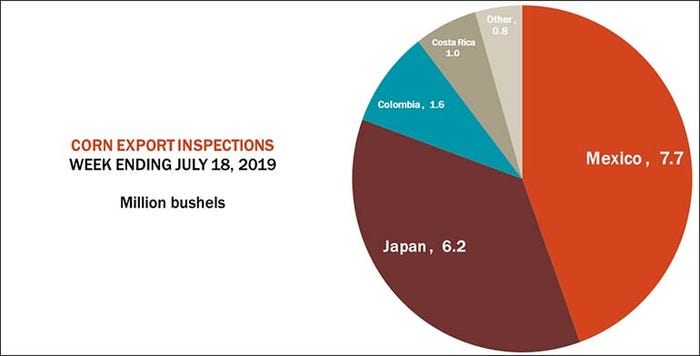

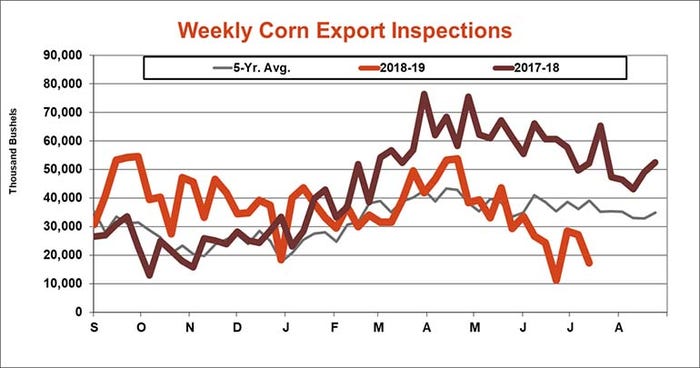

Corn export inspections also fell week-over-week, landing at 17.2 million bushels and falling below trade guesses that ranged between 19 million and 29 million bushels. The weekly rate needed to match USDA forecasts moved higher, to 40.4 million bushels. Cumulative totals for this marketing year are down 6.6% from last year, at 1.760 billion bushels.

“Corn shipments remain slow but could still hit USDA’s target with an August push,” Knorr says. “The year-to-date total is in line with USDA’s current forecast, which was reduced July 11.”

Mexico was the No. 1 destination for U.S. corn export inspections last week, with 7.7 million bushels. Other top destinations included Japan (6.2 million), Colombia (1.6 million) and Costa Rica (1.0 million).

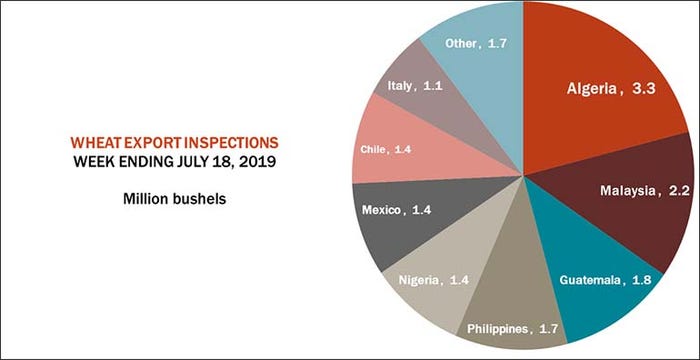

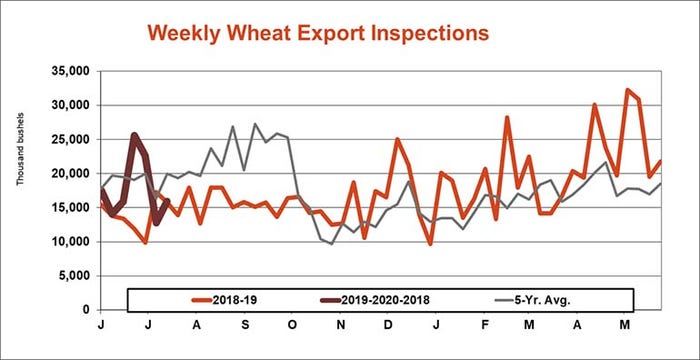

Wheat export inspections rebounded from the prior week’s tally of 12.8 million bushels up to 15.9 million bushels. That total also landed in the middle of trade guesses that ranged between 12 million and 20 million bushels. Still, the weekly rate needed to match USDA forecasts moved higher, to 18.3 million bushels. Year-to-date totals in the young 2019/20 marketing year remain 32% higher than last year’s pace, however, at 107 million bushels.

“Year-to-date wheat inspections are above last year’s total but remain fairly lackluster,” Knorr says. “Buyers still aren’t committing to big volumes yet, waiting to see how harvest turns out from Europe into the Black Sea. While crops suffered a few hits overseas, production looks good enough to keep the U.S. blocked out of key markets in the Mediterranean.”

Algeria was the No. 1 destination for U.S. wheat export inspections last week, with 3.3 million bushels. Other top destinations included Malaysia (2.2 million), Guatemala (1.8 million), the Philippines (1.7 million) and Nigeria (1.4 million).

About the Author(s)

You May Also Like