Even though soybean exports lost 4 million bushels in old crop sales last week, total volume was up significantly week-over-week, thanks to an additional 30.0 million bushels in new crop sales for the week ending August 8. China continues to be a destination worth watching, according to Farm Futures senior grain market analyst Bryce Knorr.

“Rather than buy more U.S. farm goods as the president demanded, the Chinese cancelled some of their previous purchases,” he notes. “Though the U.S. walked back some of the tariffs, delaying them until mid-December, China threatened retaliation before making more conciliatory comments today.”

Still, Chinese buyers cancelled a net 15.5 million bushels of previous deals, made as a goodwill gesture during the brief truce in the trade war this summer, Knorr says.

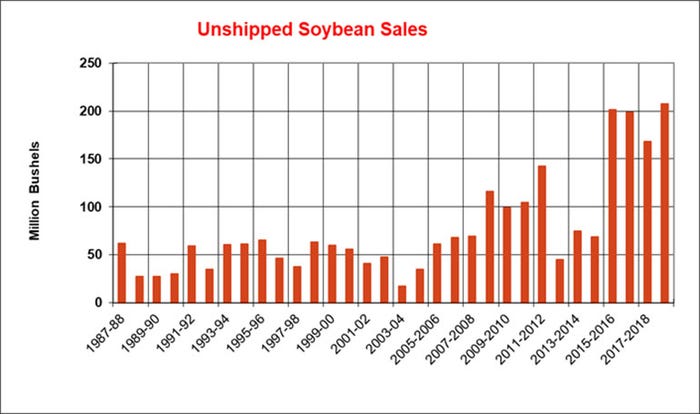

“China still has 104 million bushels of those deals still on the books, as the 2018 crop marketing year heads to its Aug. 31 conclusion,” he says. “With another 103 million bushels of outstanding sales left for other buyers around the world, it’s still unclear whether total sales for the year will reach USDA’s target.”

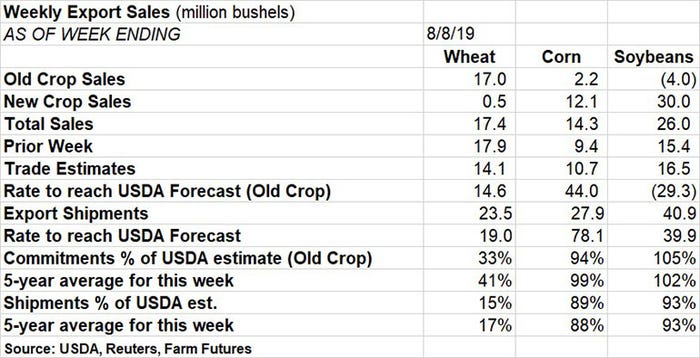

Soybean exports saw a net cancellation of 4.0 million bushels in old crop sales last week but found 30.0 million bushels in new crop sales, for a total of 26.0 million bushels. That was well ahead of the prior week’s tally of 15.4 million bushels and trade estimates of 16.5 million bushels.

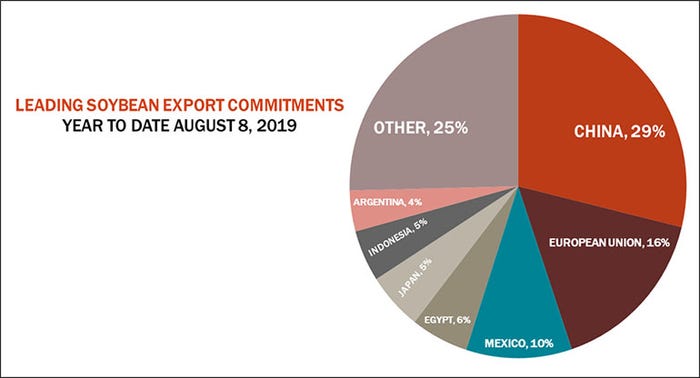

Soybean export shipments reached 40.9 million bushels last week. As the 2018/19 marketing year winds down, China remains the No. 1 destination for U.S. soybean export commitments, with 29% of the total. Other top destinations include the European Union (16%), Mexico (10%) and Egypt (6%).

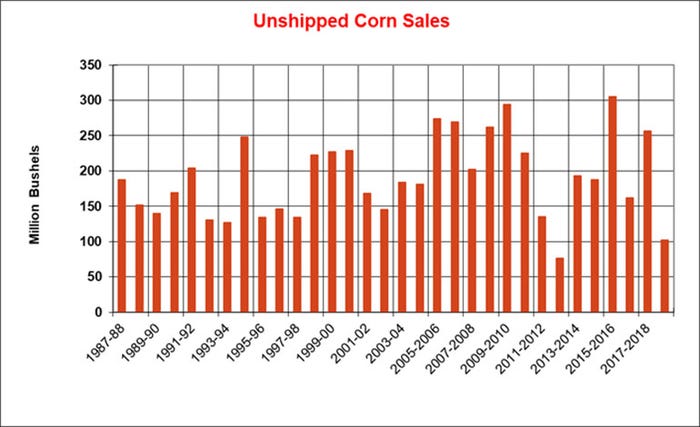

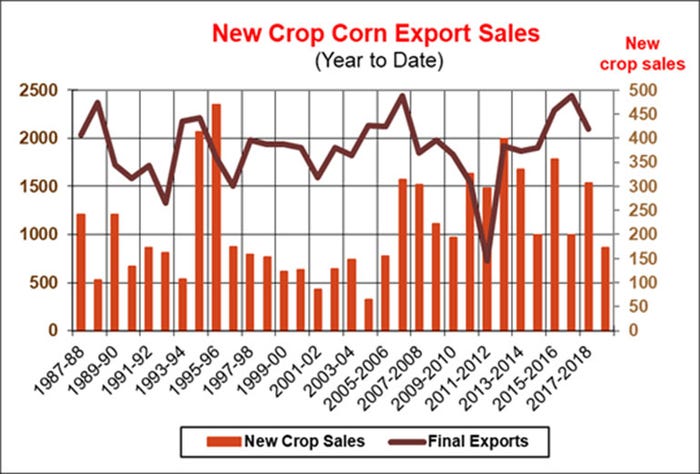

Corn export sales remained relatively flat last week after notching 2.2 million bushels in old crop sales and 12.1 million bushels in new crop sales for a total of 14.3 million bushels. Still, that tally exceeded the prior week’s total of 9.4 million bushels and trade estimates of 10.7 million bushels. The weekly rate needed to match USDA forecasts moved higher, however, to 44.0 million bushels.

“Corn seems increasingly unlikely to meet USDA’s target for the 2018 marketing year, though USDA made no revisions to its forecast Monday,” Knorr says. “New crop sales are off to the slowest start in 13 years, though business could pick up after the steep drop in prices recently.”

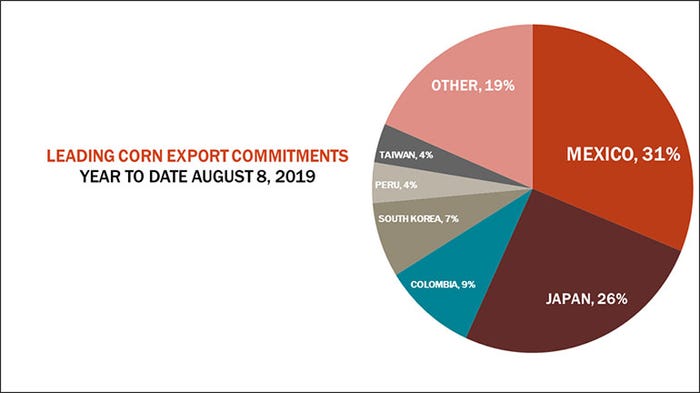

Corn export shipments fared somewhat better last week after reaching 27.9 million bushels. For the 2018/19 marketing year, Mexico leads the way after accounting for 31% of total U.S. corn export commitments. Other top destinations include Japan (26%), Colombia (9%) and South Korea (7%).

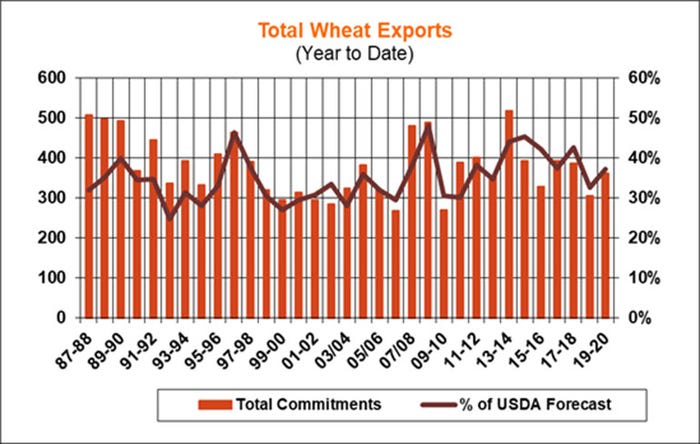

Wheat export sales topped trade estimates of 14.1 million bushels after clearing 17.4 million bushels in total sales last week. That was still slightly behind the prior week’s tally of 17.9 million bushels but ahead of the weekly rate needed to match USDA forecasts, now at 14.6 million bushels.

“Wheat sales continue to hum along, the bright spot in the export sector for U.S. crops,” Knorr says. “While the U.S. is uncompetitive in markets dominated by Black Sea originations, such as Egypt, other buyers around the world are taking advantage of plentiful supplies and cheap prices.”

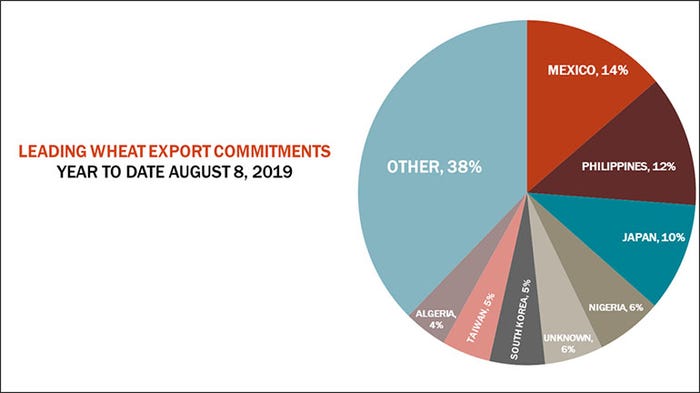

Wheat export shipments did even better last week, reaching 23.5 million bushels. For the 2019/20 marketing year, Mexico tops all destinations for U.S. wheat export commitments, with 14% of the total. Other leading destinations include the Philippines (12%), Japan (10%), Nigeria (6%) and unknown destinations (6%).

About the Author(s)

You May Also Like