Big speculators bet the right way on USDA’s Sept. 12 reports, boosting bearish positions in the run up to the bearish data from the government that hammered crop prices.

Here’s what funds were up to through Tuesday, Sept. 11, when the CFTC collected data for its latest Commitment of Traders.

![]()

Still selling

Big speculators added 44,089 contracts to their net short position in crops and livestock this week, selling more in most markets. Investors using indexes to gain exposure to commodities were small buyers, but not enough to offset the hedge fund selling.

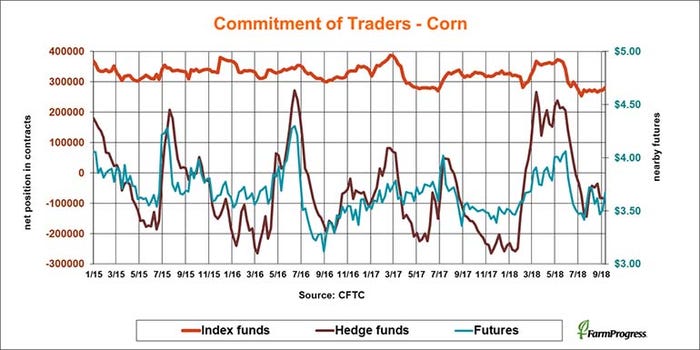

Turn thwarted

Big speculators were light sellers in corn for the second straight week, increasing their bearish bets by only 3,958 lots as some were covering, expecting friendly data from USDA. They didn’t get it.

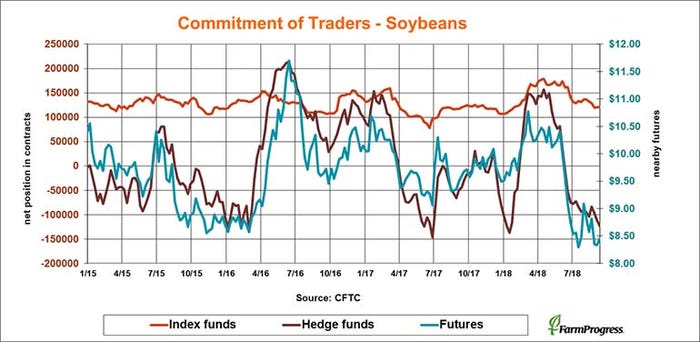

Pressing position

Big speculators sold more soybeans again this week into the USDA report, adding 11,828 contracts to their bearish bets. That made it easier for the market to stabilize on short covering after China and the U.S. agreed to restart trade talks.

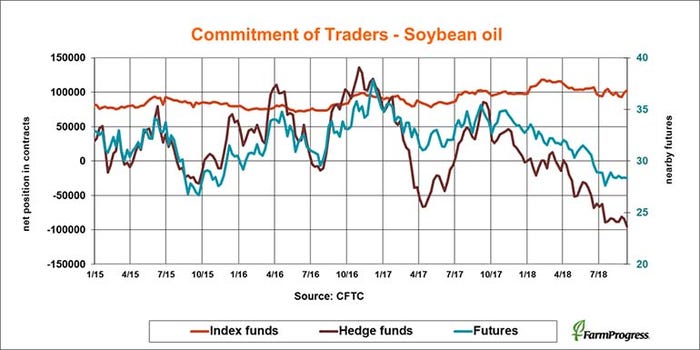

Wrong record

Big speculators established a new record short position in soybean oil last week, adding 10,957 contracts to their bearish bets.

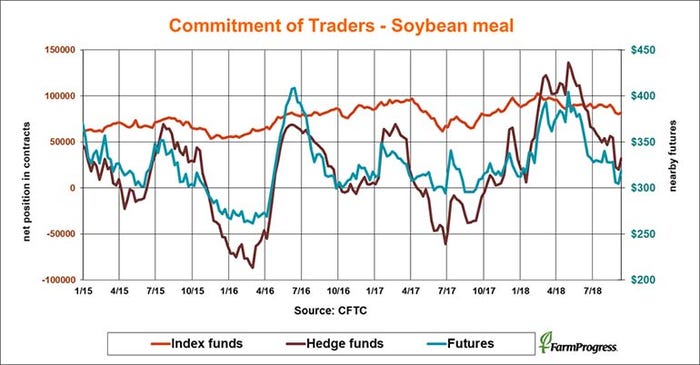

Contrarians

Big speculators did buy one part of the crop complex fairly aggressively this week, adding 12,290 contracts to their small net long position in soybean meal after Argentina moved to increase taxes on exports. That could boost U.S. soybean meal exports.

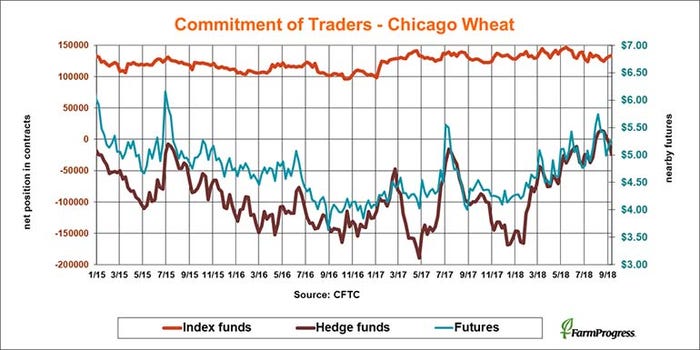

Bears are back

Big speculators extended their new bearish bet in soft red winter wheat last week, increasing the net short position by 18,775 contracts.

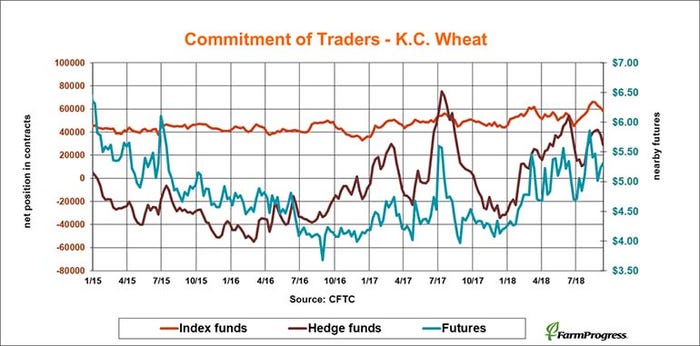

Getting smaller

Big speculators continue to ratchet down their long position in hard red winter wheat, selling a net 8,891 contracts this week.

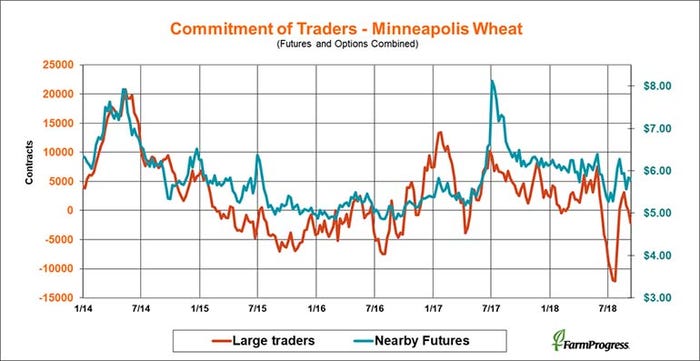

Spring has spring

Large spring wheat traders extended their small bearish bet in Minneapolis, selling a net 2,098 contracts last week.

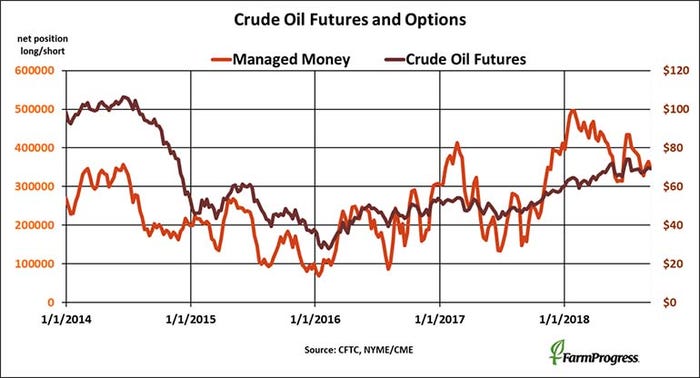

Risk averse

Risk is rising in crude oil as new sanctions against Iran near. Money managers liquidated $1.3 billion in futures and options positions last week, after two weeks of buying.

About the Author(s)

You May Also Like