It’s hard to tell whether the markets were optimistic about agriculture, or just plain scared following the G20 summit in Argentina. But funds were buying, before second doubts stirred later.

Here’s what funds were up to through Tuesday, December 4, when the CFTC collected data for its latest Commitment of Traders.

![]()

Hit the exits

Big speculators bought almost all crop and livestock contracts last week after President Trump and President Xi of China agreed to three months of negotiations on trade. Hedge funds covered a net 163,512 contracts of their bearish bets in agriculture, slashing them by more than half. Investors wanting exposure to commodities through index funds also bought, adding 23,489 contracts to their net long position.

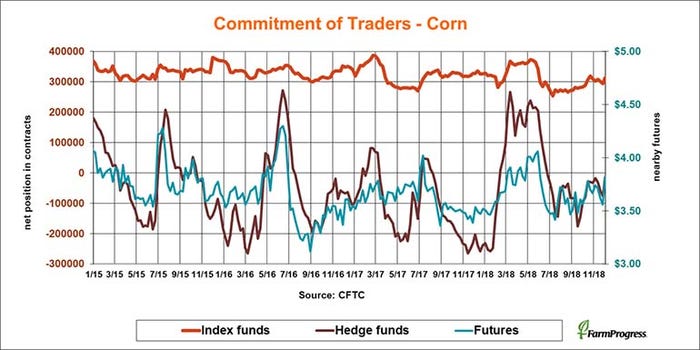

Closer to even

Buying in corn led the short covering spree. Big specs bought back 63,584 contracts of their net short position, leaving them short just 14,077 contracts, helping rally futures. Index fund investors were also buying, adding 18,994 contracts to their net long position.

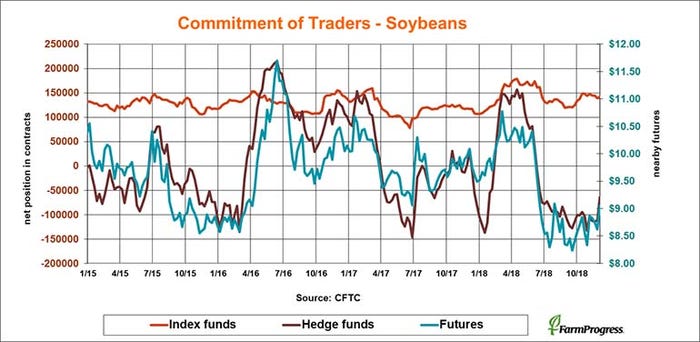

Squeezed shorts

Big speculators headed to the sidelines before and after the G20 summit, cutting 47,342 contracts off their bearish bets as nearby futures surged. These hedge fund traders were still short 64,027 contracts as of Tuesday of last week.

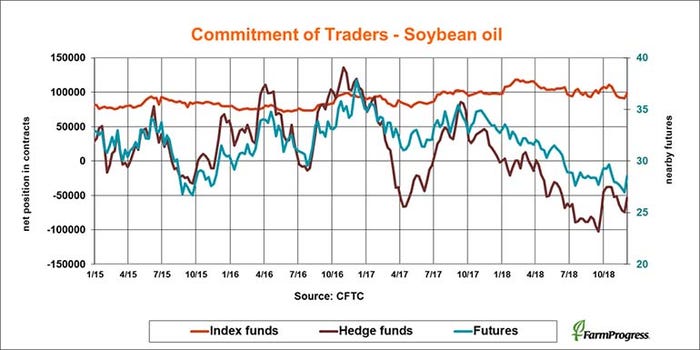

Follow the leader

Vegetable oil markets remain under pressure around the world, but short covering extended to soybean products despite plunging crush margins. Big speculators cut 20,803 contracts off their bearish bets in oil.

Cautious reversal

Soybean meal only saw light short covering from the tariff rally, which cut 3,450 contracts off the small net short position of big speculators.

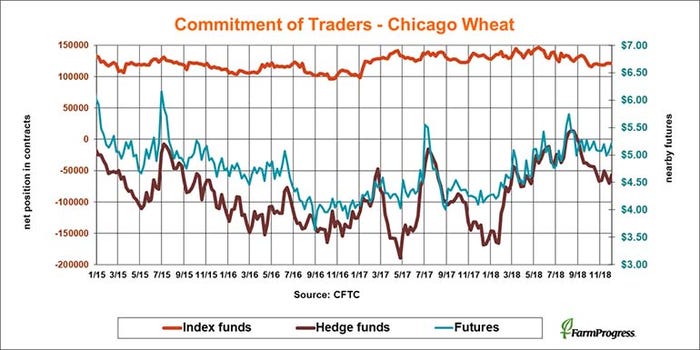

Going lightly

Wheat didn’t get a lot of oomph from the G20 news, but benefited from a little short covering too. Big speculators bought back 13,385 lots of their bearish bet in soft red winter wheat.

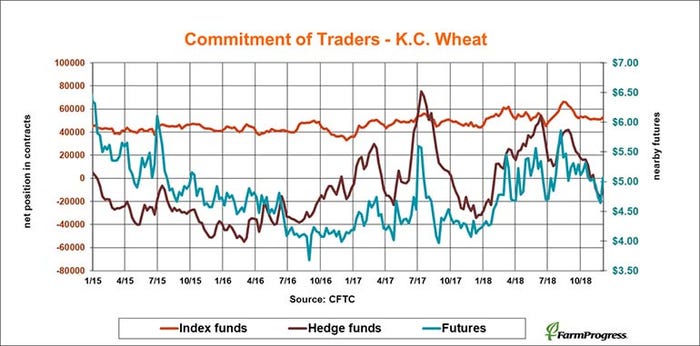

Hard sell

Big speculators bought hard red winter wheat as well, cutting their small net short position in third by liquidating a net 5,252 contracts.

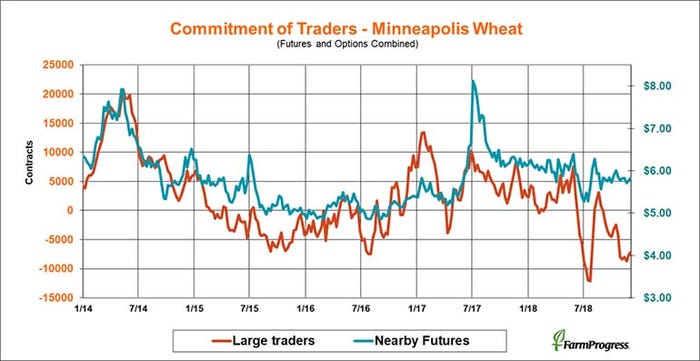

Small change

Large traders trimmed their net short position in Minneapolis for the second straight week, but not by much, buying a net 363 contracts in spring wheat.

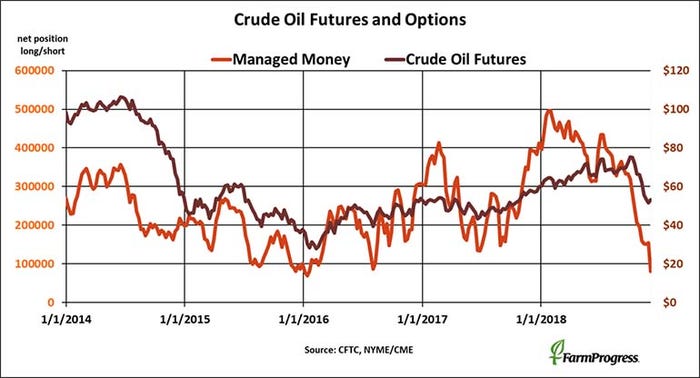

Crude crunch

Money managers dumped nearly $4 billion in crude oil futures and options last week. That took their net long position to its lowest level in nearly three years.

About the Author(s)

You May Also Like