With fresh seven-year highs scored right ahead of the USDA's February WASDE report, a massive reversal of the charts indicates that a near term top in the grain markets could be in place.

The reversal can be attributed to the fact that Feb WASDE ending stock numbers were not lowered as much as the trade was expecting. The USDA revised corn ending stocks down to 1.502 billion bushels. The corn for export portion of the balance sheet was revised higher by 50 million bushels to 2.6 billion bushels; this was the only revision on the corn balance sheet revised. The 50-million-bushel revision was less than most in the trade were thinking, including our group.

The reason for our optimistic demand viewpoint was the USDA's own export sales data. Export sales (Old plus New) for the week of January 28th were a record 296 million bushels, and double the previous record high scored back in 2012. US exporters have sold 78% of USDA's full-year 2020/2021 corn export forecast as of January 28th. We believe that the USDA will eventually have to revise the export portion of the balance sheetup by as much as 200 million bushels.

Corn market game changer

This year's game-changer for the corn market is China as they have gone from irrelevant to the dominant force in international corn trade. The USDA has a hard time grasping how many bushels China has on hand and how many bushels they need to import this year.

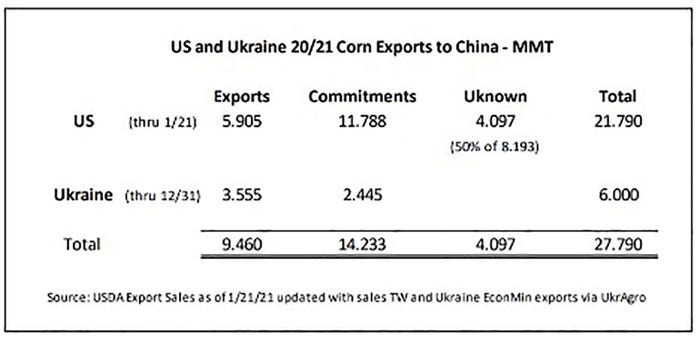

USDA finally raised China's corn imports to 24 MMT, but we believe this is still too low. Agmarket.Net’s associate, The Grain of Truth, has calculated that the combined U.S. and Ukrainian corn export commitments, along with the estimated share of commitments to �“unknown” destinations we feel could be attributed to China, currently totals 27.790 MMT. Some in the trade think it is realistic that China imports could top out at 30 MMT.

It seems like the USDA’s China ending stocks estimate is too optimistic as well. USDA raised the Chinese 20/21 reserves to 196 mt up from their previous estimate of 191mmt. Their opinion is quite different from the UN FAO (Food & Agriculture Organization), which lowered China ending stocks by 54 MMT to 139 MMT earlier in the week.

China’s corn prices

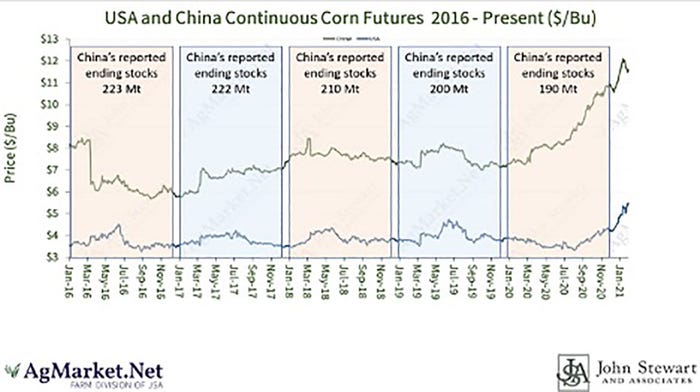

When you look at corn prices in China, it seems like the FAO has a much better handle on what is going on. When you look back at the corn price in China over the past five years and compare it to the USDA Chinese stocks estimates, you can see something has changed over the past six months. For the most part, China's corn prices traded in a $6 – $8 per bushels range in 2016 when ending stocks were estimated at 223 MMT. In the next three years, corn stocks were lowered by 1 MMT in 2017, 12 MMT in 2018, and dropped another 10 MMT to 200 MMT in 2019.

Even with these downward stock revisions, the corn price stayed in a $7 - $8 per bushels trading range. We find it interesting in 2020, that USDA lowered the stocks by 10 MMT to 190 MMT, but this time the Chinese corn market has exploded higher, testing the $12 per bushel level earlier in the 2021 calendar year. (Early in the week, the USDA put Chinese stocks at 196 MMT. )

We argue this explosive rise in prices indicates that the FAO is much closer to the realistic Chinese corn stocks than the current USDA estimate. The higher prices that they are seeing would also suggest that they are not done buying corn, as it makes sense to think they will keep buying corn until they build back stocks and drive the price back to the price range that the domestic price has been in before the past year's run-up.

Reach Jim at 815-665-0461 or [email protected]

The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. AgMarket.Net is the Farm Division of John Stewart and Associates (JSA) based out of St Joe, MO and all futures and options trades are cleared through ADMIS in Chicago IL. This material has been prepared by an agent of JSA or a third party and is, or is in the nature of, a solicitation. By accepting this communication, you agree that you are an experienced user of the futures markets, capable of making independent trading decisions, and agree that you are not, and will not, rely solely on this communication in making trading decisions. Past performance, whether actual or indicated by simulated historical tests of strategies, is not indicative of future results. Trading infromation and advice is based on information taken from 3rd party sources that are believed to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades. The services provided by JSA may not be available in all jurisdictions. It is possible that the country in which you are a resident prohibits us from opening and maintaining an account for you.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like