The ethanol industry was one of the greatest wealth-creators for farmers that I have seen in my generation. It created over 5 billion bushels of demand within the space of a decade.

Now, that demand is being quickly dismantled due to the oil wars between Saudi Arabia and Russia, but especially from COVID-19’s impact to consumer consumption.

Todd Becker, the CEO of Green Plains, a Nebraska-based ethanol producer, made a statement which I’ll summarize as: Once we get through this, we will not be the same on the other side.

What he was saying was that many ethanol plants would either go broke, would be riddled with debt, or would have a reshuffling of ownership.

At least three dozen plants have already shut down, and another three dozen are slowing production (see related story). The longer this goes on, you can expect the remaining 130 or so U.S. ethanol plants to do the same.

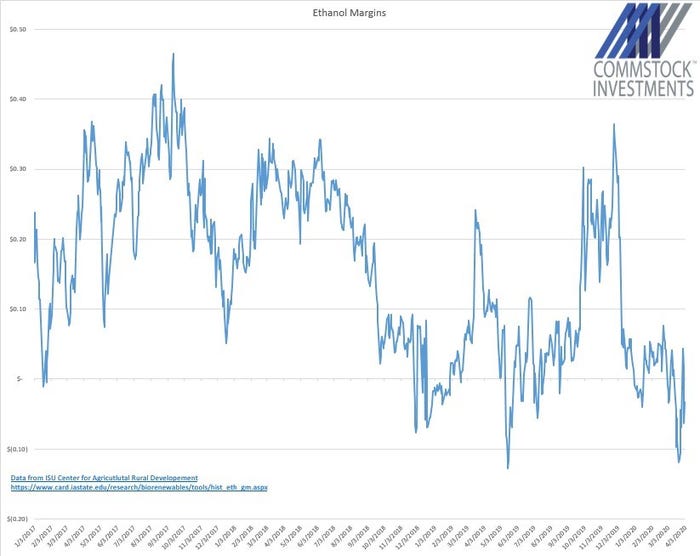

It would be one thing if the industry was losing one or two cents a gallon. But I have seen some reports of negative operating margins at -20 to -30 cents per gallon. It doesn’t take long for the losses to add up as working capital and plant equity completely erode.

It is not a question of whether to slow production, but rather how much. Those plants with access to a better export market might be better positioned to maintain productivity longer, but eventually those contracts will expire.

A billion gallon drop

Early estimates are calling for ethanol output to drop by a billion gallons or more in the next three months. That would represent 350 million bushels of corn that will be added to our already heavy carryover. Some farmers have pointed out that this will increase demand for corn to replace the loss in DDG’s. While this is technically true, it is sort of like saying you no longer have to pay the electric bill if your house burnt down. It is not much of a consolation.

For those farmers who live close to an ethanol plant that is shutting down, expect to see an even weaker basis than normal.

I hesitate to make long-term projections, as nothing like this has ever happened before. Therefore, it is impossible to know for sure. But we have to prepare for worse case scenarios, one of those being that U.S. ethanol production drops by 50%.

This will likely depend upon a number of factors. How quickly can we get COVID-19 under control and get the economy moving again? While I believe we will see a break in the coronavirus curve in the next few weeks, this doesn’t mean the virus will be completely eradicated. Consumer confidence levels will be shot to hell. Restaurants will remain empty for some time until we get a vaccine and exposure risk is mitigated. I don’t not see a quick recovery to pre-COVID-19 market conditions.

This reminds me of my first trip to Brazil. It was three months after 9/11. Three-quarters of my tour group had cancelled despite us going to a place that had no strategic relationship to the attack on New York City. Nobody wanted to fly period. It took THREE YEARS for travel numbers to return to what they were pre-9/11.

Today’s biofuel recovery could be similar.

Unlike 9/11 attacks, the coronavirus is everywhere. Somehow, I don’t see Grandma immediately rebooking the family trip to Disneyland once the coronavirus curve has broken. Consumers are going to need time to build back their confidence, much like after 9/11.

Ethanol plants can lower their corn bid but that doesn’t mean farmers are going to sell it to them. Frankly, the ethanol industry is going to need financial assistance from the federal government. Unfortunately, they are going to have to get in line behind the oil companies.

My concern is that if ethanol producers don’t get their fair share of financial assistance, oil companies will step in to purchase them at a discount, similar to what we saw with the Valero transaction.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

Futures trading involves risk. The risk of loss in trading futures and/or options is substantial and each investor and/or trader must consider whether this is a suitable investment. Past performance is not indicative of future results. Trading advice is based on information taken from trades and statistical services and other sources that CommStock Investments believes to be reliable. We do not guarantee that such information is accurate or complete and it should not be relied upon as such. Trading advice reflects our good faith judgment at a specific time and is subject to change without notice. There is no guarantee that the advice we give will result in profitable trades.

About the Author(s)

You May Also Like