With yield potential dropping and final planting dates for full crop insurance coverage near, it’s decision time for farmers wondering what to do with their 2019 corn.

Record slow progress means more growers than normal must crunch the numbers soon in this year’s version of “Let’s Make A Deal.” Producers have three basic choices: Keep planting corn and hope for the best, switch fields to soybeans or another crop, or take prevent plant and earn a portion of their crop insurance coverage.

One factor that likely won’t matter much: USDA’s next round of compensation for farmers hurt by tariffs. The aid for corn may amount to just four cents a bushel, and producers who don’t plant some or all of their corn likely won’t receive anything on lost production.

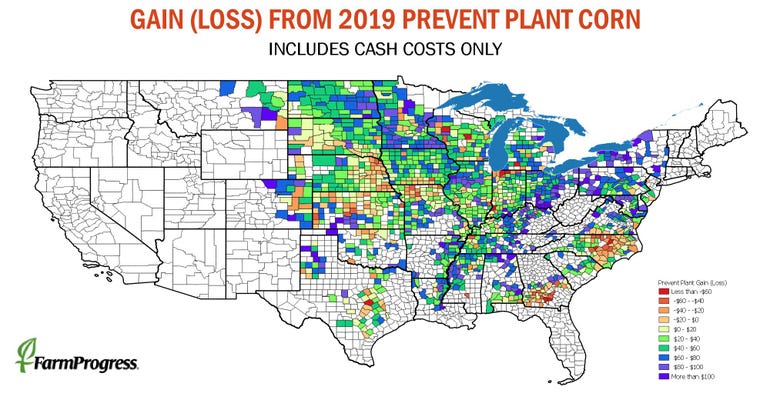

While each farm has different costs, yields and crop insurance coverage, Farm Futures analysis shows most farmers can cover cash costs by taking prevent plant, though this could mean laying off employees, cutting family living expenses and “living off depreciation” in the coming year.

Farm Futures county-by-county analysis shows farms in 84% of counties can cover cash costs, netting an average of $42 an acre with prevent plant. The feature of crop insurance pays on 55% of protection, which is figured by multiplying the crop insurance yield times the coverage level times the $4 spring futures price.

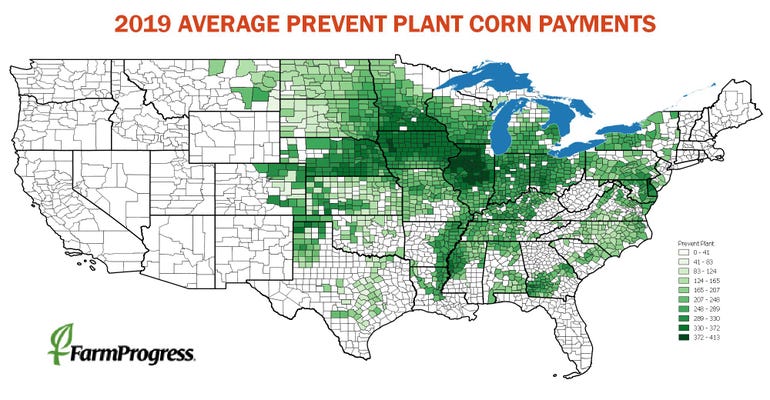

Based on current Risk Management Agency summary of business reports for 2019, on average farmers covered 74% of yields averaging 151 bushels per acre. That results in an average prevent plant payment of $246. While that may not seem like much, remember that these are the average for 1,565 counties with corn nationwide. Payment levels are much higher in the heart the Corn Belt – some high-yielding counties in Illinois top $400.

Beside raising more bushels per acre, those growers typically buy up higher levels of crop insurance coverage too. Of course, Illinois farmers also face higher costs. Average countywide rents we used in the study neared $300 an acreage in some areas of the state.

Average nationwide costs were much less as a result. Rent averaged just $124 an acre and total fixed cash costs for taxes, crop insurance, and other overhead items came to only $204. That produced an average prevent plant payment profit nationwide of $42, including those would lose money on the option.

That profit would make life a little easier, because our study included an “opportunity cost of unpaid labor” – the farmer’s sweat – of only $31 an acre on average, calculated using cost data from USDA’s Economic Research Service.

We also excluded any payments for hired labor kept on the payroll even though no crop was planted.

And we didn’t factor in any capital cost for machinery and equipment.

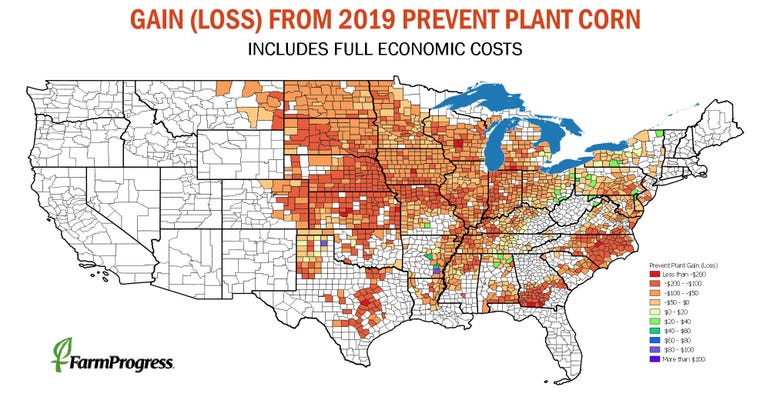

USDA’s full cost of production includes a hefty charge for machinery, including not only depreciation but interest on the value of the equipment as well. When that amount is added into total costs, along with a charge for hired labor, prevent plant looks like a much less appealing choice. Total fixed costs on average jumped to $327 an acre, triggering an average loss of $81. Just 4% of counties were in the black when all economic costs are included in the calculation.

We created an interactive Google map showing the complete calculations we used for each county included in the study. Click the box in the upper left-hand corner of the map to bring up the index; use the mouse to zoom in to find a county and click the flag to bring up its details in the index box. There are 16 different fields so you’ll probably need to scroll down to see them all, including the bottom line.

About the Author(s)

You May Also Like