Selling by funds usually isn’t positive for prices. But heavy pressure by big speculators following USDA’s bearish Sept. 12 reports set the market up for a short covering rally to end the week.

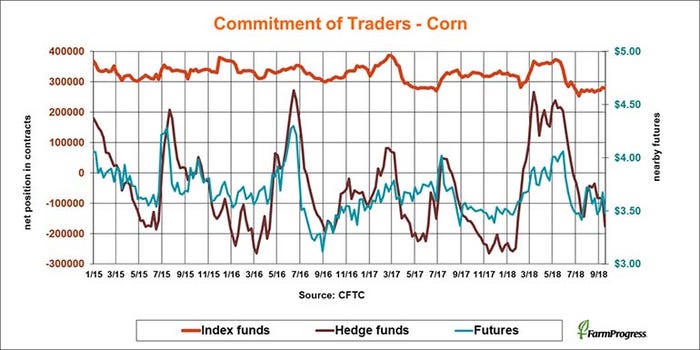

Here’s what funds were up to through Tuesday, Sept. 18, when the CFTC collected data for its latest Commitment of Traders.

![]()

Growing pains

Big speculators sold crops across the board in the latest week, adding 120,945 contracts on to their net short position. These hedge funds bought only cattle and hogs. Investors buying funds that follow indexes to gain exposure to commodities also liquidated some of the long positions.

Doubling down

Big speculators more than doubled their net short position in corn last week, adding 89,668 contracts to take their bearish bet to its widest level since January. That helped futures plunge to new contract lows before short covering lifted prices later in the week.

Steady sellers

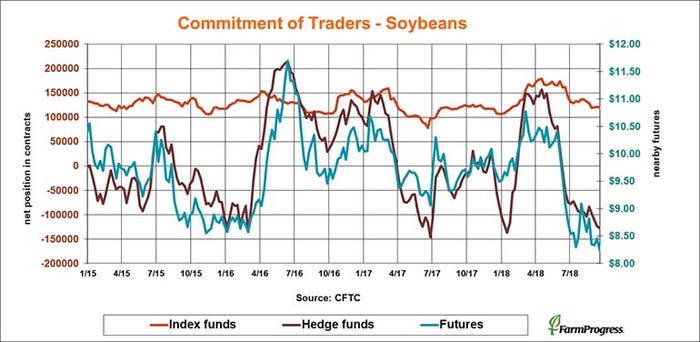

Big speculators weren’t heavy soybean sellers this week, adding 4,526 contracts to their bearish bets. But it was the fourth straight week of pressure, taking the net short position to its widest level since January.

Record breaking

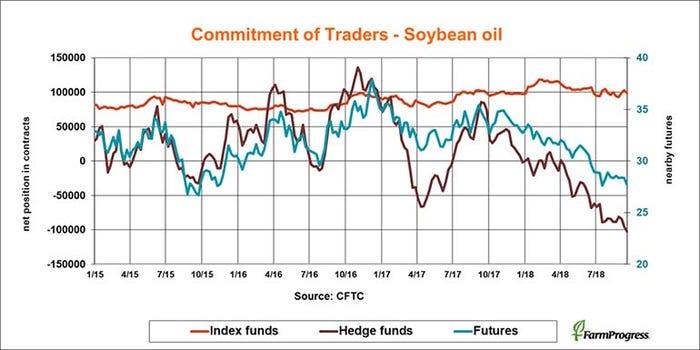

Big speculators set a record for selling in soybean oil for the second straight week, extending their bearish bet to another all-time extreme by adding 7,593 contracts to their net short position.

Full retreat

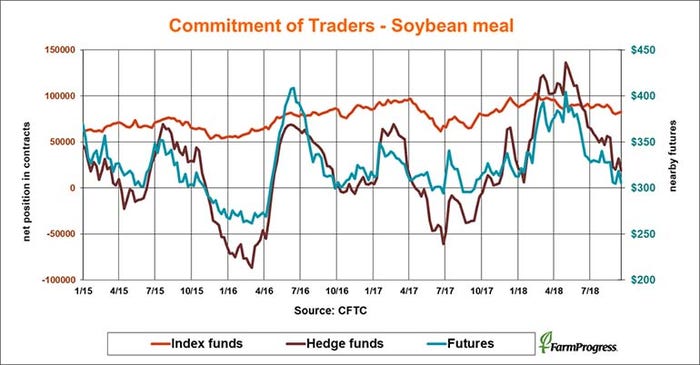

Big speculators are still long soybean meal, but not by much, after selling another net 13,202 contracts this week to take their small bullish bet down to 19,011 lots.

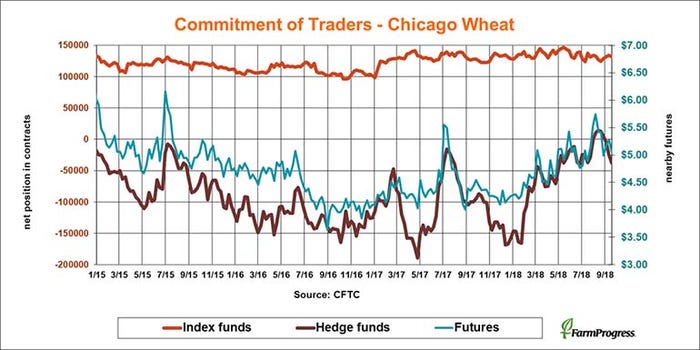

Soft market

Big speculators kept selling soft red winter wheat futures and options this week, at least until Tuesday. Hedge funds added 13,260 contracts to their modest bearish bets.

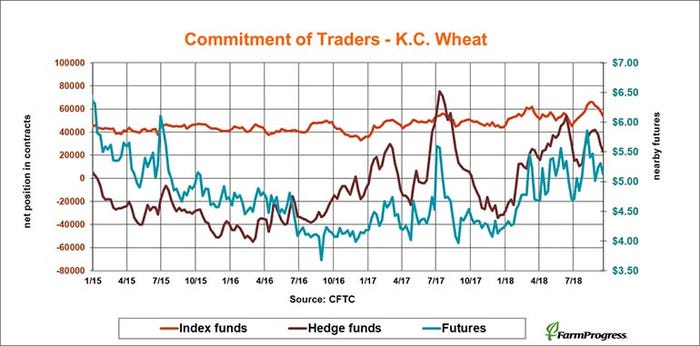

Chipping away

Big speculators knocked another 5,964 contracts off their shrinking net long position in hard red winter wheat, which fell to 23,056 lots this week.

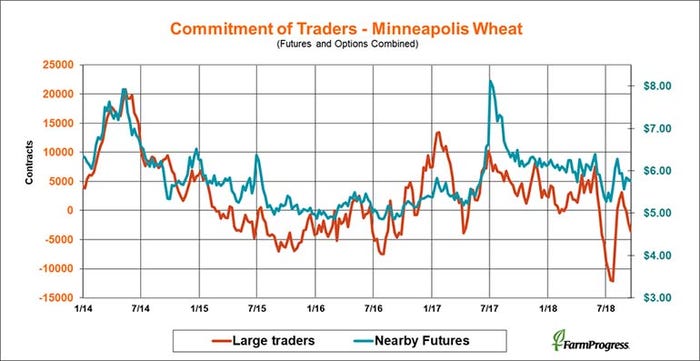

Large losers

Large spring wheat traders added more to their small but growing bearish bets, selling a net 1,343 contracts into Tuesday.

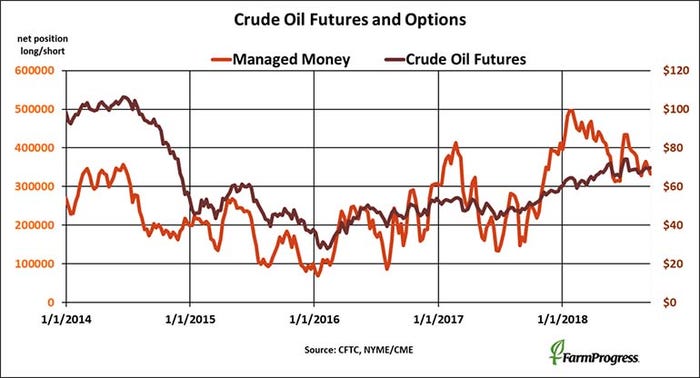

Surprised again

Money managers bailed on more of their bearish bets in crude oil this week, selling futures and options worth more than $900 million. The selling came just in time to see prices rally back above $71.

About the Author(s)

You May Also Like