The summer corn and soybeans outlook is always a little tricky to write, mostly because it’s typically written in late June for print, before we have access to a lot of the information (weather data, updated USDA acreage) that will be fundamental to trading during July and August.

But even with those information lags, there is still enough noise in these markets that farmers should be aware of through the summer months. End users continue to offer farmers healthy premiums above nearby futures contract prices to pull in more corn and soybean supplies while farmers are busy with spring fieldwork activities.

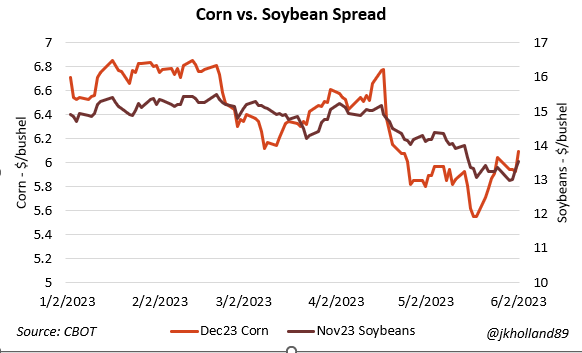

Ethanol production ramped up in June to satisfy summer blending requirements. By early June, cash bids at elevators, processors, and ethanol plants grew to span between $0.40-$0.85/bushel above September 2023 futures. While that is an impressive premium, December 2023 corn futures prices weakened $0.58/bushel (-10%) during June, suggesting that the good times may not last.

Soybean crush usage in May 2023 notched a new high for the month and the third consecutive month of new highs. Even as export demand for both soybeans and corn slowed early in the summer, soybean crush plants continued to offer cash bids at a $0.40-$0.95/bushel premium over August 2023 futures contracts through late June, pointing to strong summer crushing paces.

Some plants are already bidding for November 2023 contracts, with offers ranging between $1.25-$1.45/bushel over the contract. As the renewable diesel and biodiesel expansion continues, it seems likely we will see more of those lucrative offerings as harvest approaches.

Even though June was mostly a dry month for the Corn Belt, extended forecasts through the rest of the middle of July is trending wetter for the Midwest, just ahead of peak pollination for both crops. This bodes favorably for 2023 crop yields, even factoring in early season dryness.

But if a high moisture forecast extends into the fall, farmers may want to consider taking advantage of summer lulls in the natural gas market to forward price fall dryer fuel supplies. Natural gas prices tumbled lower this spring as Russia offloaded surplus natural gas supplies on the global market at steep discounts, which has kept global nitrogen prices trending lower.

Not only does that point to more affordable dryer fuel this fall, but it is also a favorable omen that fall anhydrous ammonia applications will be significantly more affordable than last year. We are still a couple weeks away from ag retailers publishing prices for fall inputs and even 2024 pricing schedules, but as global demand for energy wanes as economists brace for a potential recession in the third quarter there is good reason to believe that fertilizer expenses will sum up to the most reasonable payout since Fall 2020.

Of course, that won’t make much of a difference if corn and soybean prices continue to fall in tandem with the broad energy markets. In the short-run, end users are consuming corn and soybeans in a hand-to-mouth fashion, which should benefit farmers as they clean out storage bins in preparation for 2023 harvests.

But if larger 2023 corn and soybean crops are paired with a potential global economic slowdown this fall, there is no telling how long it could take before grain prices rally higher, especially as South American crop prospects are improving during the ongoing El Niño season. If your operation has the flexibility to take advantage of forward pricing into the 2024 marketing year, this summer is likely going to be the best time to do so.

About the Author(s)

You May Also Like