Grain futures broke sharply after release of bearish USDA reports, paced by heavy losses in soybeans Friday. Soybeans took the biggest initial hit, trending another 2.5% or more lower in the minutes following the August World Agricultural Supply and Demand Estimates (WASDE) report, with corn and wheat prices also trending lower Friday morning.

“USDA’s reports are bearish for corn and soybeans, plain and simple,” says Farm Futures senior grain market analyst Bryce Knorr. “Yields were significantly bigger than expected, especially for soybeans, which came in above the normal margin of error with our survey results. As we’ve been noting, soybeans went into the report with a historical tendency to break afterward, and that’s happening today certainly. Corn and wheat have better chances for turning around in coming days, and their fundamentals are better, too.”

Soybeans

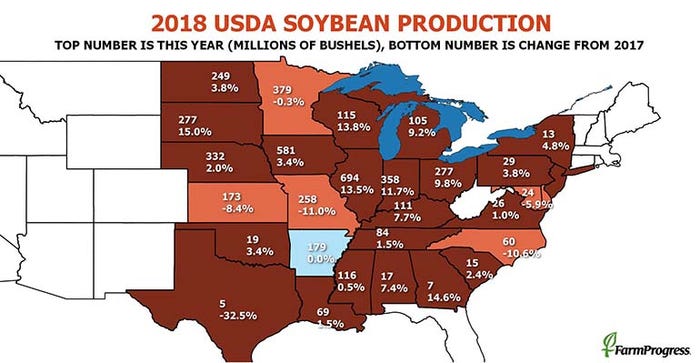

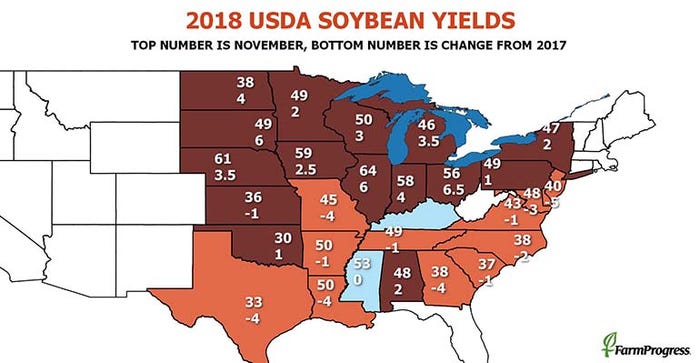

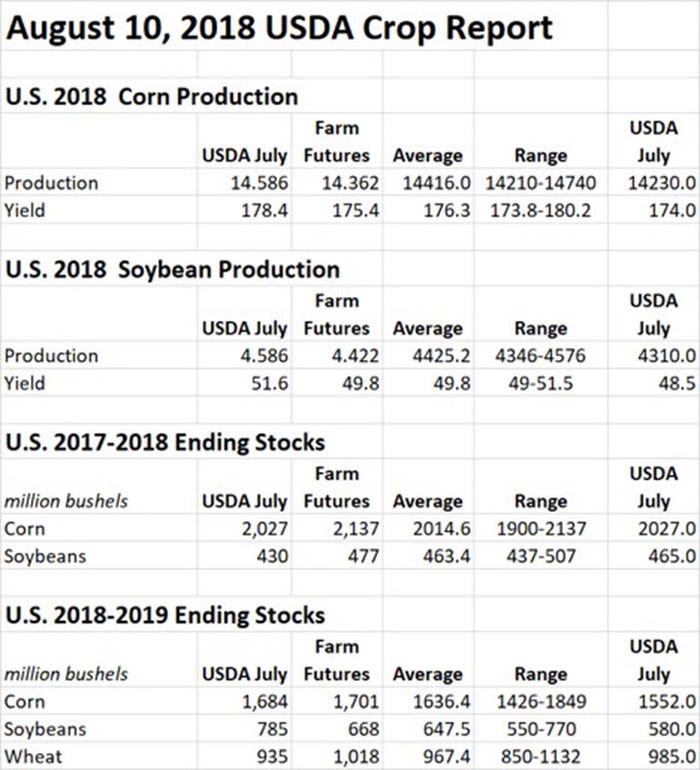

USDA has the current U.S. soybean crop’s yield potential rising sharply from its July estimates of 48.5 bushels per acre, climbing to 51.6 bpa after plenty of favorable crop conditions across the central U.S. this past month. That has the agency estimating total production at 4.586 billion bushels, up 276 million bushels month-over-month.

Analysts expected a yield bump, but not one quite of this magnitude – predicting an average of 4.425 billion bushels. That includes a Farm Futures projection of 4.422 billion bushels.

Soybean crush was raised 15 million bushels, with exports trending 20 million bushels higher month-over-month, but ending stocks still ended higher – moving 205 million bushels higher to 785 million bushels. Analysts expected a more modest gain to 647 million bushels, including a Farm Futures estimate of 668 million bushels.

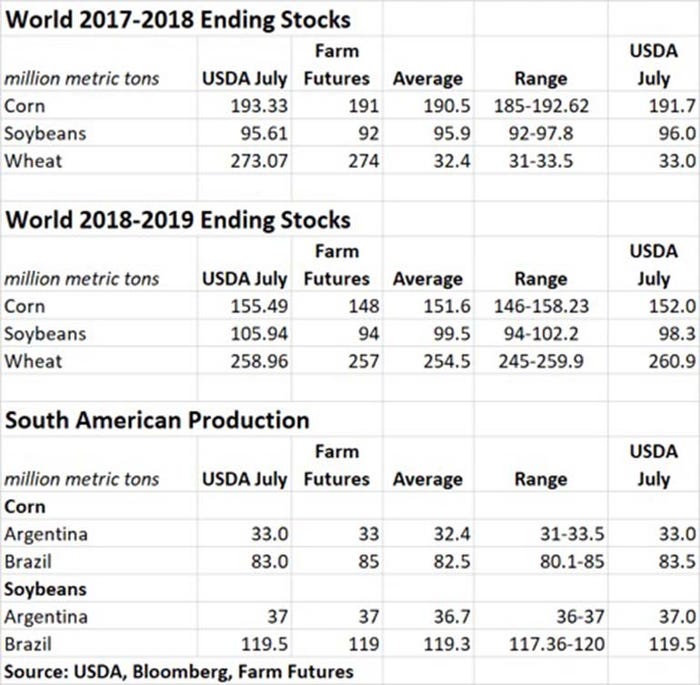

In South America, USDA elected to leave Argentina’s and Brazil’s soybean production estimates unchanged, at 1.360 billion bushels and 4.391 billion bushels, respectively.

Worldwide, USDA estimates 2018/19 soybean ending stocks at 105.94 MMT, moderately higher than the agency’s July assessment of 98.3 MMT. That also came in moderately higher than the average trade guess of 99.5 MMT.

These factors collectively push down the U.S. season-average soybean price for 2018/19 another 35 cents to a midpoint of $8.90.

“The government’s yields do match the top end of forecasts from our models of crop ratings, which have been declining,” Knorr notes. “Because USDA’s yields are based on conditions as of Aug. 1, there’s reason to expect these could be the biggest yields we see if current dry weather patterns hold.”

But even with optimistic assumptions about demand, soybean prices could remain burdened by record supplies, Knorr adds.

“Until more is known about Chinese demand, it could be tough to get the market moving,” he says. “USDA lowered its forecast for Chinese usage of 2017 crop soybeans, and it could be even lower based on recent trade data.”

It’s likely that China will have to start buying U.S. soybeans again at some point, regardless of tariffs. Until that happens, it will be hard to budge the needle much, Knorr says.

Corn

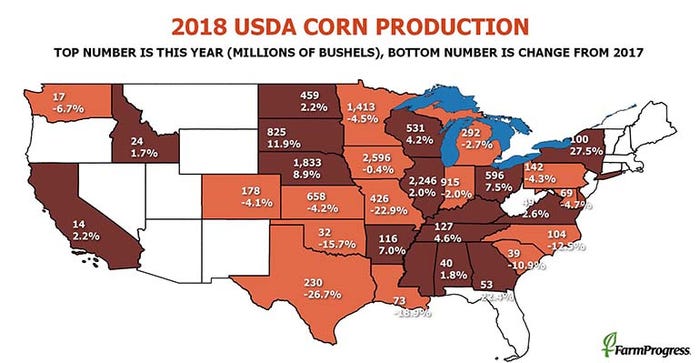

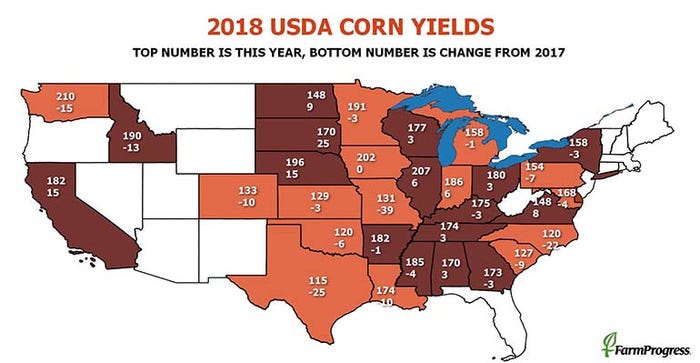

USDA’s projections for this year’s corn crop also grew in size, from July estimates of 14.230 billion bushels to its current projection of 14.586 billion bushels, an increase of 356 million bushels month-over-month. The agency’s per-acre yield estimates moved significantly from 174.0 bpa last month to its current estimate of 178.4 bpa – a record, if realized.

Again, analysts expected USDA to move corn production higher – just not quite this high. Surveys prior to today’s reports had industry experts predicting an average production of 14.416 billion bushels, which included a Farm Futures estimate of 14.362 billion bushels.

From state to state, yield estimates for Illinois, Indiana, Nebraska, Ohio and the Dakotas trended higher compared to July, with only Missouri, Minnesota and Kansas easing lower month-over-month.

USDA also has corn feed and residual use trending higher compared to July. Exports are also trending higher, as relatively lower prices are making U.S. grain more competitive with some key markets such as Brazil.

Even so, supply has outpaced usage, and ending corn stocks for 2018/19 are up another 132 million bushels to 1.684 billion bushels. Analysts expected ending stocks to rise also, with an average guess of 1.636 billion bushels, which includes a Farm Futures estimate of 1.701 billion bushels.

World ending stocks for 2018/19 corn also moved higher, from 152.0 million metric tons to 155.5 MMT. Analysts expected that figure to ease slightly, to 151.6 MMT. In South America, USDA did not alter its forecasts for corn production in Argentina, steady at 1.299 billion bushels, but slightly lowered its projection for Brazil to 3.268 billion bushels.

All factors considered, USDA lowered its season-average corn price by 20 cents at the midpoint, with a range of $3.10 to $4.10 per bushel.

Wheat

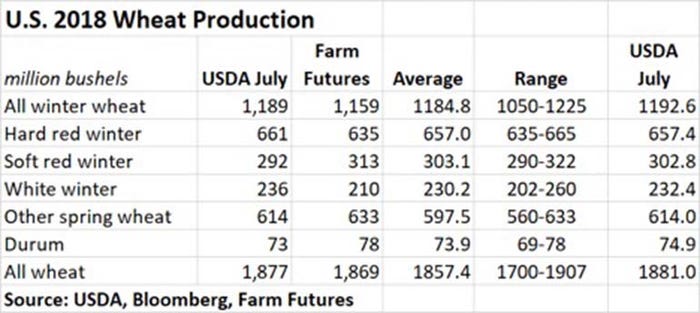

In contrast, USDA projects 2018 U.S. all-wheat production slightly lower from its July estimates of 1.881 billion bushels, edging lower to 1.877 billion bushels. Spring wheat projections of 614 million bushels were unchanged month-over-month, while winter wheat production forecasts moved from 1.192 billion bushels to 1.189 billion bushels.

Analysts were expecting a bigger reduction of wheat production estimates, with an average guess of 1.857 billion bushels, which included a Farm Futures estimate of 1.869 billion bushels.

U.S. wheat ending stocks for 2018/19 also moved lower, from 985 million bushels a month ago to 935 million bushels. World ending stocks this marketing year also fell, from 260.9 MMT down to 259.0 MMT – but remain just 5% lower than record levels from a year ago.

The European Union is the primary culprit for lower worldwide supplies, which are down an estimated 7.5 MMT (275 million bushels) month-over-month. Total EU wheat production could land at 5.052 billion bushels, which would be the lowest total in six years.

USDA raised its projected season-average price for wheat by 10 cents at the midpoint, with a range of $4.60 to $5.60.

The agency’s forecast for wheat was actually more bullish than anticipated, Knorr says. There are three primary reasons wheat couldn’t find traction for a rally today, he says.

“First, futures were weighed down by soybeans. Second, the surge in the value of the dollar tends to be bearish for wheat. Finally, charts at all three markets show a break below support lines from the July rally that tend to trigger more technical selling.”

About the Author(s)

You May Also Like