Our broker team had an internal discussion this week about why more farmers are not getting hedged up.

After the ethanol industry boom, markets identified $3 as hard support. Anytime prices came close to the low $3 range, they always seem to find new strength.

Our concern is that people have been conditioned to believe that because something has always happened a certain way, that it will continue to happen. This is a form of confirmation bias, which refers to the tendency for people to perceive future events will be consistent with past events.

If Coronavirus has taught us one thing, it is that anything is possible. I have talked to some very smart people who believe that a rally is a sure thing. I certainly hope so, but I think we can all agree that this year has been unlike any other.

Focus on what we know

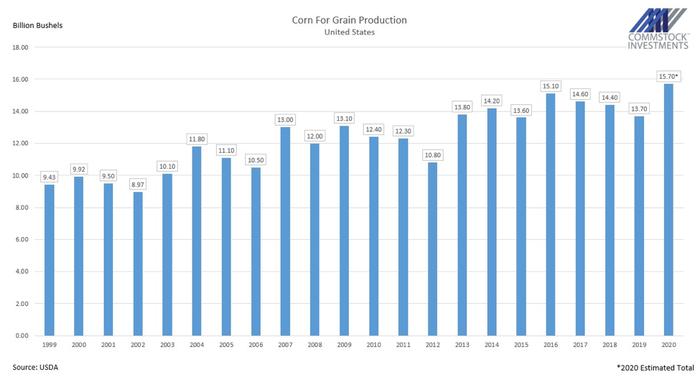

Nobody knows what grain prices will do, so let’s focus on what we do know. We know that with 97 million corn acres and trendline yields of 178.5 bpa, we will be facing a huge crop. There is a lot of speculation that farmers will switch to beans, and that very well could happen, up to a point. But even if we reduced planted area by 2 million acres, it doesn’t make much of a dent. With trendline yields, we are still looking at 15.5 billion bushels.

April’s WASDE report placed ending stocks at 2.1 billion bushels, but forecasts show it only getting higher. It is certainly plausible to add another 500 million bushels to ending stocks due to continued demand destruction. If we add 2.5 billion carryover to 15.5 billion that brings us to 18 billion bushels, the highest on record.

This puts us at a tremendous disadvantage.

This pushes ending stocks above 3 billion bushels with some estimates reaching above 4 billion. The last time that ending stocks were above 3 billion bushels was 1987. I don’t have to remind you what agriculture was like in the mid-80’s.

Will low prices cure low prices?

We also know that COVID-19 is creating demand destruction like we have never seen before. The phrase I hear a lot is that low prices cure low prices. Historically this has been true. However, this time is different. It doesn’t matter how cheap corn is. The ethanol plant can’t buy it if they are offline and the producers can’t feed it if they are euthanizing hogs.

The point of all this is that it is not too late to add hedges to your marketing plan. $3.30 December corn put options cost around 20 cents right now. If the market rallies, then great! You can sell your grain for more money or continue to add more hedges at lower prices. But the market is signaling us that this year may be different and if the price were to drop another 50 cents with those hedges, you won’t get rich, but you will be protected, and you will be able to make it another season.

Matthew Kruse, President of Commstock Investments, can we reached at 712-227-1110 or emailed at [email protected].

About the Author(s)

You May Also Like