Corn bulls are happy to hear that Chinese leaders are at least considering a U.S. request to shift some tariffs away from key agricultural crops to other products. I don't know any of the specifics or details, but perhaps this could expedite and make way for China to import more U.S. corn, ethanol, DDGS, etc. U.S. weekly corn export inspections reported yesterday were at the high end of trade estimates, up slightly from the previous week, but still below last year at this time. If we can keep this pace, we should be able to easily meet the USDA's current export estimate.

Remember, bears have been worrying and spreading fear that the USDA might once again have to lower their U.S. export estimate. Let's hope that's not the case! With the South American crop estimates getting a bit larger and weather mostly cooperative, there's still a ton of unknowns and uncertainty. I'm just hoping we can get some type of wild card boost from a Chinese trade deal and buying of U.S. corn and corn-based products.

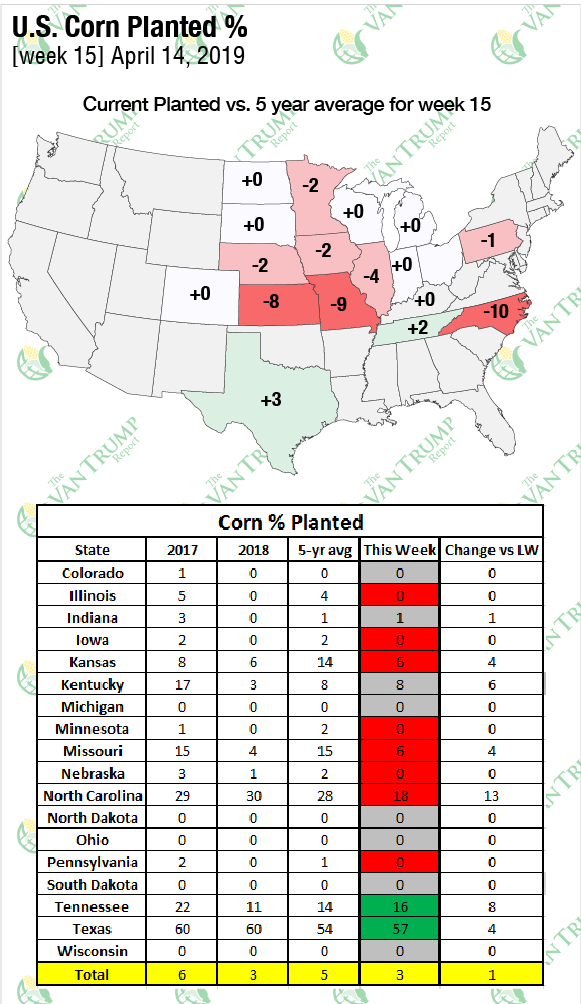

Weather can be argued by either side. Bulls are obviously saying flooded fields and too much moisture is a huge problem. Bears are saying there's still plenty of time to plant and that improved soil moisture profiles might ultimately be a big benefit for yield. Most on both sides seem to agree that there will be more preventive plant acres than currently estimated by the USDA, especially in parts of the northern production areas like the Dakotas, Minnesota, Wisconsin, etc. Bulls are quick to point to the USDA's planting progress data released yesterday afternoon that showed big production states like Iowa, Illinois, Minnesota and Nebraska already falling behind their historical pace.

Still, it's all about weather and Washington in the weeks ahead. Despite the bearish fundamentals and heavy fund short positions, I remain optimistic longer term. I'm just worried about how long farm folks and friends can continue to hold their breath underwater.

Check out my 30-day free trial to my daily report for more information.

About the Author(s)

You May Also Like