Hedge funds aren’t really hedgers in the same way farmers use markets to manage risk. These big speculators buy and sell trying to reap profits, not grain. But they manage that risk too. So it wasn’t surprising they bought back some of their bearish bets before Thursday’s USDA report.

Here’s what funds were up to through Tuesday, November 6, when the CFTC collected data for its latest Commitment of Traders.

![]()

Across the board

Big speculators bought back bearish bets in the grain market ahead of the USDA report, though they sold cotton, hogs and cattle. In all hedge funds covered 38,225 contracts of their short position. Investors using index funds to gain exposure to commodities liquidated 7,509 lots of their long position ahead of this week’s start to the Goldman Roll, when these funds move positions out of the nearby.

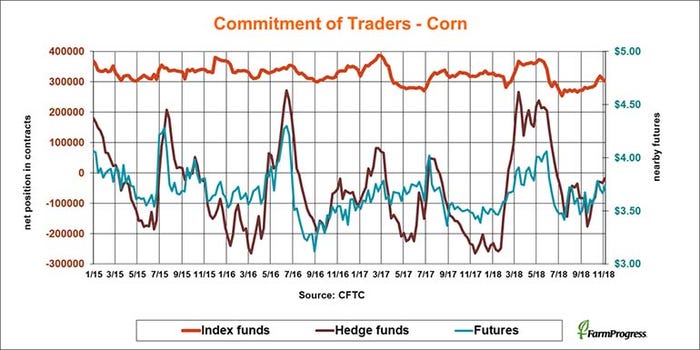

Closer to even

Big speculators covered 16,306 contracts of their shrinking bearish bet in corn, moving closer to an even position. They ended Tuesday with a net short position of 16,917 contracts, the smallest since the market fell apart in June.

Scared money

Big speculators bought back 29,575 contracts of their still large bearish bet in soybeans, as traders faced potential for USDA to cut its estimate of production. The hedge funds were still short 102,973 lots.

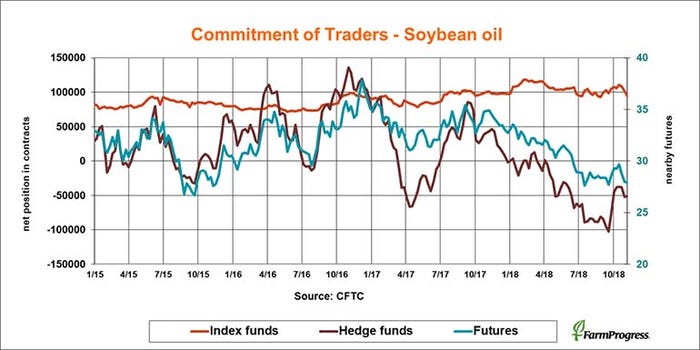

A little slippage

Big specs are still bearish on soybean oil but they bought back a little of that position this week, trimming 1,563 lots off their shorts.

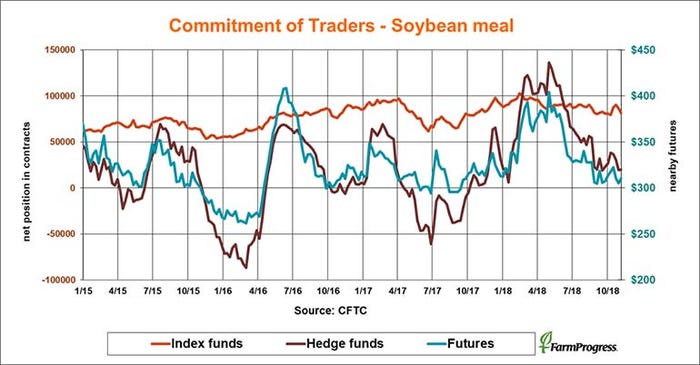

Small meal

Big speculators cut back their holdings in soybean meal this fall, but they took a break over the past week, adding 304 lots back to their bullish bet.

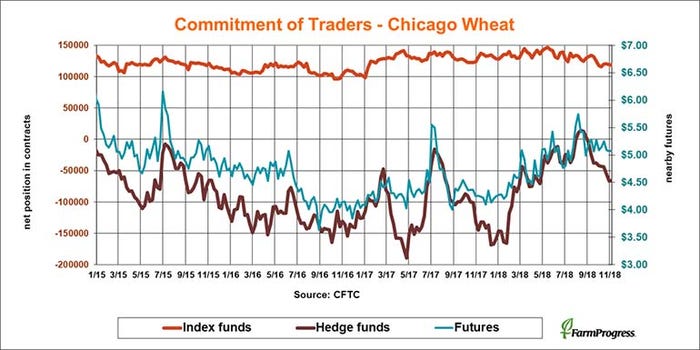

Treading water

After selling soft red winter wheat for 11 straight weeks, big speculators finally did a little buying, covering 1,521 lots of their net short position.

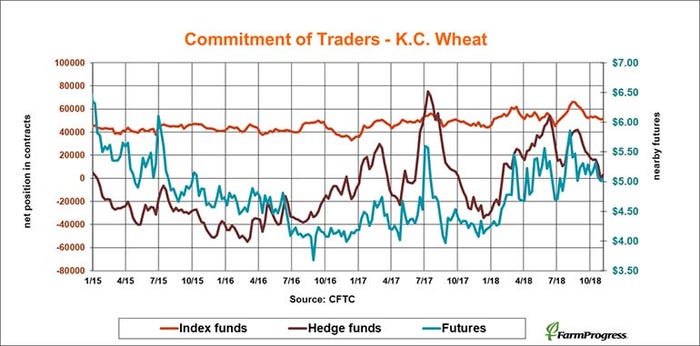

Leaning long

Big speculators were on the verge of turning bearish on hard red winter wheat last week, but they started buying ahead of the USDA report, adding 2,767 contracts on to their small net long position.

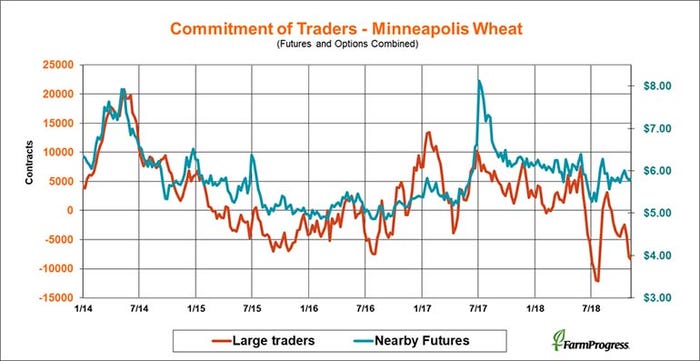

Still bearish

Large traders in spring wheat lightened up on their selling this week but still sold, adding 448 lots on to their net short position.

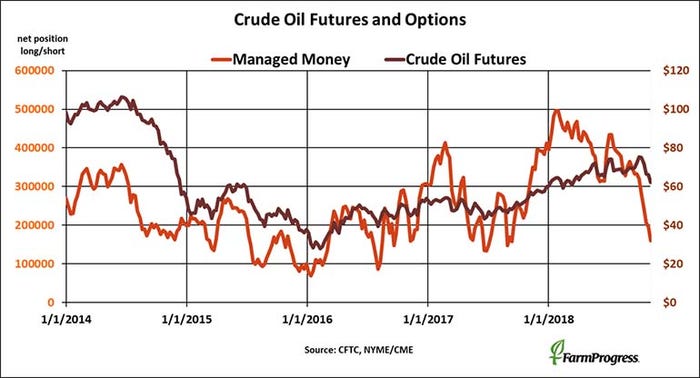

Bottom of the barrel

Crude oil officially entered into a bear market this week after losing more than 20% of its value. Money managers got the message, selling another $2.2 billion in futures and options to move their holdings to another new low for the year.

About the Author(s)

You May Also Like