Funds have been mostly bearish on commodities in 2019. That attitude began to change a little this week, but only a little, with several record bearish moves made.

Here’s what funds were up to through Tuesday, May 14, when the CFTC collected data for its latest Commitment of Traders.

![]()

A new record

Big speculators bought back bearish bets on some contracts. But their overall net short position in crops and livestock increased to an all-time bearish level this week. Buying in grains was offset by heavy selling in contracts with exposure to China, including soybeans, cotton and hogs.

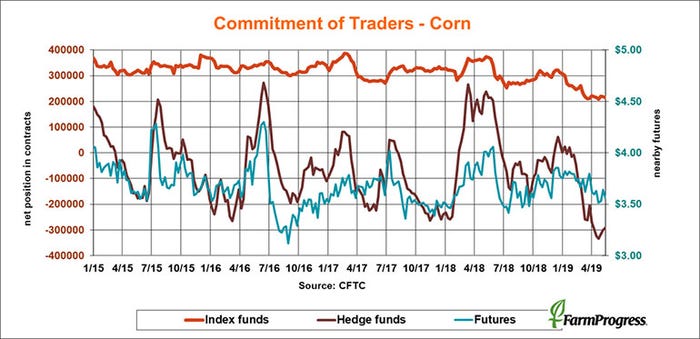

Two in a row

Big speculators bought back a little of their record bearish bet on corn for the second week in a row, liquidating more shorts later in the week. Hedge fund managers trimmed 9,424 off their net short position as of Tuesday.

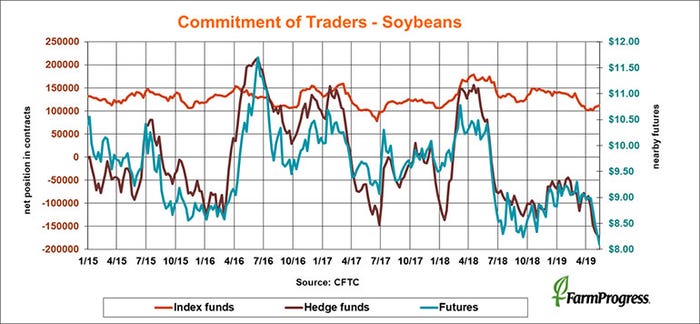

New low

Big speculators kept selling soybeans this week, extending their record bearish bet by another 9,054 contracts. That could provide fuel for short covering rallies, but those bounces typically don’t last long.

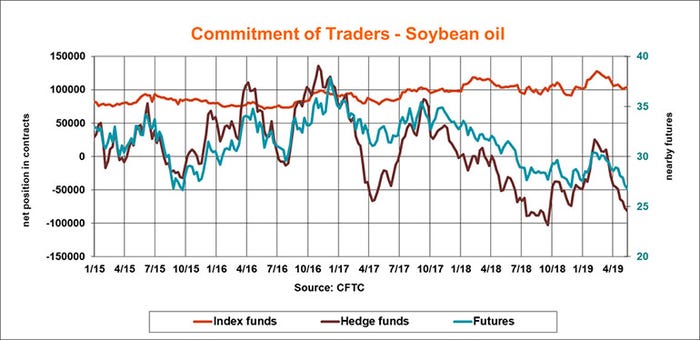

No love for oil

Big specs extended their net short position in soybean oil to another low for the year, selling 4,604 net contracts though global vegetable oil markets showed signs of life.

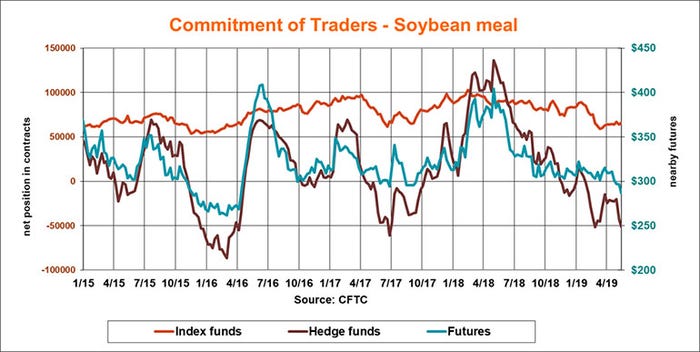

Double down

Big speculators increased their bearish bet in meal to its second widest level of the year this week, adding 8,335 contracts to their net short position.

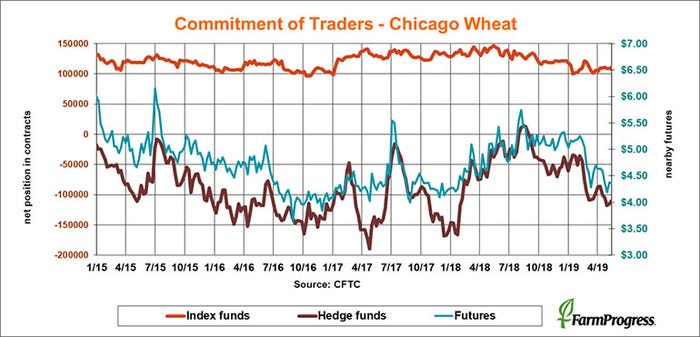

Not quite so bearish

Big speculators covered a little of their net short position in soft red winter wheat for the second straight week, buying back a net 4,813 contracts.

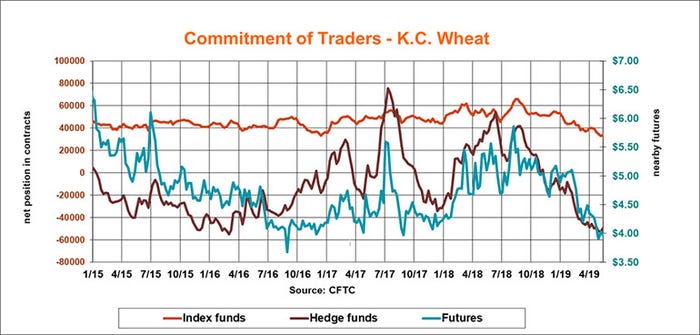

Off the bottom

Hedge funds held a near-record bearish bet on hard red winter wheat a couple of weeks ago. But they bought back some of that net short position for the second straight week, reducing it by 3,154 contracts.

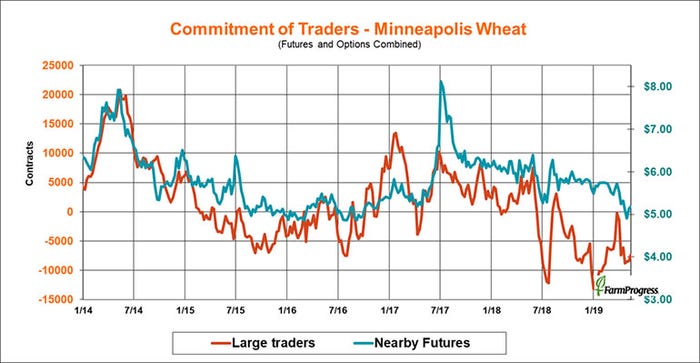

Third time

Large traders bought back spring wheat shorts for the third straight week, covering a net 1,075 contracts.

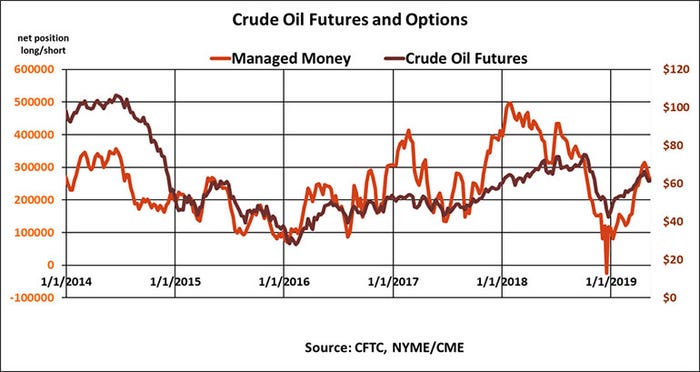

Taking profit

Money managers sold crude oil futures and options for the third straight week, dumping around $800 million in futures and options as concerns about the economy offset nervousness over tensions with Iran.

About the Author(s)

You May Also Like