It was a bruising week for many markets, highlighted by volatility in most. But the fast money wasn’t only selling last week.

Here’s what funds were up to through Tuesday, August 13, when the CFTC collected data for its latest Commitment of Traders.

![]()

Back into the pool

Big speculators overall were net sellers last week, but not by as much as earlier this summer. Hedge funds added only 12,845 contracts to their net short position in crops and livestock and were buying the soy complex and cotton, two markets roiled by the trade war with China. Investors wanting exposure to commodities through index funds were buying again too, adding 29,070 lots to their net long position.

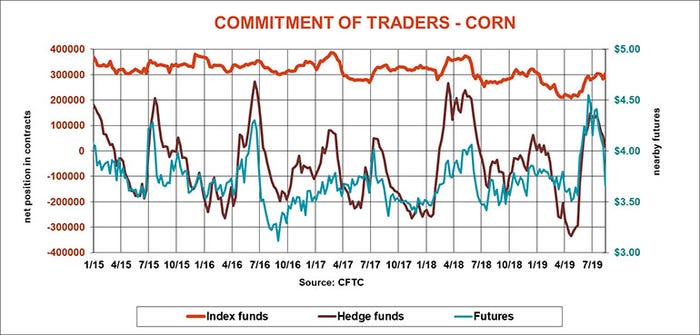

Next to nothing

Big speculators were buying corn at the end of the week, but earlier they likely wiped out most or all of their bullish bets. Hedge funds trimmed 42,088 contracts off their net long position in corn, whittling it down to 17,213 lots as prices plunged in the wake of the Aug. 12 USDA report.

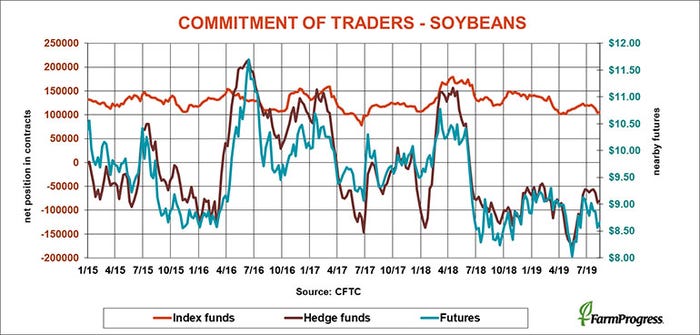

Small favors

Big speculators covered a little of their bearish bet on soybeans this week, buying back 3,817 lots as USDA cut production and acreage more than expected. Hedge funds still have a long way to go – they were still short 79,988 contracts as of Tuesday.

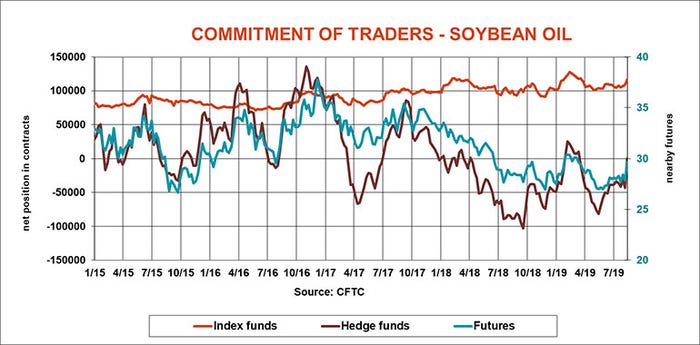

Playing catchup

Big speculators came late to the party in vegetable oil recently but that changed in a hurry this week. Hedge funds abought 43,591 contracts to moved to a small net long position for the first time since March.

Riding coattails

Momentum in the soy complex extended into meal, at least a little. Big speculators bought back 2,830 contracts of their bearish bets this week.

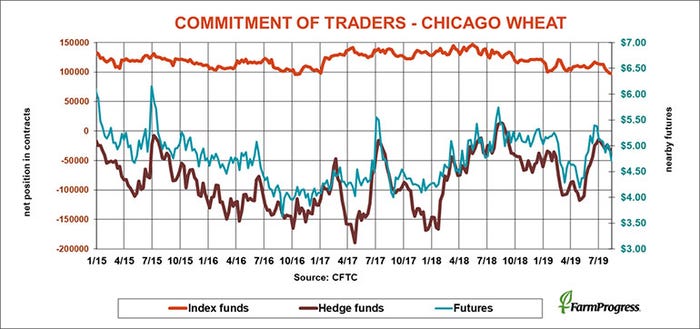

Trying to hold

Big speculators were only light sellers of soft red winter wheat despite bearish USDA numbers. The hedge funds added just 487 contracts to their modest net short position.

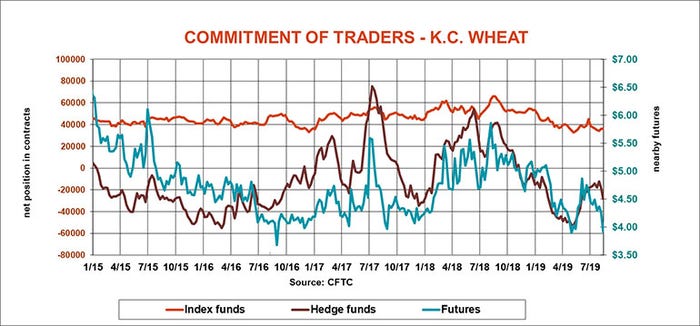

Bottom can’t hold

Hard red winter wheat slipped to new contract lows below $4 this week and big speculators gave it a push. They sold 10,051 contracts, adding to their bearish bets.

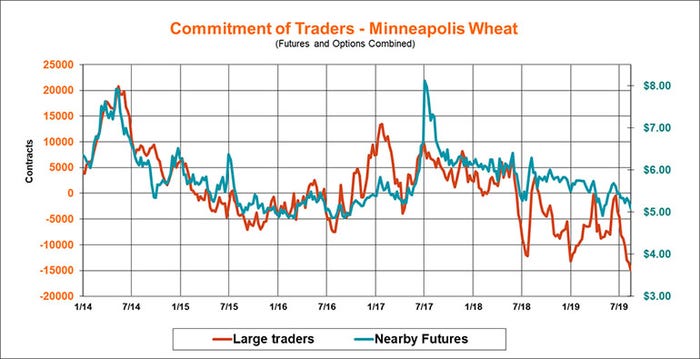

Red ink

Large traders in Minneapolis this week extended their new record bearish bet on spring wheat, adding 1,263 contracts to their net short position.

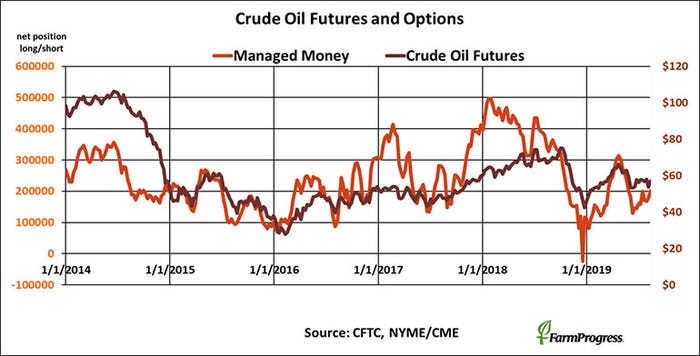

Big wager

Money managers bought crude oil seriously this week, despite nervousness over global economic growth that could hurt fuel demand. These investors added $1.3 billion bushels of futures and options to their net long position.

About the Author(s)

You May Also Like