June 3, 2019

Big speculators were bearish on crops for much of 2019. But the tide shifted with historically slow planting this spring that triggered a flurry of short covering.

Here’s what funds were up to through Tuesday, May 28, when the CFTC collected data for its latest Commitment of Traders.

![]()

Crazy for crops

Big speculators continue to scramble out of their once-record net short position in agriculture, buying a net 156,636 contracts last week. All of that came in crops as these hedge funds continued to sell livestock.

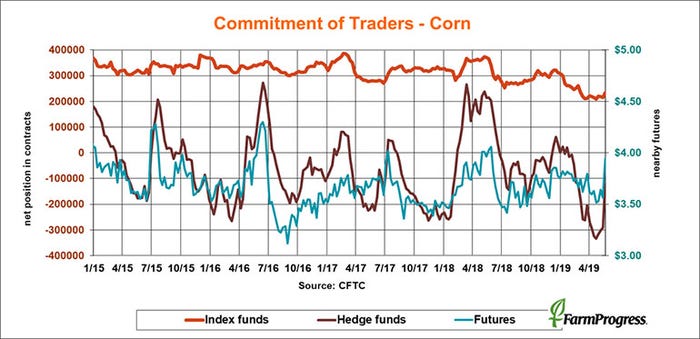

On the verge

Big speculators weren’t officially bullish on corn when the CFTC collected data for Friday’s commitments after Memorial Day. But they were close, and likely turned bullish according to daily player sheets, In all, hedge funds bought a net 96,493 contracts to be short just 25,029. Commercials were again selling, to the tune of 550 million bushels of corn, much of likely hedged from farmer sales.

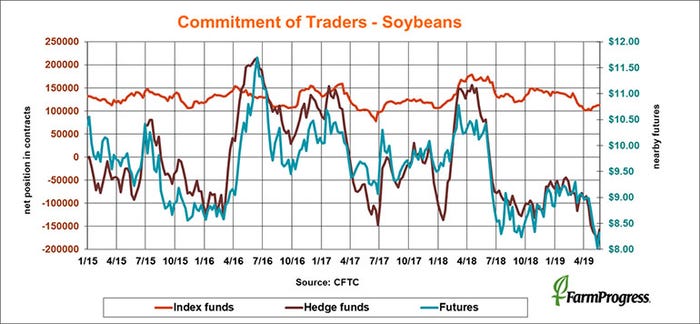

Whittle away

Big speculators continued covering bearish bets for the third straight week, liquidation another 22,420 contracts off their net short position. They’re still short nearly 135,000 lots however.

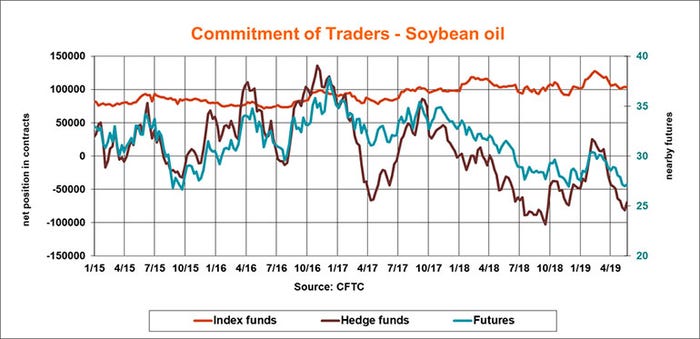

Lagging behind

Vegetable oil prices didn’t rally much on the weather move but big speculators did buy back a little more of their net short position last week, 11,258 contracts in all, about the same as the previous week.

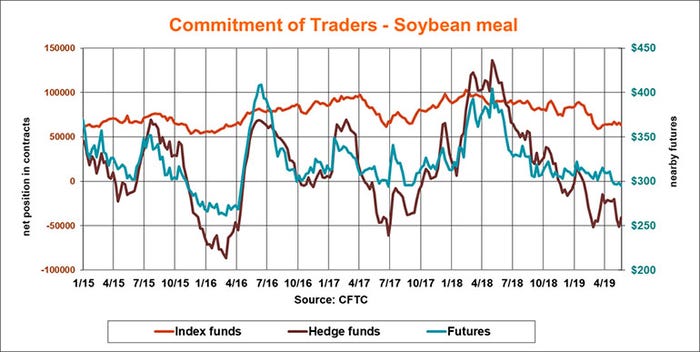

Meal time

Soybean meal prices jumped on the planting rally, spurred by short covering by big speculators, who bought a net 15,639 contracts last week.

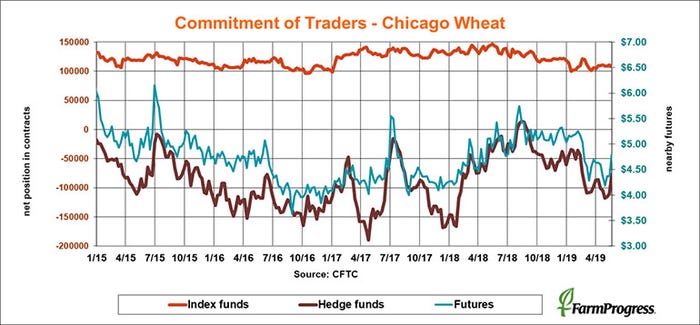

Four in a row

Big speculators covered some of their bearish bests in soft red winter wheat for the fourth straight week, liquidating a net 13,552 of their short positions.

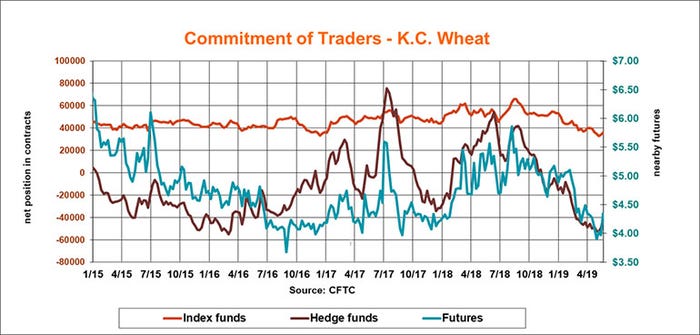

Slow going

Big speculators chipped away at their bearish bets in hard red winter wheat last week, culling 4,673 contracts from their net short position.

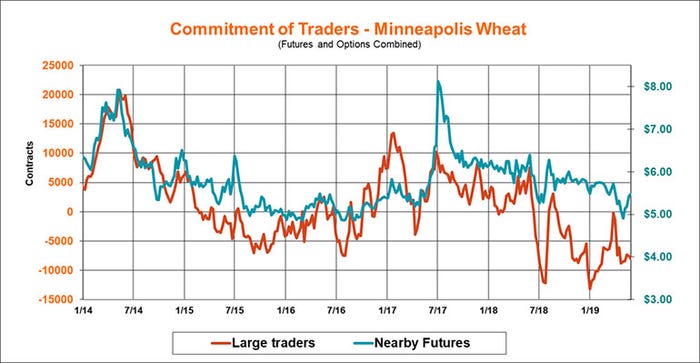

Different strokes

Large traders in Minneapolis sold spring wheat again last week, bucking the trend else elsewhere, increasing their net short position by 406 lots.

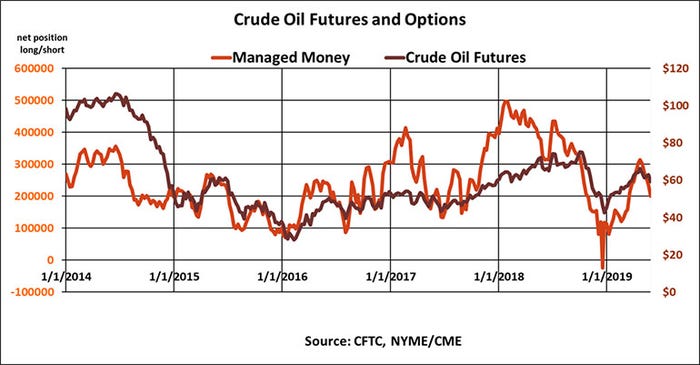

Tariff trouble

Money managers ramped up their selling of crude oil into Memorial Day, even though it’s the start of the peak summer driving season. Concerns about trade disputes’ effect on global growth was one reason big players sold $2.1 billion worth of futures and options.

You May Also Like