Commodity markets often exhibit a herd mentality, and that was true this week in agriculture.

Here’s what funds were up to through Tuesday, August 6, when the CFTC collected data for its latest Commitment of Traders.

![]()

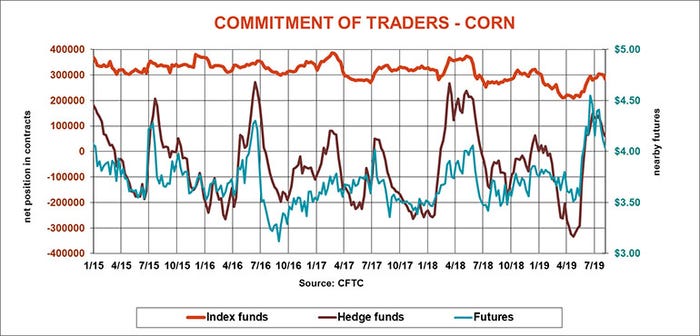

One-sided trade

Big speculators sold crops and livestock contracts across the board in the latest week, more than doubling their net short positions in agriculture. In all, these hedge funds sold 83,941 contracts. Investors gaining exposure to commodities through funds that follow commodity indexes were also selling, dumping 32,049 contracts of their net long positions.

Headed for the exits

Big speculators were sellers through the first two days of the week, lightening up bullish bets ahead of Monday’s USDA’s reports. Hedge funds cut 14,806 contracts off their net long position, trimming it to the lowest level of the summer.

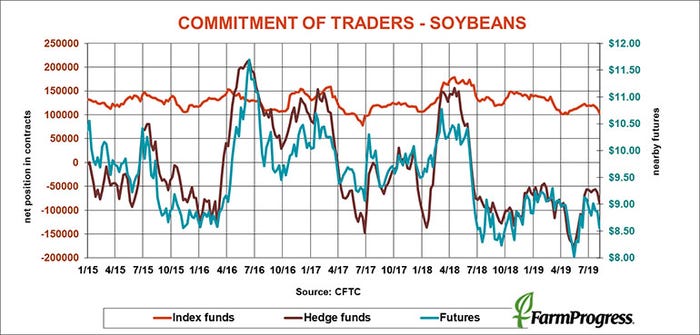

One side of the boat

Big speculators in soybeans were selling again this week, adding 20,282 contracts to their bearish bets. That provided room for short covering rallies late in the week when dry weather concerns trumped trade fears.

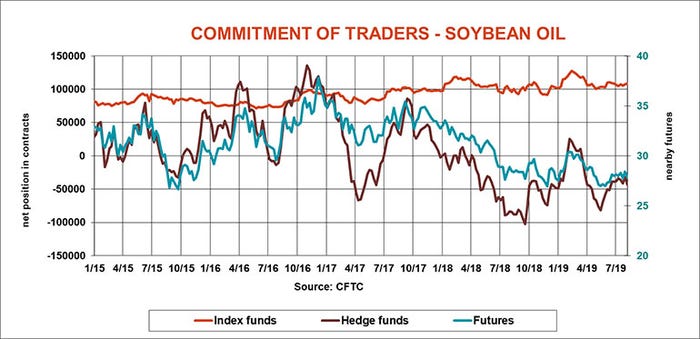

Time for a change

Soybean oil rallied sharply in the U.S. and Asia late in the week on fears slowing crush in China could boost imports. But that message didn’t reach big speculators earlier in the week, when they sold another 11,682 contracts net.

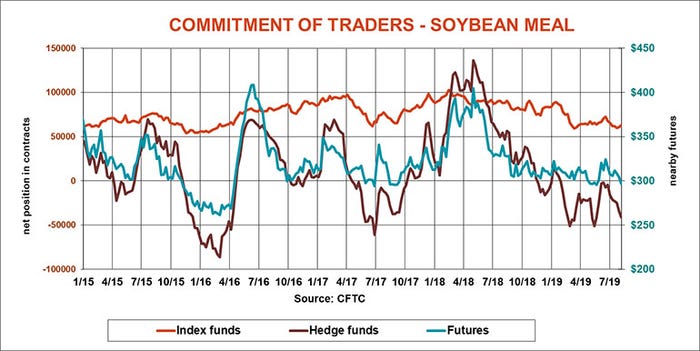

Back seat driver

Soybean meal normally drives crush trade in soybeans but accounted for a smaller percentage of processor margins this week as funds added 6,619 contracts to bearish bets. African Swine Fever is hurting demand for meal in China, weakness that’s spreading around the world.

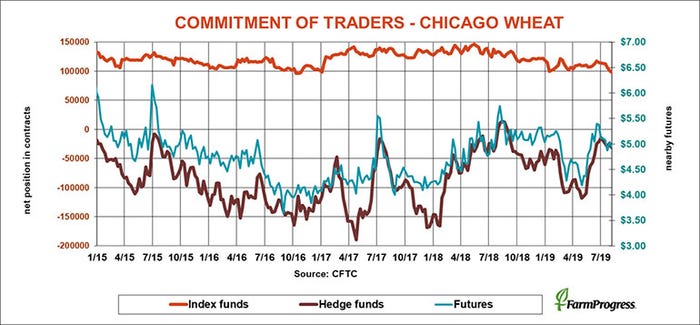

No great expectations

Traders don’t expect much news from Monday’s USDA reports on wheat. That left the path of least resistance lower for big speculators, who added 7,703 contracts to their modest bearish bet in soft red winter wheat.

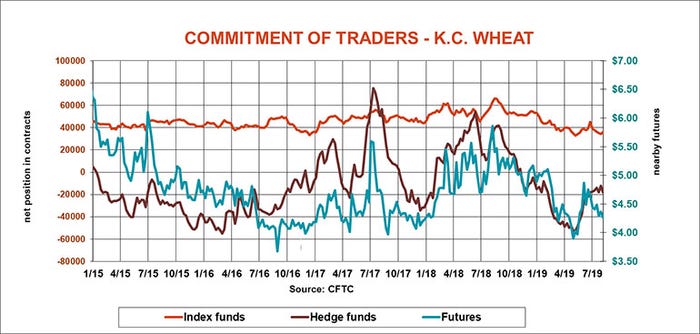

Too much stuff

Big speculators sold hard red winter wheat, extending bearish bets by 6,076 contracts as supplies look more than adequate on the Plains.

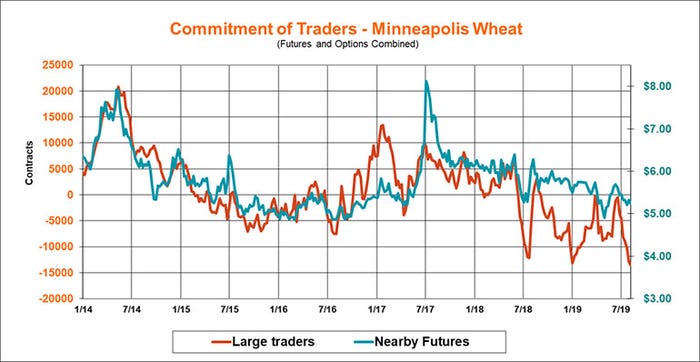

Bad record

Large traders in Minneapolis this week set the type of record farmers on the northern Plains don’t want to see. The big non-commercial traders – aka funds – sold another 600 contracts to push their bearish bet on spring wheat to an all-time record.

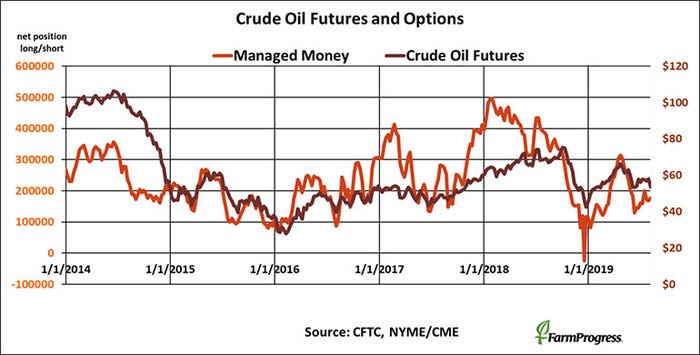

Blind-sided

Money managers were buying crude oil over the past week, adding $487 million in futures and options to their net long position, investments that lost value when new trade war talk pummeled the market.

About the Author(s)

You May Also Like