In last week’s column I outlined a positive price outlook for 2021 crop corn and soybean markets. (Corn could be the sleeper in 2021 acreage battle). But just how profitable those prices turn out depend in part upon costs farmers are penciling out now as they make spring plans and begin to lock in inputs.

The good news: Current prices for fuel and fertilizer remain overall near their lowest levels in a decade or more. While energy costs should stay affordable over the next year, rising optimism over the post-pandemic economy, not to mention higher grain prices, are already increasing fertilizer costs.

The bill for nutrients needed on a typical acre of corn remains 25% below the long-term average since 2008. But the price tag is already up 7% from COVID-19 lows as growers take advantage of better fall weather to ramp up applications.

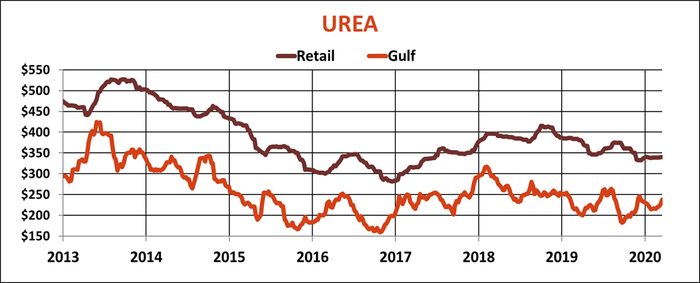

Urea is the bell cow for the nitrogen complex. Potash and phosphates are following their own news cycle but are also higher.

As usual, news out of India and China are key to urea. India as expected Monday announced its latest tender, with bids due Dec. 1 for early January shipment. After a slow start to deal-making in 2020, state buying picked up dramatically thanks to good monsoon rains and a surge in the rural labor force as workers fled cities for the countryside due to the pandemic.

China is a leading supplier of urea, but its export programs vary widely depending on local political and economic concerns. Chinese urea exports jumped to four-year highs in September thanks to previous Indian tenders, but producers appear ready to sit out the latest round to fill strong demand domestically driven by a hog industry recovering from swine fever and an economy that rebounded first from COVID lockdowns.

U.S. wholesale urea followed the rest the world higher this summer and fall, though prices here were cheap enough to encourage some product to be exported elsewhere. Exports in the first nine months of 2020 were up 47% from 2019 levels thanks to strong summer shipments and imports fell 6% year-on-year.

Gulf urea last week averaged $238 a ton, $64 off May lows, reflecting similar price moves in Brazil. Swaps trade shows a higher trend for December, with March up to $259. Retail prices also are higher, though they haven’t experienced the same increases because dealers generally didn’t lower their prices as much as international markets suffered. Recent offers appear to be running from $330 to $360.

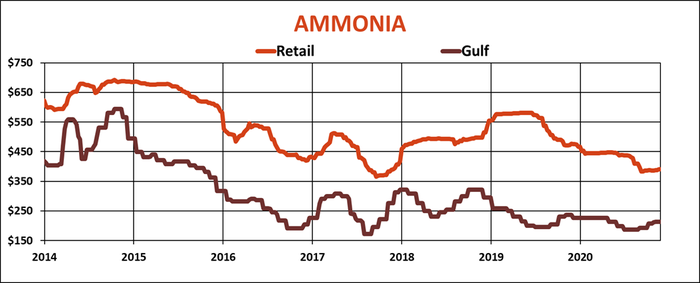

Ammonia generally follows urea, because in addition to competing for acres, ammonia is a feedstock for 46% products. Prices were subdued this year by the pandemic – ammonia has many industrial uses in addition to agriculture. Now there’s also talk of “green” ammonia, made from renewable resources instead of natural gas and coal.

Lower output from the Caribbean helped move ammonia prices higher, but gains for November Gulf contract settlement were up only $27 a ton off summer lows. Expect that bid to be higher for December though costs remain well below the long-term average. Current wholesale values translate into an average retail cost of around $435. That’s around the level of Corn Belt dealers recently. Values typically are lower on the southern Plains, where dealers were down around $350 on the summer and fall break.

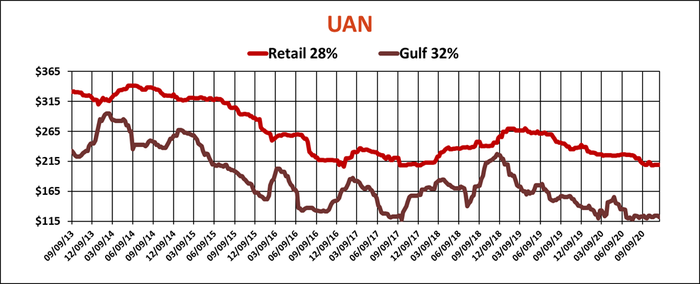

UAN remains the laggard in the complex for those who can use it now, store it or lock in a deferred price. Swaps for 32% at the Gulf closed at $122 last week, with December at $125, January at $135. April was at $148, around the same as April 2020, which translates into a retail cost for 28% around $200.

Politics jack fertilizer costs

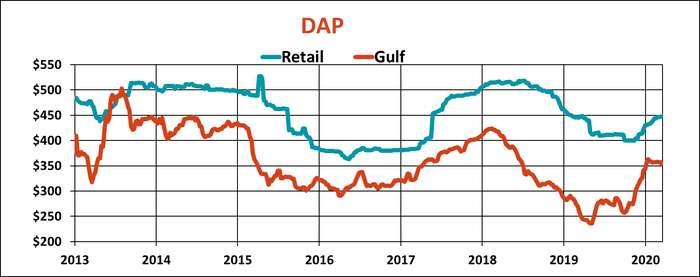

Higher nitrogen costs are one reason phosphates are also more expensive, though politics plays an important role currently. The U.S. slapped key exporters Russia and Morocco with anti-dumping tariffs, triggering an immediate jump in DAP and MAP that spread to the rest of the world too. While there’s no shortage of materials over the long-haul, the trade dispute and increased demand from higher crop prices should keep costs elevated. A decision on whether to make the duties stick is due in the first week of December.

DAP at the Gulf last week average $359 a ton with MAP $20 higher. Other suppliers, such as China and Saudi Arabia are in line with those values after freight so winter prices here aren’t a lot higher; February DAP swaps closed at $367.50 last week. U.S imports are down nearly 40% year to date, and exports are off too. Average retail DAP prices are running around $445, with a little upside pressure possible.

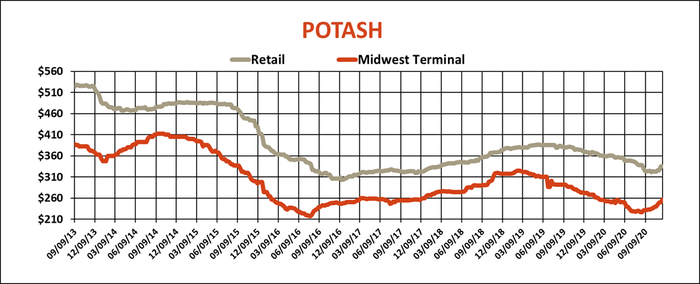

China shocked the potash market last spring by securing bargain basement prices to cover its needs. Wholesale potash prices at the Gulf drifted lower in the U.S. this summer but are up around $35 since then. Corn Belt terminal prices jumped $20 a ton last week to an average of $276, signaling a strong application season. Retail prices average around $335, but updated offer sheets from dealers reflect the double sawbuck move that could take costs higher.

Energy prices are also on the move, though in some cases that’s not saying much after crude oil futures briefly traded in negative territory during the first round of COVID panic. Petroleum’s rebound found support on positive news about vaccines and ideas OPEC and its allies will extend export curbs. Crude futures closed at $43 Monday, close to the top of their trading range since the pandemic break. While demand concerns from the new wave of the coronavirus are a short-term anchor, a huge recovery doesn’t seem likely either. U.S. producers have plenty of capacity ready to come back on line if prices rise – remember, only a few months ago the U.S. was on the very of becoming number one in crude again,

Current supply and demand fundaments shows crude futures fairly valued around $41.30 according to my pricing model. Fund traders are buying crude again, and positive vaccine news could drive the market near $50 this winter if bears go into hibernation.

Crude’s value helps determine prices for diesel. ULSD futures delivered in New York Harbor closed around $1.31 a gallon Monday – their highest since the March meltdown left a huge gap on the chart. Refineries continue to operate at only around 75% of capacity. Midwest runs were a little higher to meet harvest demand, but that buying is over now. As a result, basis in the ULSD cash market is trending seasonally weaker, a sign that supplies should start building again soon.

Group 3 wholesale diesel costs look fairly valued around last week’s $1.25 closing price but fundamentals suggest risk at the farmgate level to $1.90 over the winter. So growers should be watching this market closely over the next month for buying opportunities to lock in spring needs.

Propane also follows crude oil generally. Wholesale benchmarks are trading around 55 cents a gallon – cheap historically, but 35 cents off March lows. The best buying opportunities typically come in the late winter and early spring. Sometimes weakness can also be seen in summer, but that trend could be offset this year by rising crude and gasoline prices if newly vaccinated Americans head back to the highways en masse.

Knorr writes from Chicago, Ill. Email him at [email protected]

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like