With corn and soybean prices at multi-year highs, USDA’s monthly Supply/Demand report set for release tomorrow is garnering more interest than usual.

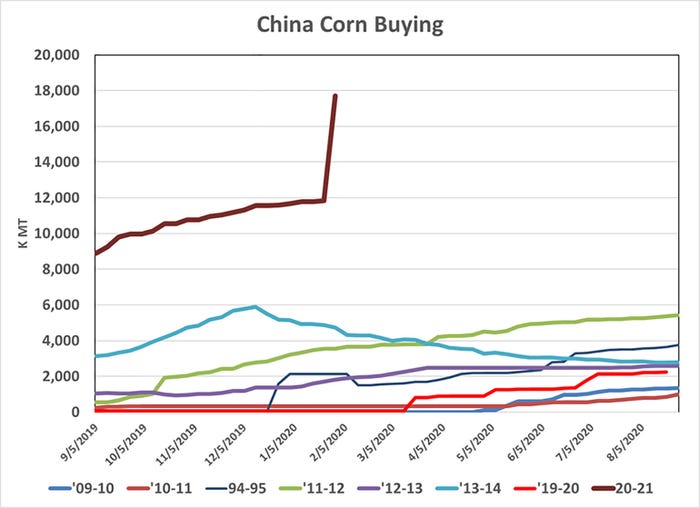

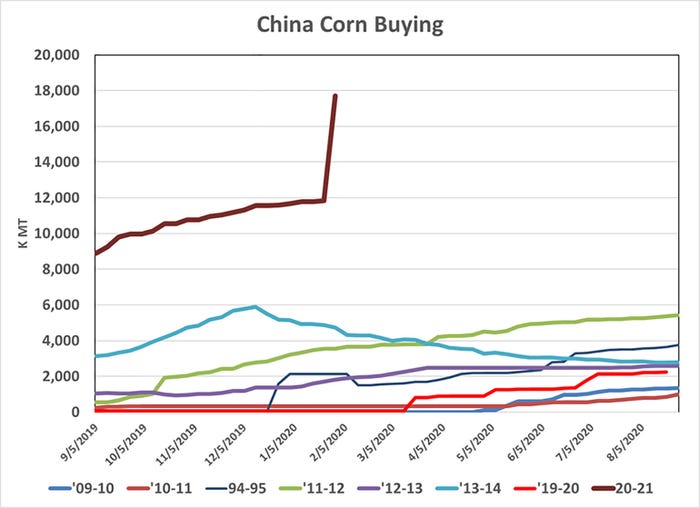

At the top of the list: what adjustments will USDA make to export forecasts, particularly for corn in the wake of recent large purchases by China? Last week alone China purchased a record amount of corn at 230.7 million bushels. The chart below shows just how different China’s purchases are this year in comparison with previous years.

What the trade thinks

What the trade thinks

It appears the consensus of market analysts and traders, commonly referred to as the trade, is anticipating a significant increase in U.S. corn exports. For example, the average trade estimate for U.S. corn ending stocks is 1.363 billion bushels (calculated range: 1.108-1.502). If this number is realized and compared to the January USDA estimate of 1.552 billion bushels, it would result in a decline of 189 million bushels.

This number would result in a stocks-to-use ratio of 9.2%.

The last time our stocks-to-use ratio was at this level was six years ago in the 2014/2015 crop year. Corn prices in the fall of 2014 dropped to $3.20 per bushel. In the summer of 2015, corn topped out at $4.40.

These numbers are obviously different than where we see corn today. ATI Research has a much lower estimate of corn ending stocks, at 1.111 billion bushels, or a stocks-to-use ratio of 7.4%. This estimate looks more like the 2013/2014 crop year where the contract low was $4.25 in January of 2014 and the contract high that spring was at $5.20.

While past performance does not necessarily equal future results, these figures are worth pondering. Are we simply looking at a weather market, are current prices inflated, or is the USDA off in their ending stocks number?

Soybean estimates

Soybeans present a different challenge as USDA’s January carry-out estimate of 140 million bushels is already historically tight. U.S. export sales commitments (accumulated exports + unshipped sales), however, are already at nearly 97% of the USDA annual export forecast of 2.230 billion bushels. The trade is looking for the carry-out to fall to 119 million bushels (range: 102-140), which is a 3% stocks-to-use ratio. It will be interesting to see if adjustments to imports, crush and/or exports are made with the report release.

In 2013/2014 the carry-out dropped to 92 million bushels, equating to a 2.6% stocks-to-use ratio. We nearly ran out of soybeans in the summer of 2014. The harvest price of soybeans in 2013 fell to $12.50 and the contract high reached $15.37 in May of 2014.

Keep it simple

In this historically uncertain environment, a pricing alternative does not need to be complex to be effective. Ideally, a marketing strategy/risk management plan should be simple enough that it can be explained and understood in a typical conversation.

One of the attractive features of utilizing options is the flexibility provided. For example, the purchase of a put option not only provides a price floor for anticipated production but also enables participation in upside price movements after the position is established. In addition, a put option does not commit the producer to deliver the production that is being protected.

This can be particularly beneficial for crops in a year when poor weather results in a shortfall in output relative to expectations, such as the drought of 2012.

Effective risk management entails developing and implementing a strategy that provides price protection, yet also enables participation in market movements. Regular communication with your risk management advisor is prudent in serving as a reminder of the importance of consistency in following your risk management plan.

Contact Advance Trading at (800) 664-2321 or go to www.advance-trading.com.

Information provided may include opinions of the author and is subject to the following disclosures:

The risk of trading futures and options can be substantial. All information, publications, and material used and distributed by Advance Trading Inc. shall be construed as a solicitation. ATI does not maintain an independent research department as defined in CFTC Regulation 1.71. Information obtained from third-party sources is believed to be reliable, but its accuracy is not guaranteed by Advance Trading Inc. Past performance is not necessarily indicative of future results.

The opinions of the author are not necessarily those of Farm Futures or Farm Progress.

About the Author(s)

You May Also Like