June 26, 2020

Demand uncertainty due to the coronavirus pandemic will make marketing your 2020 crops challenging. Unfortunately, most farmers used futures price objectives to drive their old- and new-crop marketing plans and may not have considered including a time objective.

The limitation of such a plan this year could have been the need to trigger new-crop sales when December corn futures trade from roughly $3.50 to $3.70 per bushel. Those price levels might not be reached before harvest without a significant weather threat to impact production.

Many farmers could get caught with large quantities of unpriced bushels to price come harvest, with the potential for tremendous storage capacity concerns and low cash prices. What if your new-crop corn marketing plan was based on total crop revenue rather than just a futures price minus the local basis?

Let’s say your goal is to generate at least $100-per-acre total revenue above your estimated corn crop costs for 2020. For the corn price, we’ll use $3.20 per bushel. This is the national average cash price projection for corn from the World Agricultural Supply and Demand Estimates report released on June 11 for the 2020-21 marketing year that begins on Sept. 1.

Profit potential

Start with these three steps to determine your corn profitability potential.

Estimate your 2020 cost of production comparing this year to previous years.

Consider the federal government payments to be received for corn.

Calculate your breakeven price using various corn yield estimates and projected national average corn cash price of $20 per bushel.

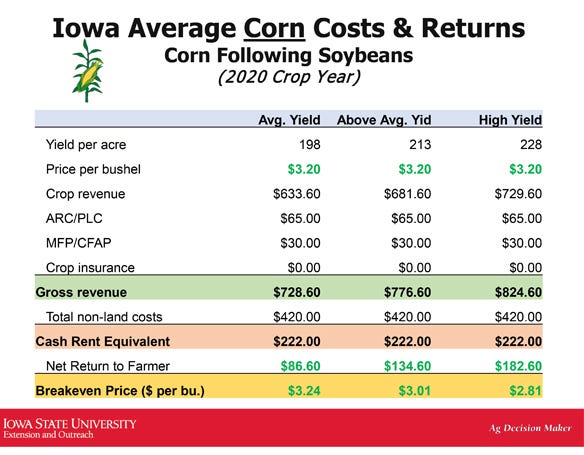

For example purposes, we’ll use the Iowa State University Ag Decision Maker publication Estimated Costs of Crop Production in Iowa 2020, File A1-20. Total non-land costs using the medium yield level for the corn following soybeans is $420 per acre and appears in the table below. The Cash Rent Equivalent of $222 per acre reflects the 2020 statewide average cash rent found in the Cash Rental Rates for Iowa 2020 Survey, File C2-10. That’s a total crop cost estimate of $642 per acre.

The federal government payments to be received include the average Price Loss Coverage payment for 2020 corn. It was calculated using the $3.20-per-bushel average cash price projected, subtracted from the $3.70-per-bushel effective reference price. Multiply this difference times 85% of base acres. A new PLC yield estimate of 160 bushels per acre was used.

Note that farmers have until Sept. 30 to update to their new PLC yield effective for the 2020 crop. That payment would be about $65 per acre and received in October 2021. The Coronavirus Food Assistance Program (CFAP) payment for corn currently being made is an estimated statewide average of $30 per acre. So, plan to add about $95 per acre onto your total crop revenue.

Estimating total crop revenue

The 2020 Iowa trendline corn yield is about 198 bushels per acre. Multiply this times the average $3.20 per bushel. That’s a crop revenue of $633.60 per acre. Add the $95-per-acre average government payments for a total crop revenue $728.60 per acre. If you subtract the average non-land cost and cash rent equivalent per acre, the net crop revenue is roughly $86.60 per acre. Consider this as a net return to management for corn.

Your final corn yield could prove much higher with good crop growing conditions. The Iowa corn crop was planted approximately two weeks earlier than the five-year average. As of June 21, the USDA National Agricultural Statistics Service’s Crop Progress and Condition report indicated that the Iowa corn condition was rated at 85% good-to-excellent. That’s a relatively high crop rating for mid-June. The state’s topsoil and subsoil moisture levels were rated at 92% and 93% adequate to surplus, respectively.

Figuring breakeven prices

The estimated costs of corn production for both non-land and cash rent equivalent totaled $642 per acre. This amount was divided by yield estimates that increased by 7.5% and 15% above the average of 198 bushels per acre. With good 2020 final corn yield prospects, the following yield estimates and breakeven prices were used as an example:

average yield = 198 bushels per acre = $3.24 per bushel

above-average yield = 213 bushels per acre = $3.01 per bushel

high yield = 228 bushels per acre = $2.81 per bushel

Your marketing plan might be to set a total revenue goal of say $750 per acre for corn. A secondary goal might be to trigger new-crop cash sales when you can get at least 20 cents per bushel above your estimated breakeven price. This leaves more opportunity to continue to price 2020 new-crop corn into July and early August and avoid the likelihood for lower cash prices and wider basis come harvest.

Consider using a revenue-based marketing plan for corn in 2020. With good corn yield prospects, lower breakeven prices are likely. Think about making new-crop corn sales while a futures price premium still exists and before the potential harvest basis widens. A tool such as a cash forward contract could lock in both futures price and a local basis.

A contract for a late September delivery to a processor might provide even better basis opportunities. If you have adequate on-farm storage, consider using a hedge-to-arrive contract that locks in the futures price but doesn’t set the basis. Before delivery, work with your merchandiser to “sell that large carry” on those bushels but leave them stored on your farm. Then make plans to deliver during the late winter or spring when better basis opportunities should exist.

Iowa State University Extension has created a new web page to assist producers looking for timely crop marketing education, including webinars, webinar replays with handouts, weather outlook videos, and crop marketing strategies newsletters at Virtual Ag Marketing Clubs.

Important deadlines for 2020

Participating in federal farm programs will be the main source of income for farmers this year. Federal payments are expected to come from two main sources: the Agriculture Risk Coverage and Price Loss Coverage programs, and the special financial assistance programs enacted to provide payments to cushion losses caused by the adverse economic effects of the coronavirus.

The main special assistance program is the Coronavirus Food Assistance Program. It is providing payments in 2020 to farmers who apply and qualify to receive the payments, but the payment is based on 2019 production and the number of unpriced bushels a farmer had on Jan. 15, 2020. You need to keep the following dates in mind to participate in these programs and qualify for the financial help they offer. Key dates for crop insurance participation are:

June 30 — 2020 ARC-PLC enrollment

July 15 — acreage certification

Aug. 28 — CFAP application

Sept. 30 — PLC yield update for 2020 crop

Oct. 1 — crop insurance premiums due without penalty

March 15 — 2021 ARC-PLC election and enrollment

March 15 — 2021 crop insurance changes

Johnson is an ISU Extension farm management specialist. Contact [email protected].

About the Author(s)

You May Also Like