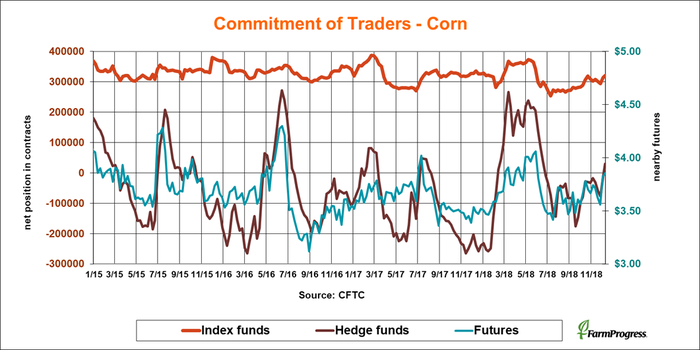

Bearish tides washed over the grain market for most of the summer and fall as weather worries faded and new concerns about China’s tariffs unfolded. But big speculators took a big step over the past week, turning bullish on corn.

Here’s what funds were up to through Tuesday, December 11, when the CFTC collected data for its latest Commitment of Traders.

![]()

More covering

Big speculators aren’t bullish on everything, but they continued to cover short positions last week, trimming bearish bets by 53,847 contracts. Investors using index funds to provide exposure to commodities were also purchasing, adding 19,609 contracts to their net long position in ag.

Follow the money

Big speculators have been covering their short position in corn fairly consistently since it peaked in September. But this week the buying turned into the real thing as funds purchased a net 43,825 contracts to turn long for the first time since June.

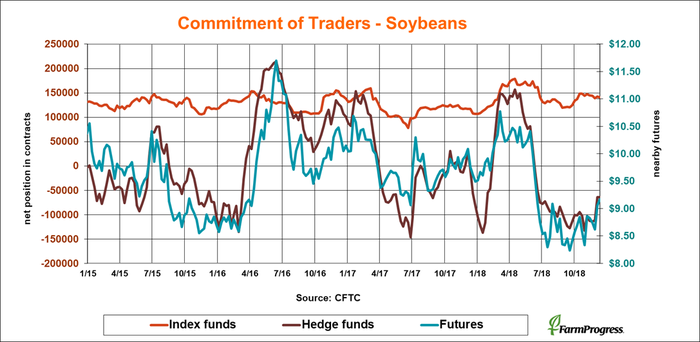

Moving cautiously

Big speculators by and large didn’t take the bait of renewed buying by China. They trimmed their net short position in soybeans by only 175 lots as of Tuesday, then started selling again later in the week.

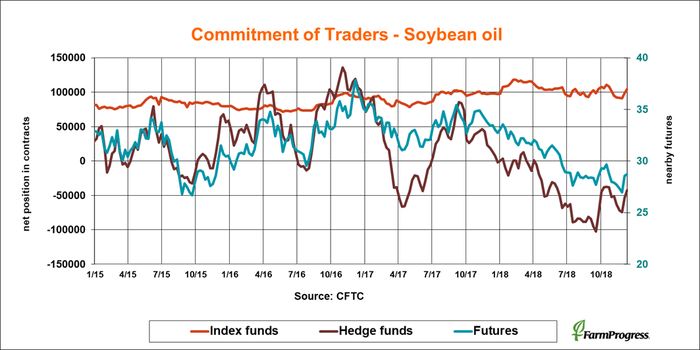

Oil’s well

The soybean oil market showed hints of a bottom this week, and that mood was aided by short covering from hedge funds. The big speculators cut 10,786 contracts off their net short position in the product.

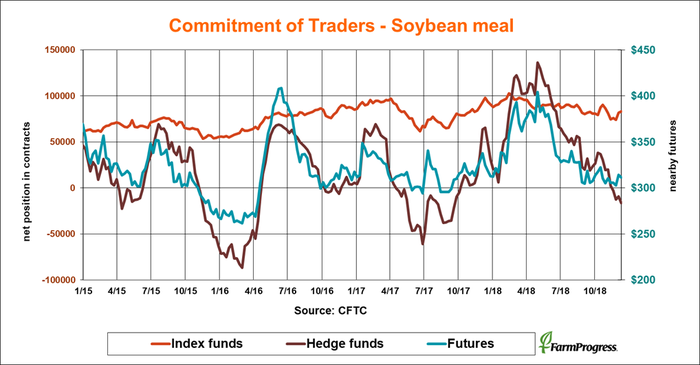

Mealy mouthed

Bulls rejected buying in soybean meal, selling a net 7,171 contracts to boost their modest bearish bet.

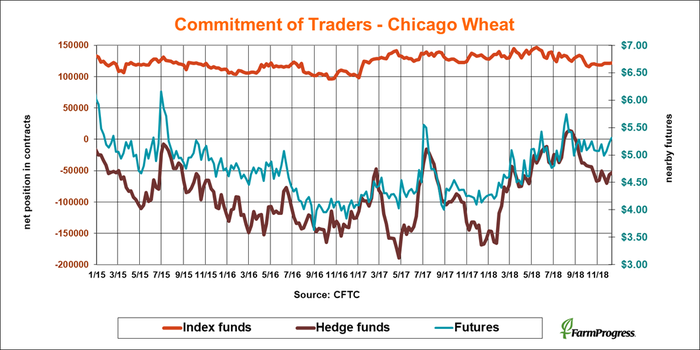

Light stuff

Big speculators covered a little more of their net short position in soft red winter wheat, cutting 3,275 lots off their bearish bet.

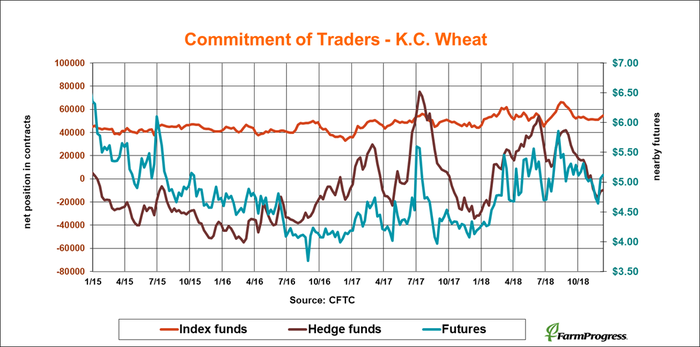

Double time

Big speculators bought hard red winter wheat for the second straight week, cutting another 1,160 contracts off their modest bearish bet.

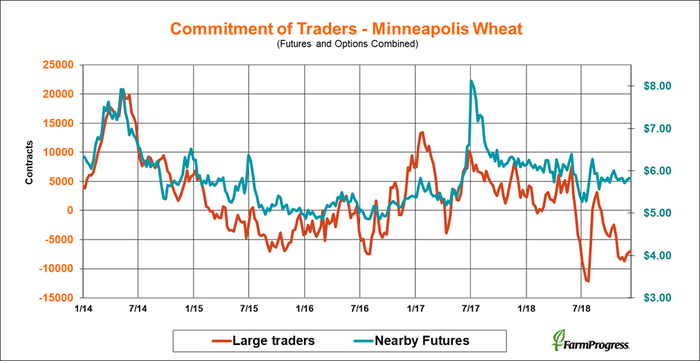

Around the edges

Large traders trimmed their net short position in Minneapolis for the third straight week, but only by a little, buying a net 236 contracts in spring wheat.

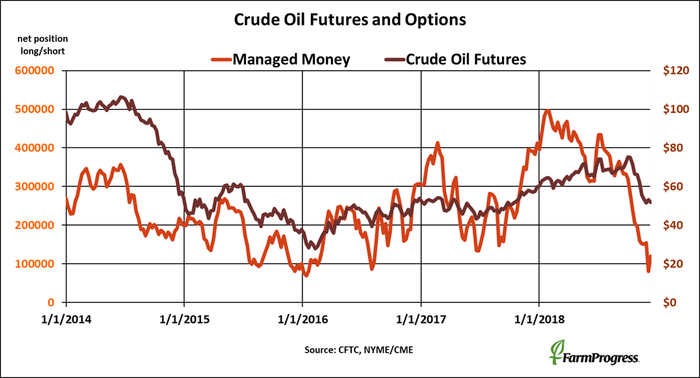

Fill ‘er up!

After dumping more than $26 billion worth of crude oil futures and options this year, money managers decided it was time for a change last week as OPEC and its allies agreed to cut production in 2019. These players bought around $2 billion, though prices remained weak.

About the Author(s)

You May Also Like