At the end of the calendar year, many producers prepay for inputs to reduce taxes and potentially avoid higher prices in the spring. To prevent the risk of profit margin reductions (from a decline in commodity prices), producers may want to consider obtaining downside price protection for a portion of their anticipated 2024 production at the same time as inputs are purchased.

One strategy is purchasing put options on the yield required to pay for the input purchased, and carrying the put option position until the projected crop insurance price is determined.

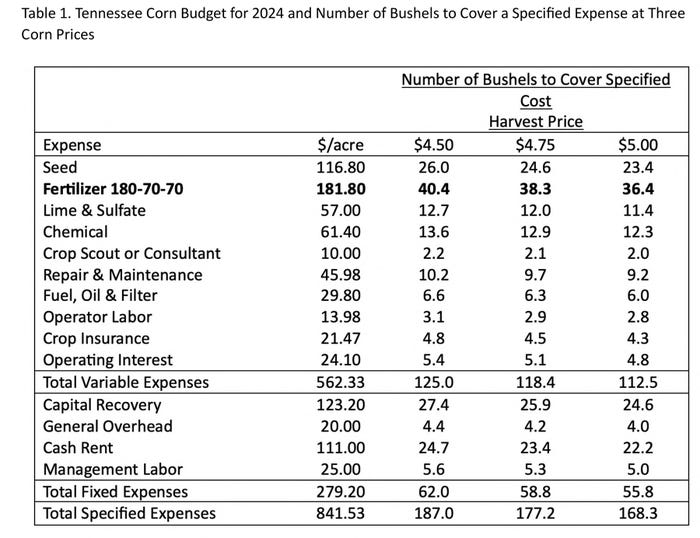

Table 1 shows a simple budget for Tennessee corn production (target yield of 180 bushels per acre), and the number of bushels of production required to cover the specified expense at different corn prices. This is computed as the cost of the production input per acre divided by the harvest price.

Source: University of Tennessee Institute of Agriculture

For example, a fertilizer expense of $181.80 per acre would require 40.4 bushels per acre to cover the fertilizer expense at a corn price of $4.50 per bushel, 38.3 bushels per acre at a corn price of $4.75 per bushel, or 36.4 bushels per acre at a corn price of $5.00 per bushel.

Financial mitigation

A producer can mitigate financial risk by using put options to cover the amount of production needed to cover that input cost, thus bridging the price risk gap until crop insurance prices and revenue protection are determined.

A producer with 260 acres of corn, seeking to set a futures price floor at $4.75 per bushel and provide sufficient price protection on the bushels needed to pay the fertilizer expense, could purchase two put options (5,000 bushels each covering 260 acres x 38.3 bushels per acre = 9,958 bushels). On November 21st a $5.20 December 2024 corn put option could be purchased for 45 cents, setting a $4.75 futures floor.

The put option could be carried until March 1, at which time projected crop insurance prices are established and revenue protection for the upcoming crop are determined. At that time, the option purchaser can evaluate the price protection their crop insurance provides and decide to maintain the put option position or exit.

If the December corn futures contract is below $4.75, the purchaser can maintain the put option position for additional price protection or exercise the option for a financial gain. If the December corn contract is above $4.75, the purchaser can maintain the position or exit the put option position and recoup a portion of the premium based on the time value remaining.

Producers should examine times during the year when they are exposed to price and financial risk and seek strategies to mitigate those risks.

Using put options can be an effective tool to remove some price risk when prepaying for fertilizer, and other inputs, until crop insurance prices and revenue protection are determined.

Source: Southern Ag Today, a collaboration of economists from 13 Southern universities.

Read more about:

EconomicsAbout the Author(s)

You May Also Like