You don’t need a weatherman to tell which way the wind blows. And when grain markets drop, it’s usually the result of fund selling.

Here’s what funds were up to through Tuesday, July 23, when the CFTC collected data for its latest Commitment of Traders.

![]()

In retreat

Both hedge funds and index traders sold this week, though amounts were mostly light. Big speculators added 44,069 contracts to their small new net short position, while those following indexes cut 7,467 lots from their holdings in crops and livestock.

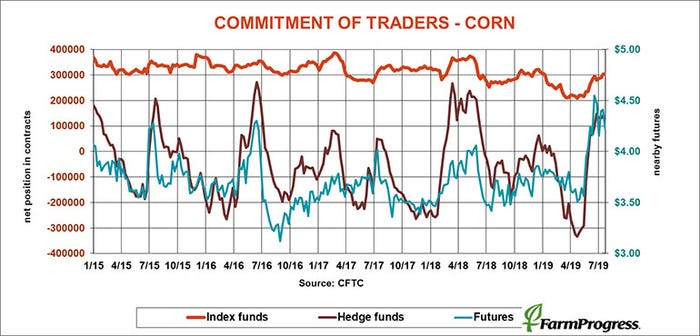

About face

After buying corn the two prior weeks, big speculators turned sellers as temperatures broke. The hedge funds trimmed 32,246 contracts off bullish bets as of Tuesday and dumped more into the end of the week.

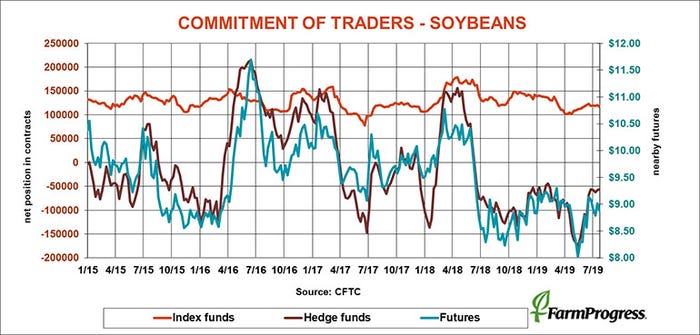

Less gas

Big speculators in soybeans covered more of their net short position in soybeans, but only a little, buying a net 1,363 contracts overall.

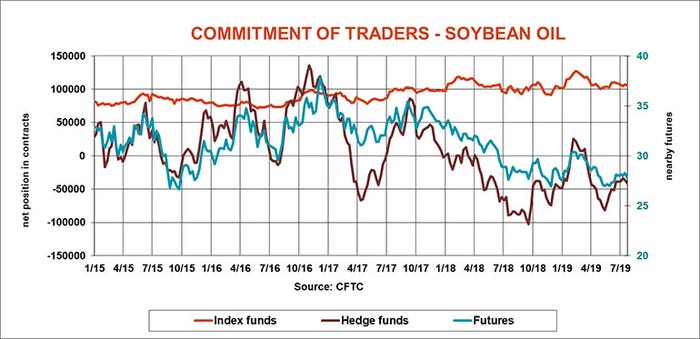

No answer

While vegetable oil prices in Asia were volatile this week, big speculators weren’t buying Chicago’s soybean oil futures. They added another 5,120 contracts to their bearish bet in the product.

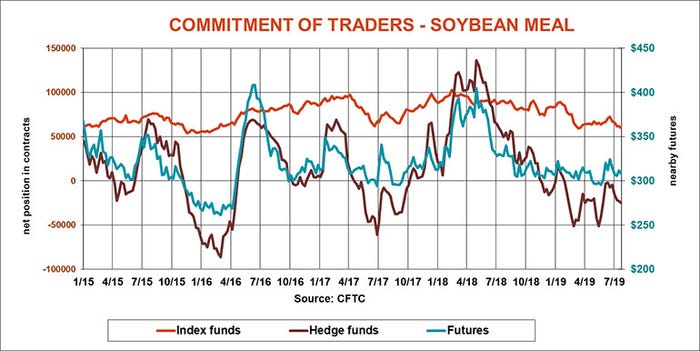

More bearish

Big speculators sold soybean meal for the fourth straight week, adding 1,911 contracts to their modest bearish bet against the product.

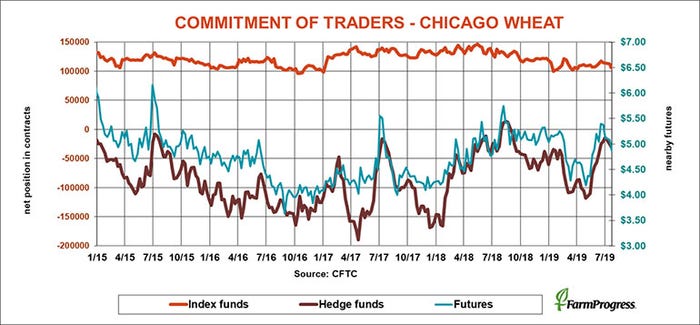

Soft market

Both index traders and big speculators sold soft red winter wheat this week. Hedge funds added 5,889 contracts to their small bearish bet while investors trimmed 7,177 lots off their holdings.

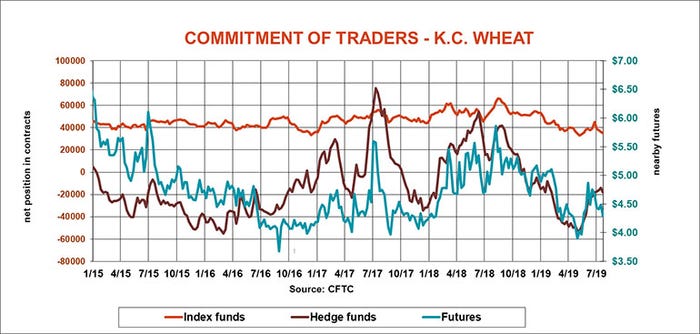

No more

After covering some of their once large bearish bet in hard red winter wheat for 11 straight weeks, big speculators headed in the other direction this week, adding 3,918 contracts to their net short position.

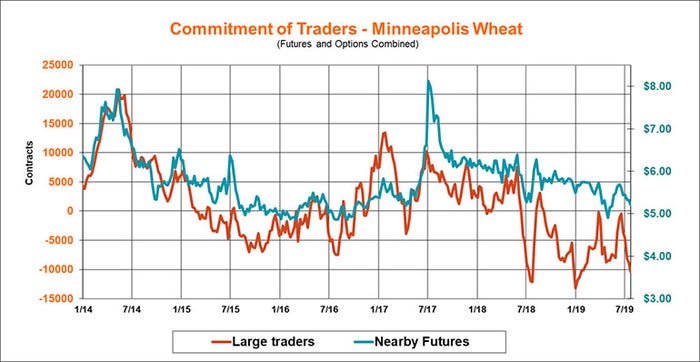

Out on tour

The spring wheat tour confirmed lower yields this week. But large traders sold as the tour began, adding another 1,501 contracts to their bearish bet in Minneapolis, taking it to seven-month high.

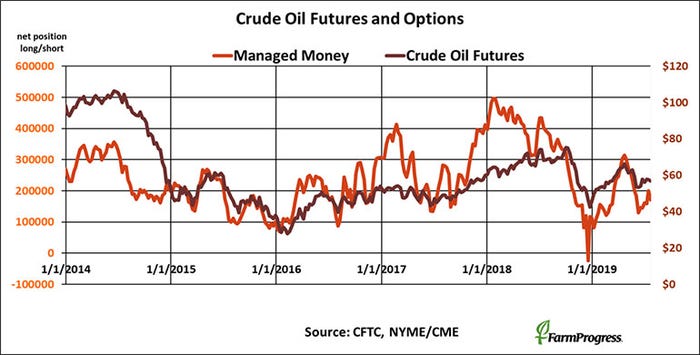

No tanks

Money managers dumped crude oil this week as worries with Iran cooled a bit, selling $1.6 billion in futures and options.

About the Author(s)

You May Also Like