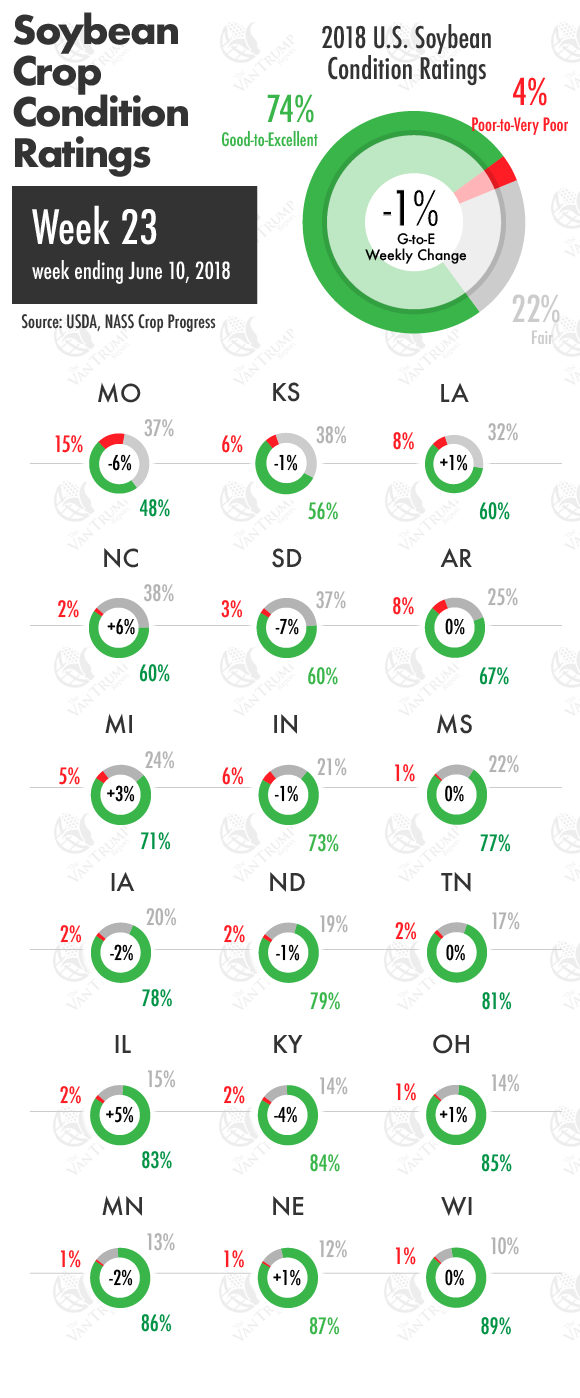

Soybean crop conditions also take a slight step backwards, but similar to corn still remain extremely strong. The USDA now shows the U.S. crop rated 74% "Good-to-Excellent" vs. 75% last week vs. 66% last year vs. 74% in 2016. The USDA also showed the crop now 93% "planted" vs. the 5-year historical average of 85%. The crop was also reported 83% "emerged" vs. the 5-year historical average of 69% emerged by this date. In other words, the U.S. soybean crop appears healthy and running slightly ahead of schedule.

As for today, the trade is eager to see what the USDA delivers in regards to the latest U.S. export and crush estimates, as well as their latest adjustments to the South American crop. Last month the USDA cut their Argentine production estate from 40 MMTs down to 39 MMTs, so perhaps there's still another small cut coming, but more than likely nothing significant. The USDA bumped Brazilian production higher last month from a record 115 MMTs to an even higher record of 117 MMTs.

Bottom-line, probably not a lot of overall change in South American production. Perhaps a slight decline in the Argentine crop and a slight increase in the Brazilian crop. Obviously, trade headlines involving the Chinese are also still in play as the market tries to figure out what happens with the large supply of U.S. old-crop soybeans that have been marked as "sold" but have yet not been "shipped"?

I am also keeping an eye on the strength of the U.S. dollar vs. the South American currencies. World trade is definitely in focus and creating headwinds. There's also not much in the way of any real widespread U.S. weather story. For the most part weather conditions have been fairly cooperative, which has some thinking the USDA could actually bump their current yield estimate a hair higher. If they do, I don't see it being anything significant, but it could give the bulls another reason to backpedal.

From a technical perspective, I still think we could test psychological support at $9.50 and then perhaps the lows set back in June of last year at $9.38 per bushel. As a producer, I'm happy with the fact I was aggressive on the rallies and have 65% of our estimated price risk removed. I continue to target the late-August to late-October time frame as our next window of opportunity. If we can re-test the lows on the chart, I will be looking for ways to re-own a small portion of my previous sales.

About the Author(s)

You May Also Like