After being battered this fall by sellers, commodity markets showed a few signs of finally turning around this year. Fund traders weren’t buying everything, but they weren’t selling across the board, either.

Here’s what funds were up to through Tuesday, November 27, when the CFTC collected data for its latest Commitment of Traders.

![]()

Bottom feeding

Big speculators were still selling ag futures and options this week, extending their net short position by another 34,109 contracts as of Tuesday. But the big boys were buying later in the week, covering some of those bearish bets to help boost prices. Meat contracts continue to find favor, along with other markets seeing a lot of selling this fall.

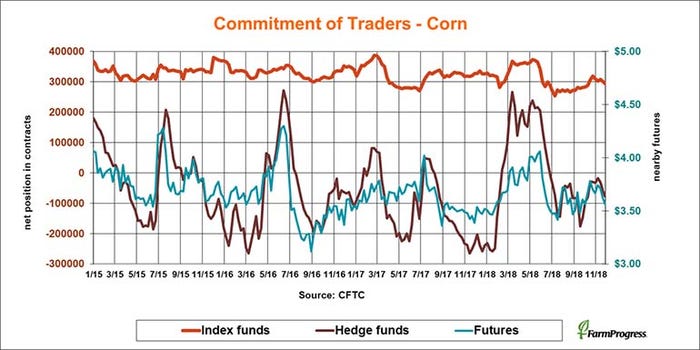

Time for change

Big speculators were still selling corn early this week, boosting their modest bearish bet by another 18,840 contracts. But they covered those shorts and more the rest of the week, helping prices rise a dime.

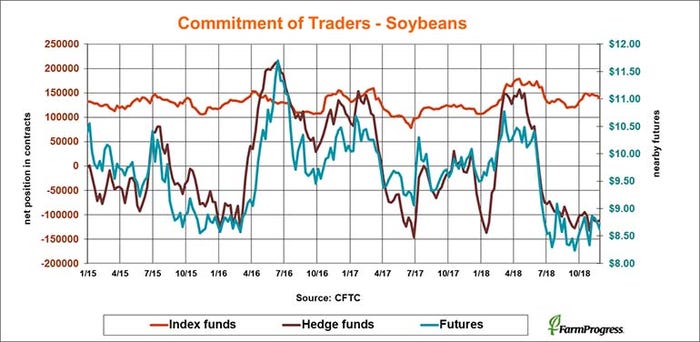

Muzzled bears

Big speculators covered a little of their bearish bet early in the week, buying a net 3,234 contracts and adding more later in the week, waiting for Saturday’s talks between President Trump and China’s President Xi at the G20 summit.

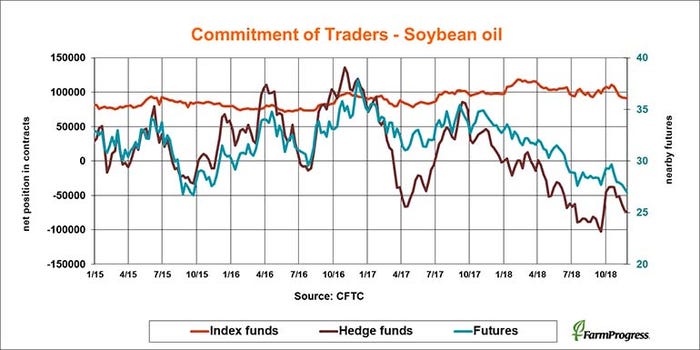

Still short

Big speculators have been bearish on soybean oil since spring, and that didn’t change last week. Hedge fund traders added 2,495 contracts to their net short position.

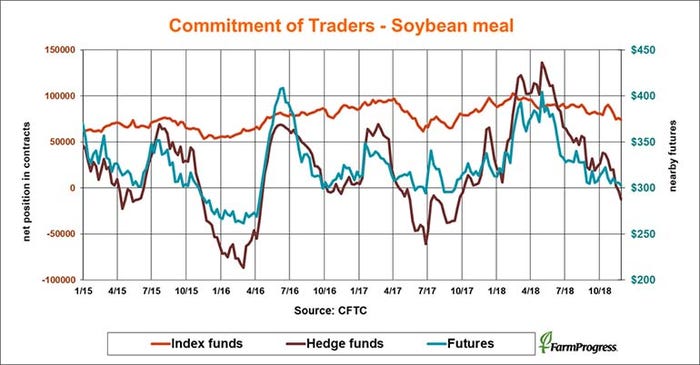

Crushed hopes

After being bullish on soybean meal for most of 2018, big speculators sold again last week, adding 9,748 contracts to their small net short position.

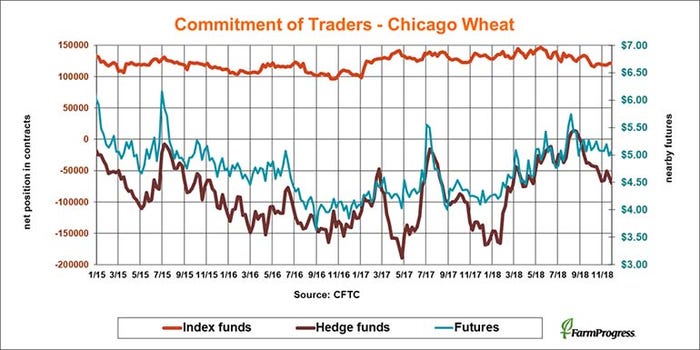

Broken record

Big speculators sold soft red winter wheat again last week, adding 10,111 contracts to their net short position. But index funds giving investors exposure to commodities were small buyers in wheat.

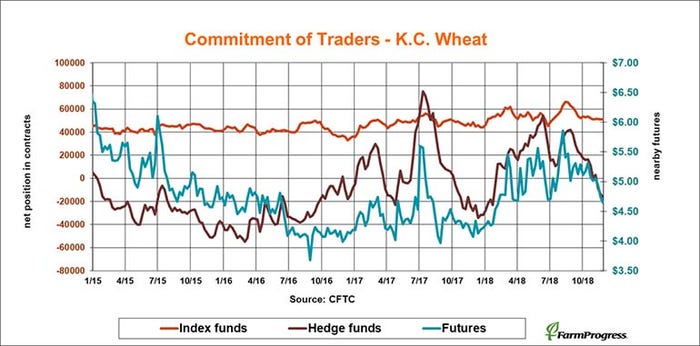

More selling

Big speculators sold hard red winter wheat for the sixth straight week, boosting their modest bearish bet by another 2,286 lots. That was enough to punish futures to new contract lows.

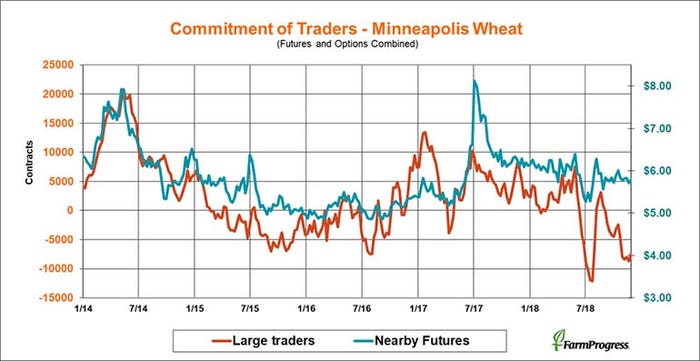

Cash crunch

Deliveries on first notice day Friday were heavy in spring wheat. But large traders were buying back some of their short positions earlier in the week, trimming the bearish bet by 1,164 lots.

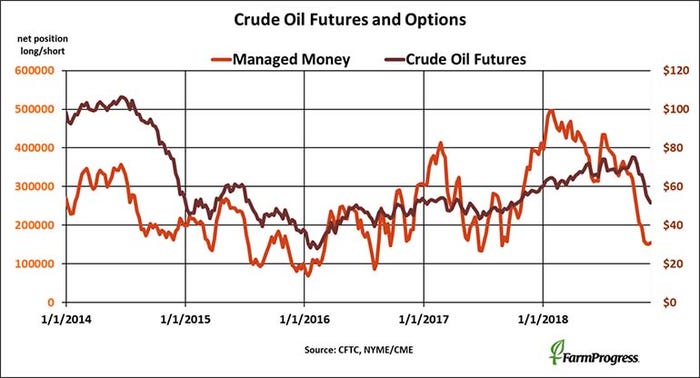

Bargain hunting

Money managers dumped more than $19 billion in crude oil futures and options over the past five month. But selling dried up as crude neared $50 a barrel. These funds bought $203 million in crude last week as the market faces a crucial OPEC meeting in the coming week.

About the Author(s)

You May Also Like