With world traders ever more fearful of tightening grain supplies, the question the market needs to ask is how high do prices need to go to ration demand. Determining what price levels will ration demand is hard to predict, but we haven't seen any indicators that have entered the rationing phase yet.

Ethanol: With ethanol margins running between +55 cents in the east to + 48 cents in the west, we see no reason for this industry to back off its production. Ethanol production for the week ending April 30th averaged 952,000 barrels a day. This is up 0.74% vs. last week and up 59.2% vs. last year. Total ethanol production for the week production was 6.664 million barrels. The industry consumed an estimated 96.18 million bushels in last week's production. With the U.S. continuing to open up and see the tourism industry rebound, we anticipated demand for gasoline/ ethanol to increase throughout the summer and into the fall.

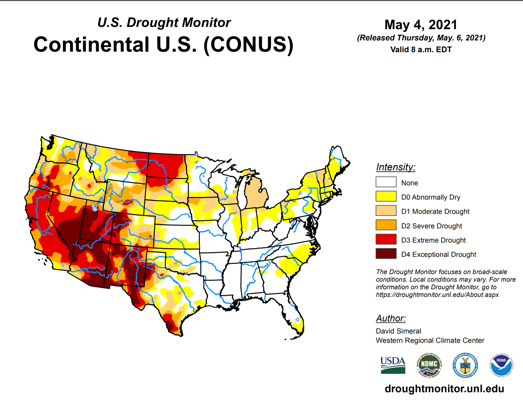

Livestock: With hog prices (profitability) where they are, there is no reason for this sector to back off as well. The cattle industry is moving away from the high corn cost and feeding more wheat, but they are not liquating; they are just changing what they are feeding in the rations. With the Spring wheat portion of the country experiencing drought conditions, it may limit the amount of wheat that is provided in the Nothern Plains

Exports: Export demand continues to remain strong well. The US has sold 98.8% of the USDA's current soybean estimate way ahead of the five-year average pace of 94.7% sold. Corn sales are even further along as we have sold 99.9% of the USDA's export goal. The five-year average sales pace is 84.4% sold by the last week of April. We anticipate the USDA will be upping both the corn and soybean export targets on the May WASDE report.

South America: With Brazil's Safrina corn crop estimates falling by the day, the world will be looking for supplies to make up for the lost production. We estimate if Brazil’s safrina crop falls to 90 MMT, it will take 400 million bushels off the world market, opening up more demand for U.S. supplies. When Chinese importers compare CBOT prices to their prices, they look cheap. Corn on the Dalian exchange was trading at $10.85 per bushel while soybeans are $25.45 per bushel this week.

New crop prospects: The U.S. crop prospects for this year are far from certain as well. Planting progress continues ahead of pace, but dry soil conditions concern both producers and end-users. Without finding additional acres to plant, a 5-bushel decline in the U.S. national yield will produce less corn this upcoming season than what is being consumed this season.

Protect upside: Our firm believes that producers should remain flexible in marketing this year's crop due to the potential for extreme price moves. We continue to encourage those considering making cash/futures sales to buy calls to protect the upside, as what looks like a good sale today may feel like a mistake by this fall. They are producers who made the business decision to sell $4-plus cash price corn for spring delivery earlier this year who are now feeling sour about those sales when they compare the price they are receiving to the spot delivery price. Fall sales currently at $6 price levels could be just as disappointing this fall if the U.S. has a severe weather problem. Even though buying calls is an expensive check to write, they could pay off handsomely as they keep your upside open and allow you to participate if the market trades to all time highs.

Another reason to consider buying calls against new crop sales is you are the reason that prices are higher. You might have sold what you thought would be 45% of your anticipated production, but due to drought, your 45% sold may end up being 80% sold. Which could mean you are not able to fulfill your sales obligation. You could roll the 2021 hedge to 2022, but with the way the spreads trade in bull markets, you will lose even when you move the hedge for the 2021 crop to the 2022 year. If you purchased the call, it would help generate revenue that will hopefully allow you to buy out of the contracts you can not fulfill, or offset a portion of the future hedge losses.

In this time of extreme volatility, we encourage producers to keep two thoughts in mind. Am I profitable, and what am I doing to protect this profitably? For ideas on how to accomplish this, please contact any AgMarket.net team member or download our app at https://www.agmarket.app/app. It was developed by a producer for producers to help you track farm profits, sales, and expense reports along with the cost of production and inventory.

About the Author(s)

You May Also Like